Binance Coin Price Prediction: One more dip while BNB whales lockup the supply

- Binance Coin has ascended with a lower volume than the previous decline.

- The RSI has space to climb but broke through support on the last pullback

- Invalidation of the bearish thesis is a breach above $350.

Binance Coin price could be setting up for another decline. Key levels have been identified.

Binance Coin points south

Binance Coin price has been trading within a congested zone throughout September. The bulls have hurdled both the 8-day and 21-day simple moving averages, which is likely to entice sidelined traders to enter the market. However, the Relative Strength Index paints a different picture of what is going on.

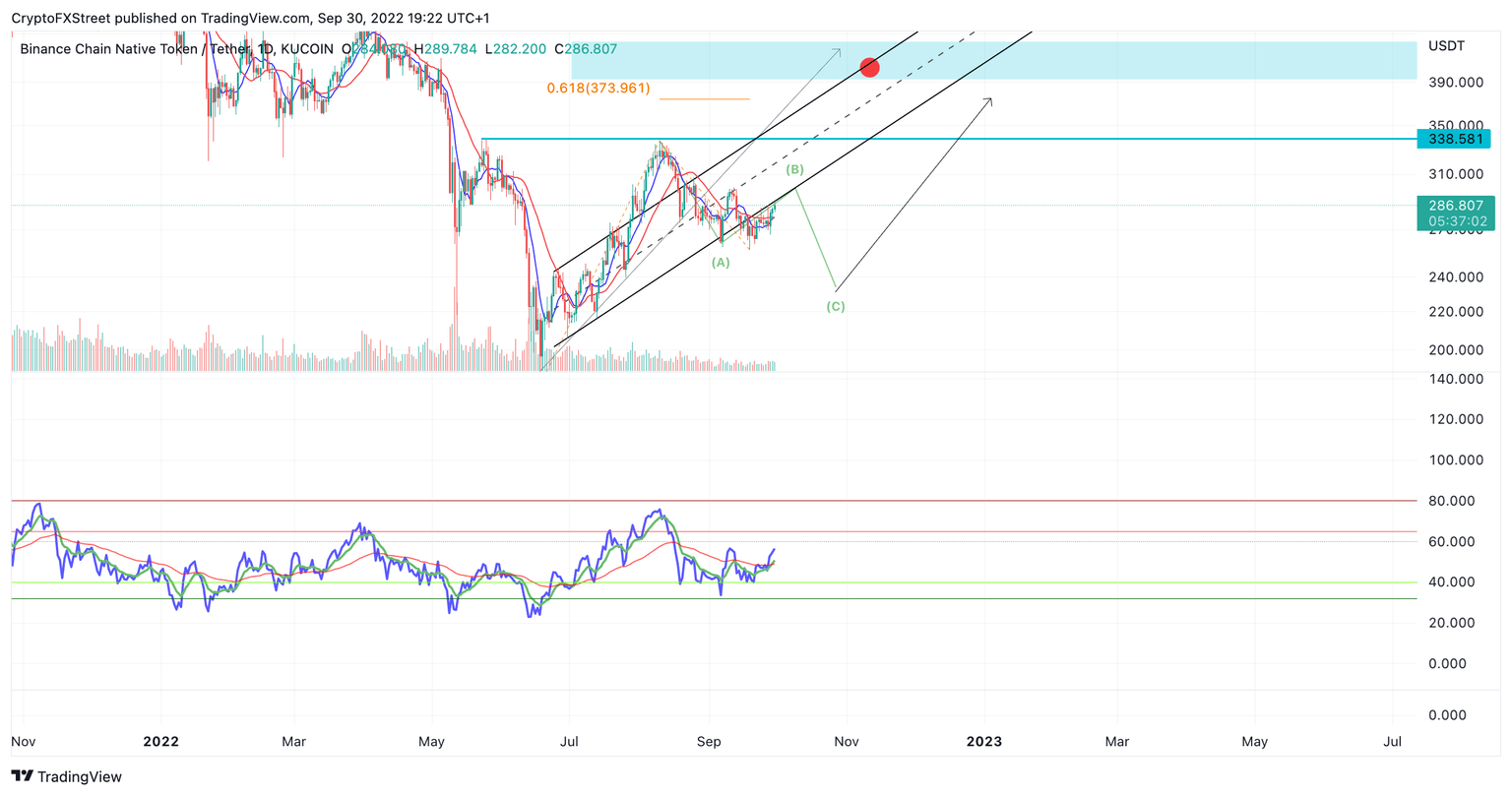

Binance Coin currently auctions at $287. The Relative Strength Index shows the downtrend breached through the definitive line in the sand that would constitute a market bottom. The BNB price breached through an ascending parallel channel that the bulls are currently retesting.

Lastly, the Volume Profile is still less than the previous uptrend, which was far fewer transactions than the declining rally that brought BNB into the current range. BNB will need to rally impulsively, (presumably near the $350 order block) to show the technicals necessary to invalidate the bearish thesis.

BNB USDT 1-Day Chart

Thus traders should be cautious as Binance Coin should be more bearish in the short term than meets the eye. A Fibonacci Projection level using the previous swing highs in August and swing low in September shows the bears could induce a seller's rally towards $220 if the technicals are correct.

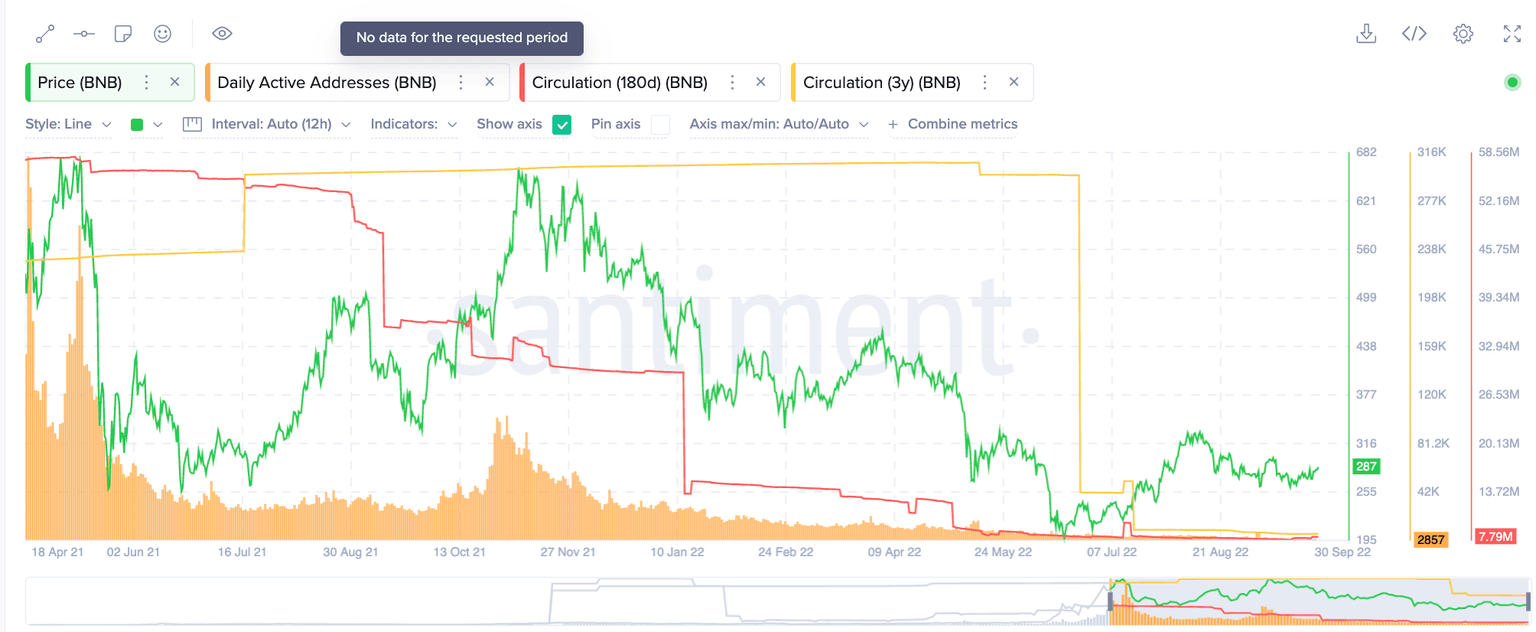

If the BNB price does fall to $220, traders may want to consider dollar cost averaging some BNB for the long run, as the on-chain analysis still shows significant lock-up of the decentralized exchange token. Currently, BNB has 21 million tokens in circulation, a supply last witnessed in 2020 when BNB traded at $14 just before the infamous 5x rally by 2021.

Santiment's Price, Circulaiton, and Actve Wallet Address Indicators

In the following video, our analysts deep dive into the price action of Binance Coin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.