Binance burns $676 million in BNB fueling a price rally while regulators join forces against the exchange

- Binance burned upwards of $676 million in BNB tokens amidst regulatory crackdown from the CFTC.

- Binance’s burn of 2 million BNB tokens has fueled a price rally in the native token of the exchange.

- The US Federal Agency Chair Rostin Behnam called out the exchange for intentionally breaking regulations, according to Bloomberg’s report.

Binance, one of the world’s largest crypto exchanges, announced a burn of $676 million worth of BNB tokens. Burning an asset removes it from the circulating supply permanently, reducing the selling pressure on it. BNB price rallied in response to the exchange’s 2 million token burn.

Also read: Ethereum price explodes, ETH deposits pick up pace

Binance burns over 2 million BNB tokens

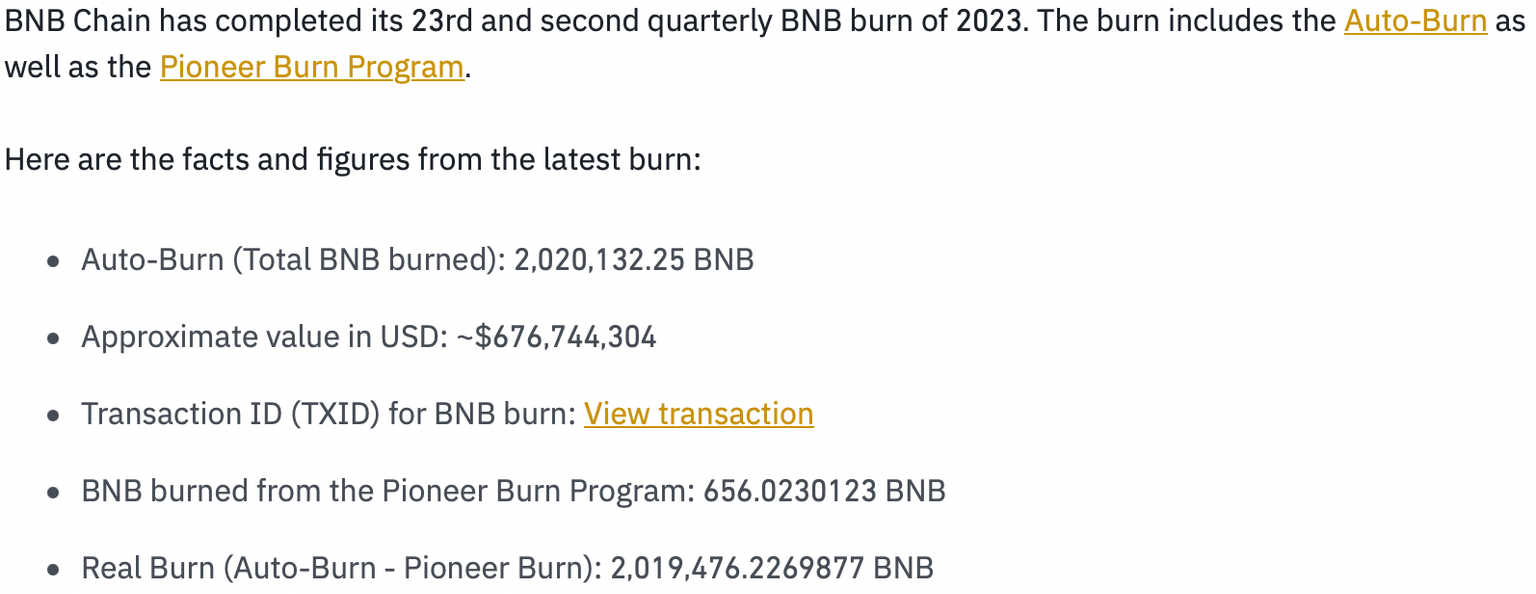

Binance, the largest cryptocurrency exchange by trade volume, burned 2,020,132 BNB tokens worth $676,744,304, according to its recent announcement. The burn reduced the supply of the exchange’s native token, reducing the selling pressure on BNB in the long term.

As Binance tackles regulatory crackdown, there is a spike in concerns surrounding the exchange’s native token and BNB price is struggling to wipe out losses amidst rising selling pressure on exchanges.

BNB burn

Binance’s move to burn 2 million BNB is therefore timed to fuel a recovery in the native token.

How BNB burn fueled a price rally in the native token

The 2 million BNB burn was followed by a recovery rally in the asset. BNB price yielded nearly 4% gains to holders since Thursday. The exchange’s native token was exchanging hands at $332.88 at press time, after nearly 7% gains since April 7.

As seen in the BNB/USDT price chart below, the native token of the exchange is currently in a short-term uptrend. Binance Coin price climbed above the resistance at the 23.6% Fibonacci level at $327 and is inching closer to the $339.80 target.

BNB/USDT 4H price chart

Once Binance Coin’s price crosses the hurdle at $339.80, it could rally to the $346 level, BNB’s mid-March peak. BNB price is currently above three key Exponential Moving Averages at 10, 50 and 200-day.

A decline below $327 could invalidate the bullish thesis for the exchange token.

Binance continues to battle regulatory hurdles

Binance is facing intense regulatory scrutiny. According to Bloomberg’s recent report, the Commodity Futures Trading Commission Chair, Rostin Behnam criticized the exchange for “intentionally” breaking regulatory rules.

Behnam was quoted in an event at Princeton University on Thursday,

These are not unsophisticated individuals. They are starting large companies and offering futures contracts and derivatives to US customers.

The exchange’s battle with regulators seems uphill with recent developments and commentary from the CFTC chair. The SEC is therefore not alone in bringing allegations against the exchange and regulatory authorities have joined forces in their crackdown on the trading platform.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.