Binance Coin Price sprouts again, prompting bullish move

- Bulls have eyes on $320 and $337 levels, but first, they must overcome resistance at $300.

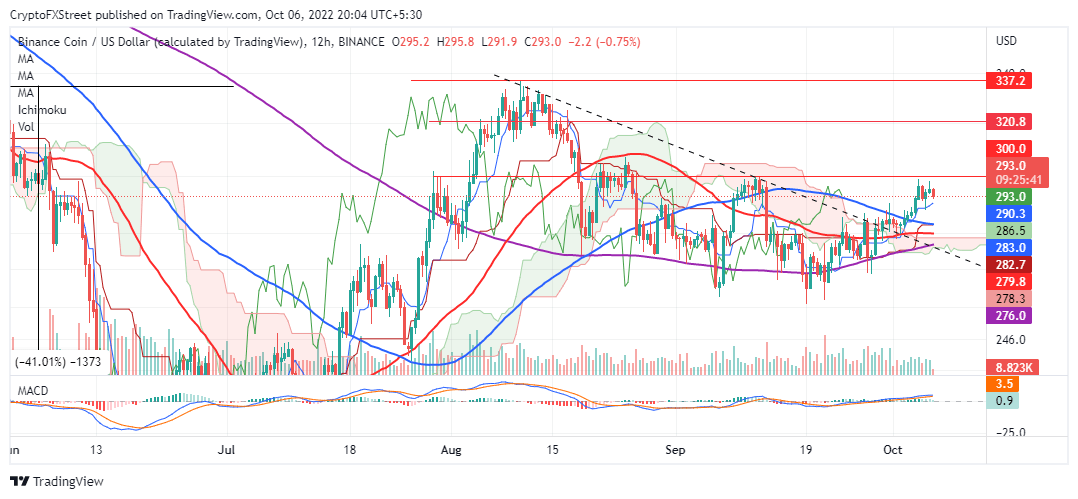

- Binance Coin price sits on top of the Ichimoku Cloud amid rising investor speculation.

- Low network activity could snuff out BNB’s bullish spark, risking another correction to $285 and $255, respectively.

Binance Coin price is gradually flipping its narrative, intending to close the week above $300. The native exchange token, BNB, rebounded from support it defended at $255 in September – a move that saw it step above a critical falling trend line. If buyers guard BNB’s higher support area at $290, the gap to $300 and even $320 could be closed quickly.

Binance Coin price bullish swing elicits optimistic speculation

The MACD (Moving Average Convergence Divergence) on the 12-hour chart confirms the momentum behind Binance Coin price. As the index crossed into the positive region (above the mean line), sidelined investors returned, hoping to see BNB brush shoulders with $300. A break above a crucial multi-month trend line cemented the bulls’ influence, propelling Binance Coin price to $298 for the first time since September 12.

BNB/USD 12-hour chart

The Ichimoku Cloud indicator applied to the same chart foreshadows a continued uptrend. Traders can use this technical index to gauge future price momentum by identifying potential support and resistance areas. Binance Coin price will keep trending to the upside as long as it sits above the cloud; see the chart above.

Meanwhile, a 12-hour to a daily close above BNB’s immediate support at $290 could prompt a sharp move past $300. Long traders looking to take short-term profits should consider exiting at $300, while the most optimistic could hold on till the $320 level or even $337 is tagged.

Previously dormant BNB tokens on the move – but what does this mean for the price?

A significant amount of previously dormant BNB tokens is on the move, according to on-chain data from Santiment. The Age Consumed metric tracks the movement of previously idle tokens. Ideally, it multiplies the number of BNB tokens changing addresses daily with the number of days since they last moved. Spikes in this metric point to growing volatility amid a hike in investor speculation.

BNB Age Consumed Metric

Often such movements come before a big breakout – with Binance Coin’s positive narrative intact, the path with the least resistance could remain to the upside. On the other hand, traders should be looking for price action below $290, which might trigger a sell-off to $285 and possibly to $255.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B17.34.36%2C%2006%20Oct%2C%202022%5D-638006684825825793.png&w=1536&q=95)