Axie Infinity price eyes 45% gain after AXS flips two-month resistance

- Axie Infinity price rallied 56%, slicing through a declining trend line after two months.

- As AXS consolidates, there is a good chance AXS will trigger a 46% ascent to $81.54.

- A breakdown of the range low at $45.93 will invalidate the bullish thesis.

Axie Infinity price exploded last week as it embarked on a massive run-up. This rally flipped a crucial hurdle into a foothold, signaling a major breakout. Therefore, investors can expect AXS to continue this upswing after a brief period of consolidation or retracement.

Axie Infinity price eyes higher high

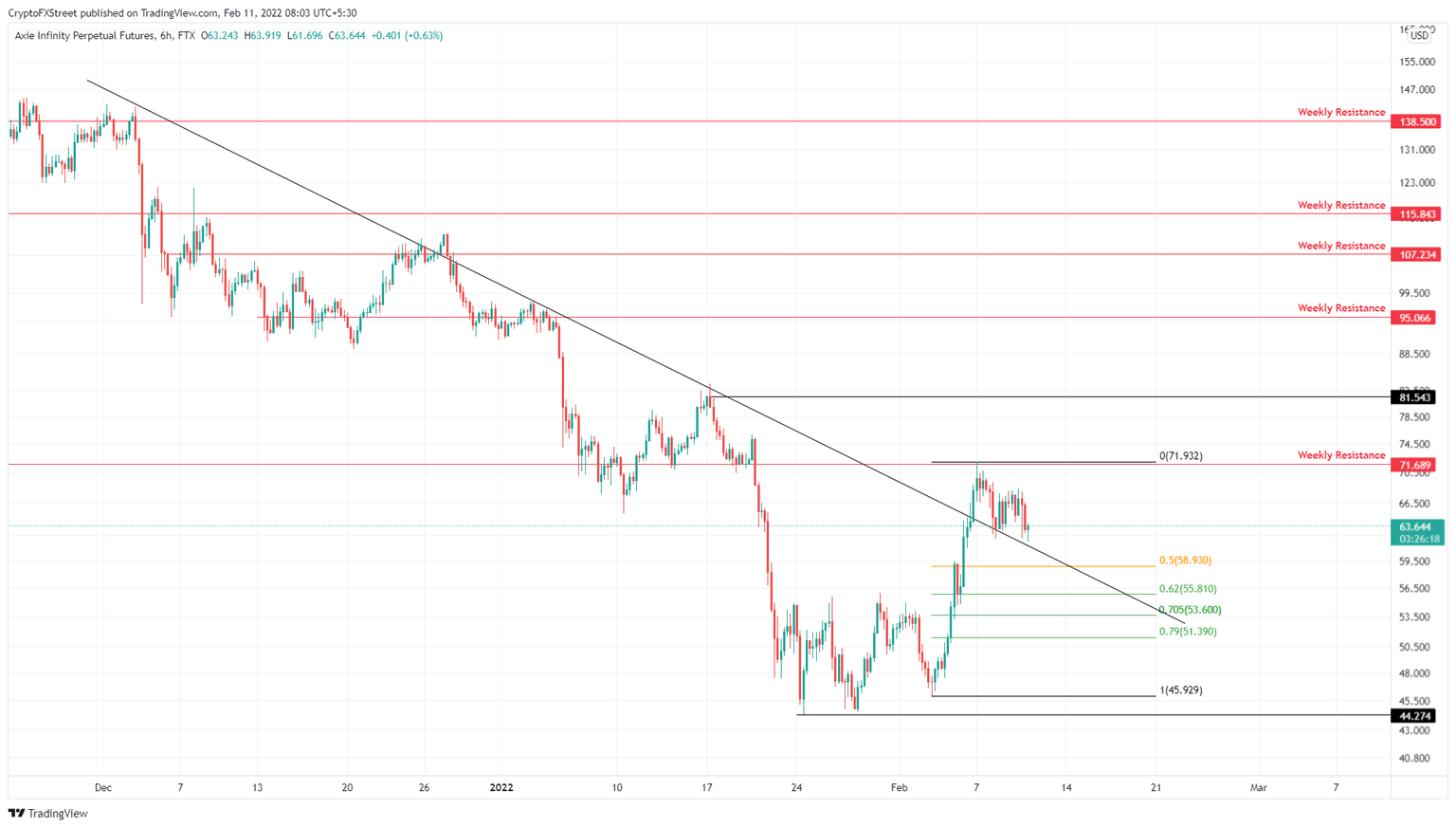

Axie Infinity price formed a base around the $44.27 support level, triggering a 56% uptrend. This move set up a swing high around the weekly resistance barrier at $71.69 on February 7 after flipping the two-month resistance barrier into a support level.

Since then, Axie Infinity price has retraced 14% and is currently retesting the recently flipped declining trend line. An uptrend is likely to originate as AXS bounces off the support level, but market participants should be prepared for a retest of the 62% or 70.5% retracement levels at $55.81 and $53.60, respectively.

A bounce off the $53.60 foothold is likely to lead to a slice through the $71.69 hurdle and retest the next blockade at $81.54. This move would constitute a 46% ascent and is likely where the local top is capped for Axie Infinity price.

AXS/USDT 6-hour chart

On the other hand, if Axie Infinity price continues to free fall, it will retest the range low at $45.93. A bounce off this barrier could recover the losses, however, a six-hour candlestick close below it will create a lower low, invalidating the bullish thesis.

In such a case, Axie Infinity price could revisit the $44.27 support level and attempt another uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.