Axie Infinity price forms bullish pennant before breakout to new all-time highs

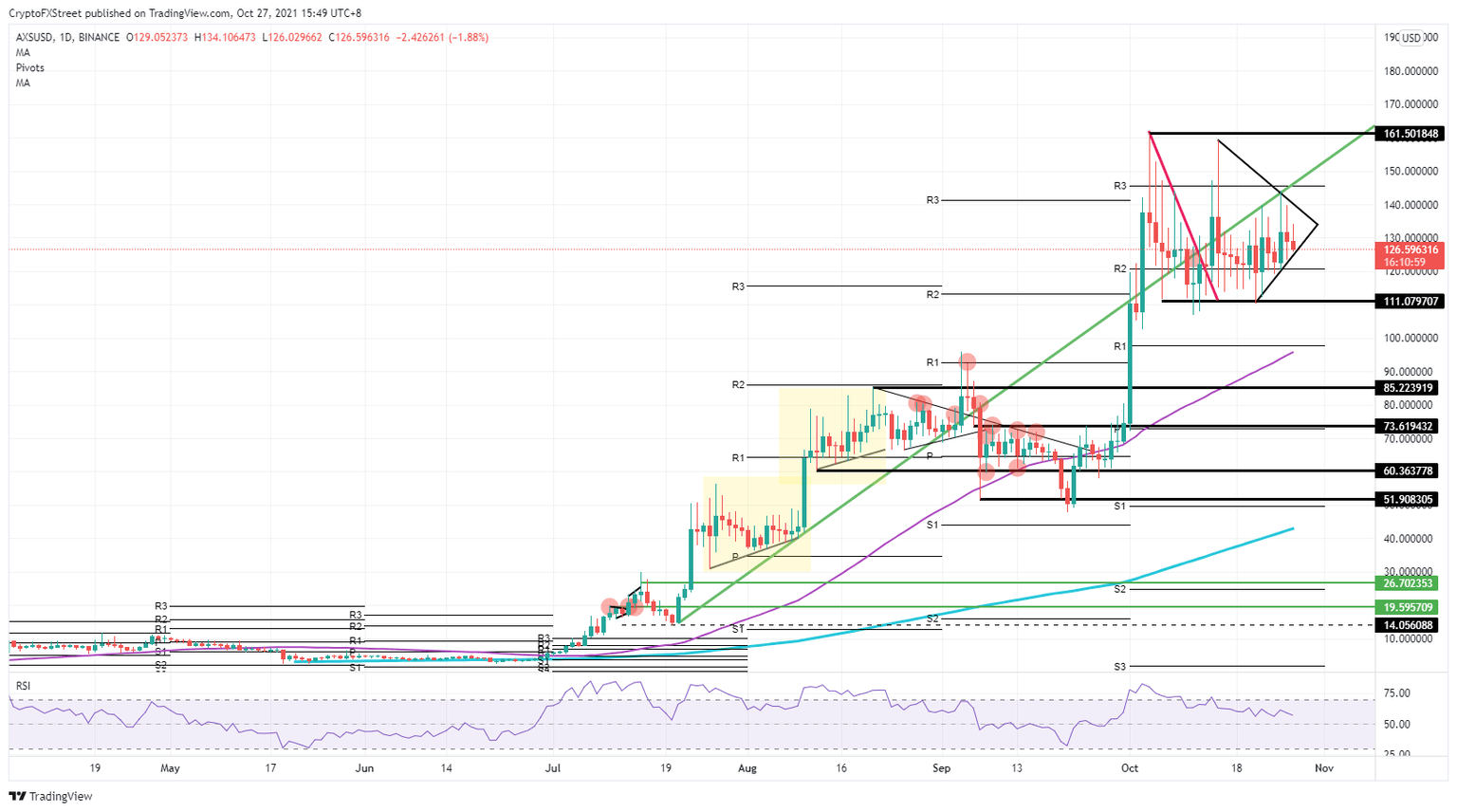

- Axie Infinity price has been in a pennant formation since October 21 and looks set for a bullish outbreak.

- With the RSI going to more neutral levels, bulls have the upper hand to add more buy-side volume to AXS price.

- Once above $150, bulls will be able to test $161.50 and possibly make new all-time highs.

Axie Infinity price (AXS) has not been making any new highs since October 4 when the price started to consolidate inside a pennant formation. With bulls awaiting the proper discount to rejoin the uptrend, the pennant looks ripe for a bullish outbreak. Following the break out, a retest of the all-time highs looks more than likely, with a possible new record high achieved.

Axie Infinity price sees support above $120, targeting $161 and new record highs

Axie Infinity price started its uptrend around September 21, which has so far resulted in 221% gains.. Recently AXS price has faded a bit under some profit-taking, now the current pennant formation looks ready to give bulls another shot at making new all-time highs. With the Relative Strength Index (RSI) firmly in the neutral zone, bulls can easily add large chunks of buy-orders to their portfolio without fear of pushing the RSI into overbought territory.

AXS price needs to stay above $120 in order for bulls not to get stopped out of their longs. After that it could pop higher towards $150. At $150, a new all-time high will be within grasp. Expect a possible $170 to be tested, but expect a quick return to $150 as this uptrend will start to lose steam and see quite some considerable profit-taking.

AXS/USD daily chart

Should the pennant break down in favor of bears, expect a break below $120. That would see bulls fleeing the scene as their stops got hit. A break below $111 would open the door for a sharp nose dive towards $85, which would mean that almost half the rally had been retraced. However, this would also provide some interesting levels to pick up AXS price at a discount.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.