Ethereum price rally to $2,000 is fueled by these catalysts and macro moves

- Ethereum price crossed key resistance at $2,000 in an explosive move, with the crypto market cap inched closer to $1.3 trillion.

- Experts argue Thursday’s Producer Price Index indicates that market participants are headed towards disinflation, fueling a bullish sentiment among risk asset holders.

- Twitter’s partnership with eToro is another driving factor for Ethereum’s run up to the $2,000 level.

Ethereum price crossed key resistance at the $2,000 level after the crypto market capitalization started climbing to the $1.3 trillion level. Experts predict an Ethereum price rally to the range between $2,400 and $2,800.

Also read: Ethereum Shapella upgrade is successful, debate ensues on whether ETH is a security

Ethereum price climbed above $2,000 post a successful Shapella upgrade

Ethereum price rallied to the $2,000 level in an explosive move post the successful completion of the Shapella upgrade. The altcoin climbed above the resistance level despite the rising selling pressure from the ETH tokens that are being unlocked.

ETH/USD 4H price chart

Upwards of $32 million worth of ETH tokens were unlocked, however ETH holders signaled their confidence in the altcoin, despite the mounting selling pressure on the second-largest asset by market capitalization.

These three catalysts are driving Ethereum price higher

The rise in crypto market capitalization, US PPI data and Twitter’s partnership with eToro for implementing crypto trading for users are the key catalysts that fueled Ethereum’s run up to the $2,000 level.

Crypto market capitalization is inching closer to $1.3 trillion after Bitcoin’s massive rally to the psychological barrier at $30,000. The rising market cap of digital assets is a sign of rising confidence among crypto traders for cryptocurrencies like Ethereum.

Interestingly, the release of US Consumer Price Index for March 2023 and PPI print on Thursday, shows that traders expect disinflation. This is a bullish sign for risk assets like Ethereum.

Today’s US PPI print shows that we’re headed for faster than expected disinflation…

— tedtalksmacro (@tedtalksmacro) April 13, 2023

Headline:

+2.7% vs +3.0% Exp. (Prev. +4.6%) YoY

Core:

+3.4% vs +3.4% Exp. (Prev. +4.4%) YoY

Indicative of further falls in CPI/PCE in coming months. pic.twitter.com/oixNH0Kioh

With social media giant Twitter enabling crypto trading through its partnership with eToro, traders gained confidence in cryptocurrencies and alternative cryptos like Ethereum. The anticipation surrounding the ETH upgrade was dispelled by a smooth completion of the Shanghai hard fork.

Where is Ethereum headed next

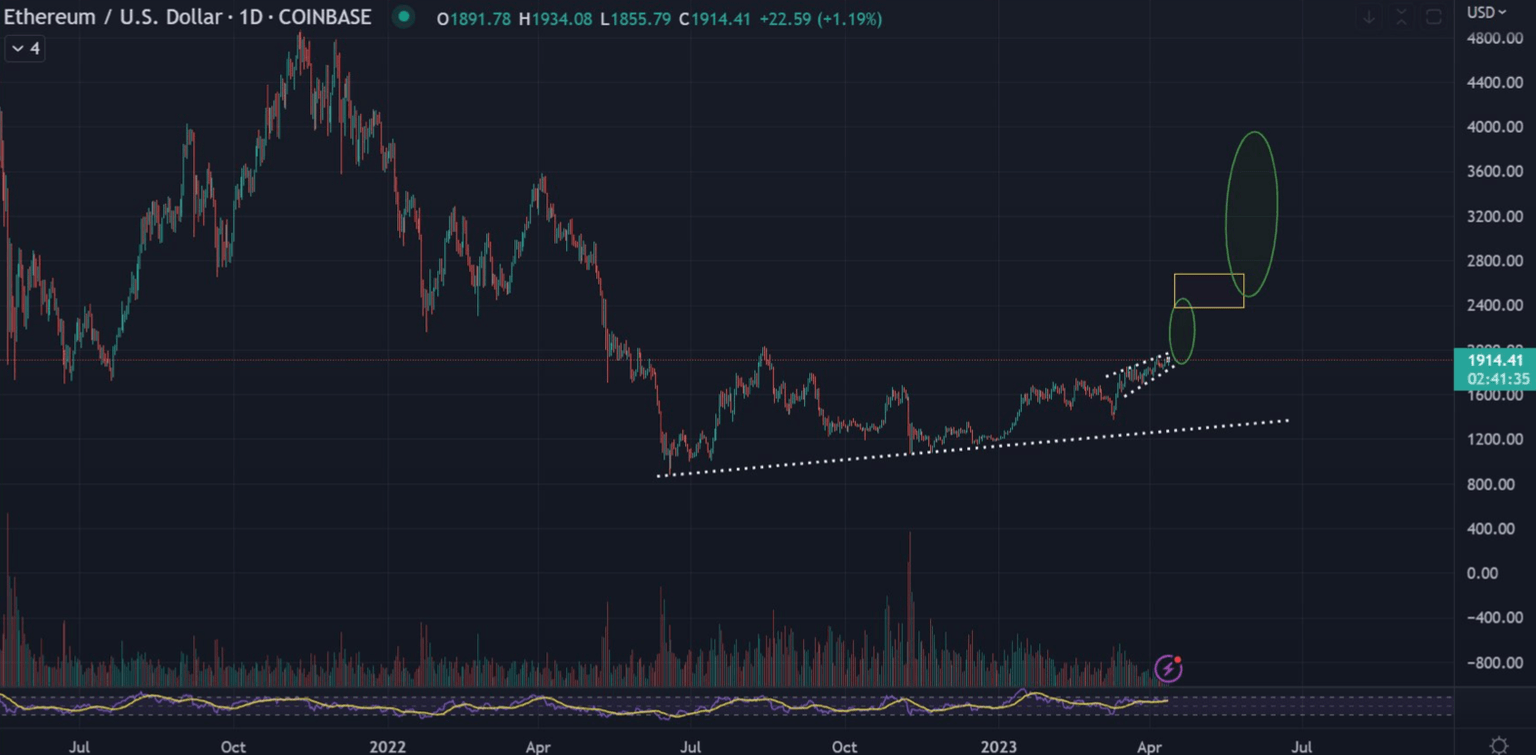

Bluntz_Capital, a crypto analyst and trader, predicted a rally in Ethereum price. Experts believe ETH is on track to rally to the zone between $2,400 and $2,800 level. Ethereum price could climb to the $2,400 level for lack of a critical resistance between $2,000 and $2,400.

ETH/USD 1D price chart

Once Ethereum price clears the resistances at $2,400 and $2,800, the next target for the altcoin is the $4,000 level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.