Binance Coin price could revisit $210 if this level fails to hold

- Binance Coin price saw a bullish breakout three weeks ago, but it failed to sustain.

- As a result BNB could still approach a stable support level at $243, a breakdown of which could trigger an 11% crash to $216.

- A daily candlestick close above $301, however, will invalidate the bearish thesis for the exchange token.

Binance Coin price continues to defy a bullish outlook and slide lower as selling pressure builds up. This development will soon approach a stable support level, a breakdown of which could result in a steep correction for BNB holders.

Binance Coin price in trouble

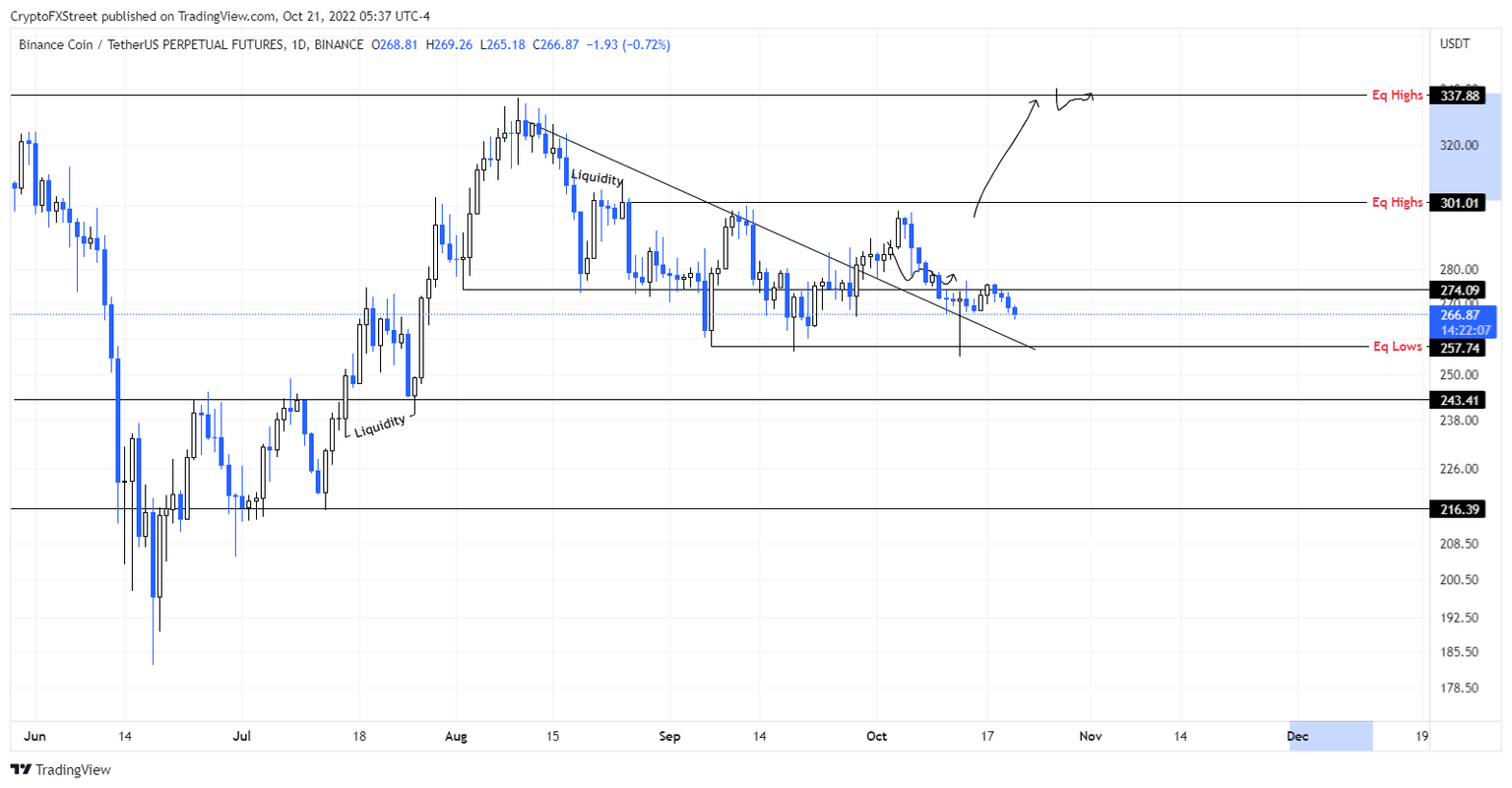

Binance Coin price printed three lower highs and lower lows since August 12, denoting a bearish trend. On September 28, however, BNB triggered a bullish breakout above the trend line connecting these swing points.

As a result, Binance Coin price rallied 6% but fell short of retesting the $301 hurdle. Eventually this failure turned into a reversal. The ongoing downtrend is likely to sweep below the $257 equal lows and potentially dip lower due to the current market conditions.

The kicker, however, will be the subsequent support level at $243, a breakdown of which could catalyze an 11% downswing to $216. A retest of this lower level is likely to be a good place for accumulation of BNB at a discounted price.

So investors looking to buy BNB should be patient whilst market participants hoping to short Binance Coin price can start hunting for entries.

BNBUSDT 1-day chart

While the bearish narrative detailed above makes sense, Binance Coin price needs to shatter and flip the $257 support level into a resistance barrier to confirm it. At the same time there is a chance that a spike in selling pressure that is then rapidly followed by a bounce at this barrier could trigger a sweep of the $301 hurdle.

A daily candlestick close above this level will invalidate the bearish thesis and kick-start an uptrend. This development could see Binance Coin price rally 12% and tag the $337 resistance level.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence Binance Coin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.