Binance Coin price at risk of dropping 10% after BNB case reveals intent to evade US Law

- Binance Coin price has not joined the breakout trades in altcoins and cryptocurrencies on Thursday.

- BNB is still under pressure from the CFTC regulatory lawsuit.

- The Wall Street Journal revealed that Binance offered perks to evade US Law.

Binance Coin (BNB) price is at risk of dropping sharply yet again as some more details came out on the back of the Commodity Futures Trading Commission (CFTC) lawsuit against Binance. Evidence is very clear that there was an intentional strategy to evade US law, CFTC Chair Rostin Benham said on Bloomberg Television. This opens up a very large exposure for Binance to large fines, sanctions and possibly even a ban.

Binance Coin sees accusations mounting as sell-off risk grows

Binance Coin price flirted with the green ascending trend line earlier this morning in the ASIA PAC session after the Wall Street Journal printed the story on the allegations and proof of evidence. As a broker, Binance has been allegedly helping clients to circumvent the US rules and laws when it comes to trading cryptocurrencies as a US citizen. The CFTC case is being added to the pile of cases that the Internal Revenue Service (IRS) and federal prosecutors recently launched against BNB.

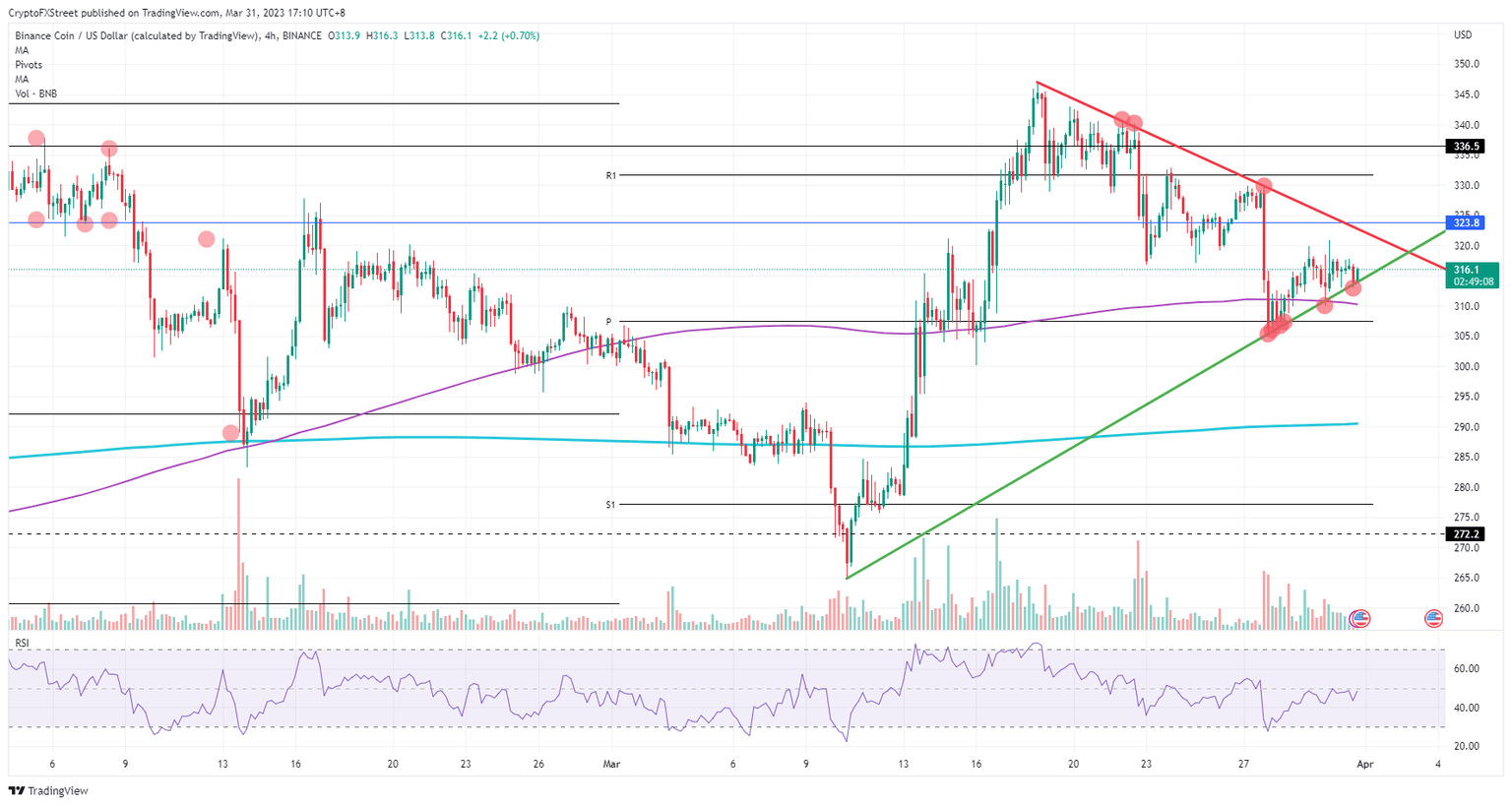

BNB will be stuck in courts and court rulings for several months and possibly years to come, costing millions in fees for lawyers and possible fines and penalties. Expect this to have a negative replication for BNB price with a drop of nearly 10% as the first leg lower. That means that $300 can no longer be maintained, and price action needs to reside near $290 at the 200-day Simple Moving Average as support for now until further details get communicated.

BNB/USD 4H-chart

As these litigations can take months or even years, price action could continue and only react when there is an outcome at hand. This opens room for BNB to jump back up toward that red descending trend line. Expect a breakout to be difficult, but a swing toward $345 is possible if it materializes.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.