Binance approving SHIB as a collateralized asset causes 10 billion in open interest as Shiba Inu price rises

- Binance exchange has approved the Shiba Inu token to serve as collateral, adding the meme coin to its Flexible and VIP Loan services.

- The move sparked renewed optimism for the token, causing a 5% price surge alongside 10 billion in open interest positions.

- With this many contracts still open, market participants will watch the market closely.

Binance, the largest exchange by trading volume, has the ShibArmy elated after an announcement on Friday, August 4, clearing Shiba Inu token to serve as a collateralized asset alongside 22 other cryptocurrencies that will henceforth be loanable on its Flexible and VIP Loan services.

#SHIB Enter collateral assets By #Binance #SummerOfShibarium https://t.co/MNw4nVd8c2 pic.twitter.com/ykD8wQ3QtT

— chimi | Summer Of Shibarium (@chimiwaw) August 4, 2023

Also Read: Bitcoin price holds above $29,000 after below-expectations US NFP data

Binance gives Shiba Inu price a bullish fundamental

Binance Exchange’s list of loanable assets has increased, with 22 new tokens coming in. Among them Shiba Inu, whose investors are activated by the news as indicated by the striking surge in open interest over the last 24 hours.

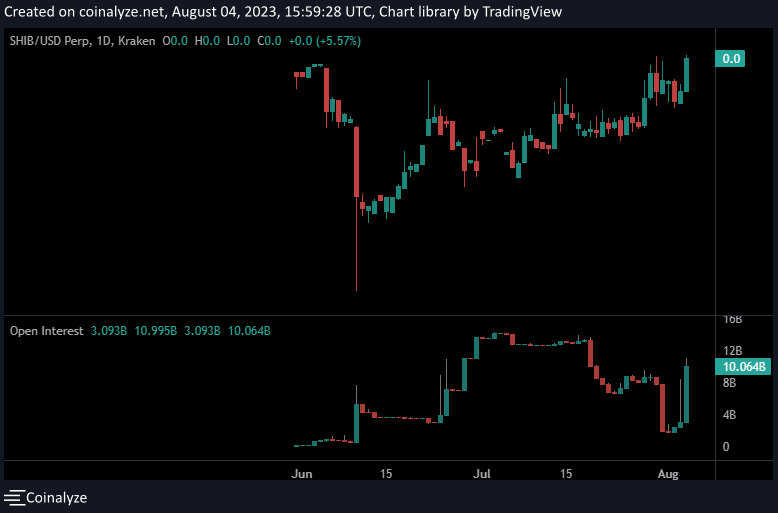

SHIB Open Interest

Based on the chart above, the overall SHIB positions among traders hit 10 billion, with the open interest comprising both short and long positions. With this many contracts still open, market participants will watch the market closely as capital inflow continues streaming.

Shiba Inu price is already up 5% on the day, as of press time, with a 24-hour trading volume surge of 70%, the SHIB market has turned active with prospects for more gains. Historically, an increase in open interest coupled with a sustained price surge confirms an uptrend.

Shib Inu price forecast amid renewed focus on the SHIB market

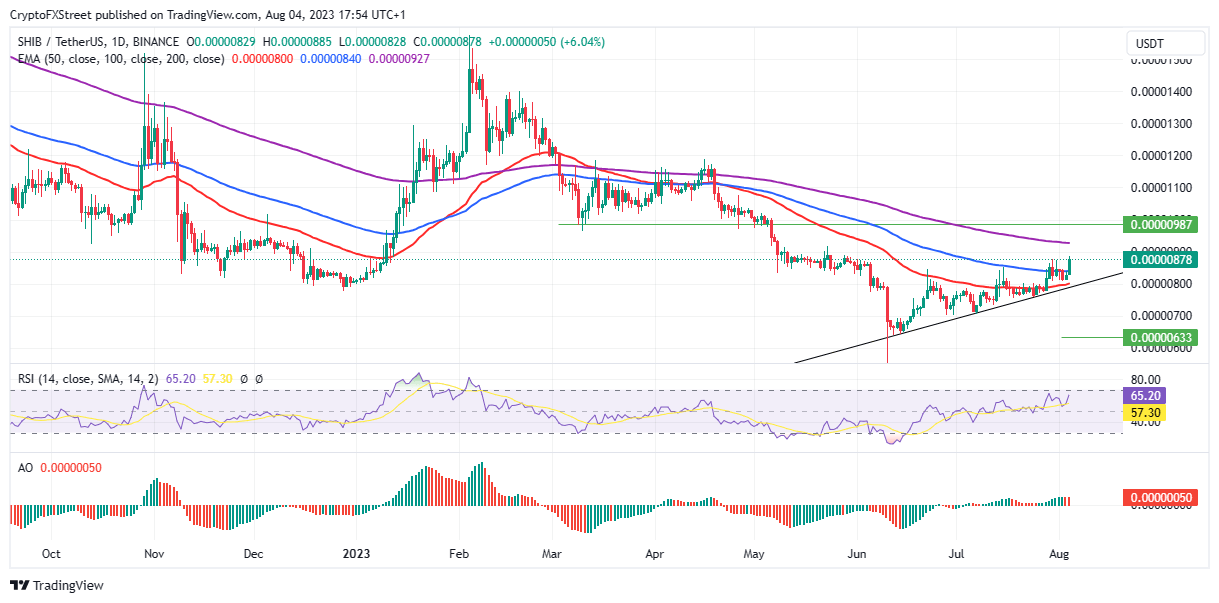

Shiba Inu (SHIB) is auctioning at $0.00000877 at the time of writing, flaunting a long green bar as bulls lead the market. Increased buyer momentum above current levels could see SHIB tag the 200-day Exponential Moving Average (EMA) at $0.00000927 after a substantial breach of the 100-day EMA hurdle at $0.00000840.

In a highly bullish case, the current uptrend could see the meme coin tag at the $0.00000987 resistance level. Such a move would constitute a 12% rise above current levels.

The Relative Strength Index (RSI) is moving north, suggesting rising momentum, with the Awesome Oscillators (AO) bolstering the stance as the histograms are in the positive zone.

SHIB/USDT 1-day chart

On the flip side, the rally could be interrupted by profit taking as long positions become liquidated just below the 200-day EMA at $0.00000927. The ensuing selling pressure could see Shiba Inu price fall back below the 100-day EMA at $0.00000840.

A decisive break below the confluence support between the 50-day EMA at $0.00000800 and the uptrend line could invalidate the bullish outlook.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.