Base network's TVL surges 25% fueled by USDC reminting

- Base network's Total Value Locked (TVL) soars by 25.23%, surpassing Ethereum Layer 2 zkSync Era.

- The growth is primarily driven by the minting of native USDC, which saw a 472% increase.

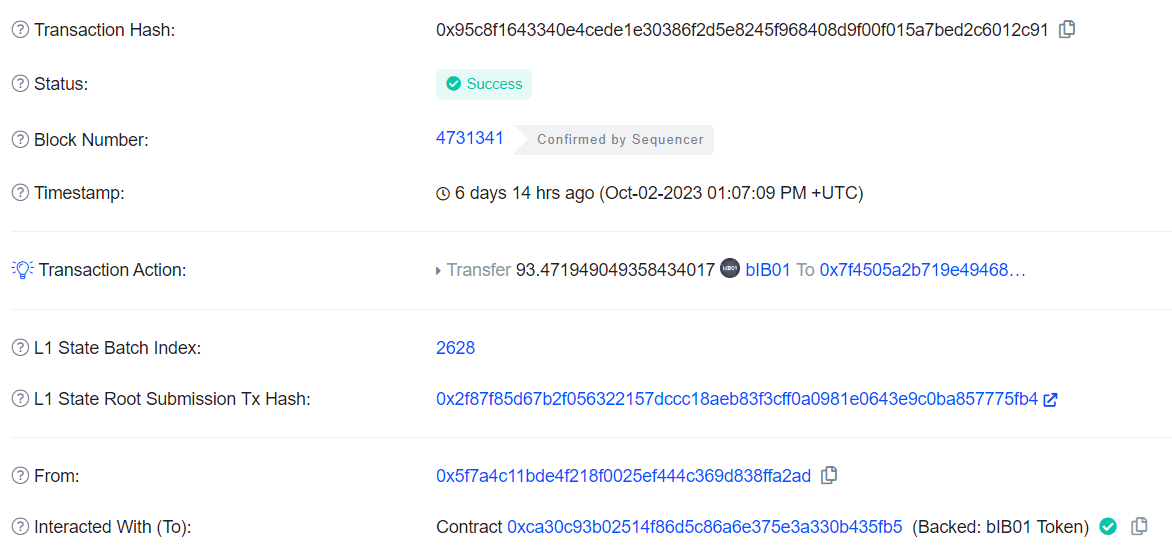

- Backed Finance recently issued tokenized ETF bIB01 on the Base network.

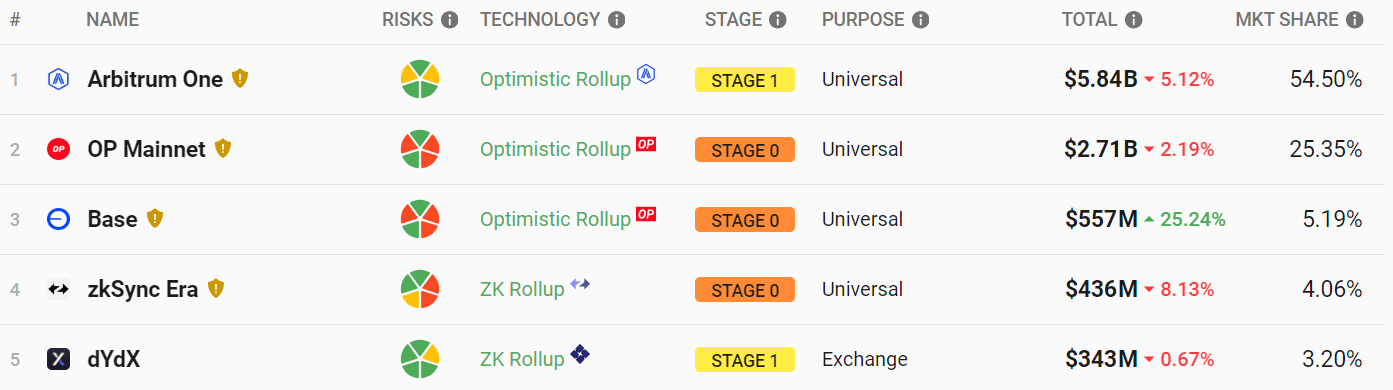

Base network's Total Value Locked (TVL) has now touched $557 million based on L2Beat data, marking a major uptick within the past week. The main reason for the surge is the minting of native stablecoin USDC on the network that saw a 472% increase. Backed Finance recently forayed onto the network Base with tokenized Blackrock exchange-traded fund (ETF).

Base's TVL skyrockets by 25%

Base network's Total Value Locked (TVL) surged by over 25% in the last seven days, reaching $557 million. The increase has re-established Base's dominance over other Ethereum Layer 2 networks like zkSync Era. zkSync Era, which uses Zero-Knowledge Proofs technology for verification, stands at $436 million after losing 8% TVL.

Layer 2 on-chain data

Base network, which is at Stage 0 based on the maturity of features, saw major re-minting of native USDC tokens. The stablecoin issued by Circle saw an increase of over 470% with the minting surpassing 159 million on Monday. This is a promising trajectory in Base's TVL after experiencing its first major outage on September 5, a hiccup that lasted 43 minutes.

A similar surge was seen in September, soon after Friend.tech launched on Base.

Also Read: Ethereum Layer 2 networks BASE, zkSync Era make history, ETH bites the dust

ETH L2 debuted first tokenized ETF

Base, an Optimistic Rollup incubated by Coinbase, saw the introduction of its first tokenized security in the past week. Backed Finance, known for tokenizing real-world assets, recently issued bIB01 as tokenized BlackRock's iShares bond ETF on Base.

The official release from Backed emphasized on creating tokenized Real World Assets (RWAs) that seamlessly integrate with developers' applications. The platform highlighted Base as a network that prioritizes developers' needs by offering cost-effective and developer-friendly on-chain development.

Despite the positives, Base experienced a dip in daily active users, dropping to 49,662 on Sunday. On Saturday, the number stood at 68,957 as per DUNE analytics. The dip comes after a period where Base consistently maintained over 100,000 users throughout most of August, even surpassing 145,000 daily active users on August 21.

Base TVL growth is a positive indicator but it is primarily attributed to USDC minting. Therefore, the growth might not be sustainable. The recent dip in daily active users raises questions about the network's ability to maintain its user base over the long term.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.