Assessing the chances of Bitcoin price revisiting $20,000 before 2022 ends

- Bitcoin price consolidates on the four-hour timeframe, hinting at a volatile move soon.

- A minor retracement to $16,536 is likely before BTC kickstarts its explosive rally to 2022’s highest traded level at $19,235.

- Invalidation of the bullish outlook will occur below the $15,937 support level.

Bitcoin price shows a tight consolidation in the four-hour timeframe, indicative of a volatile move. The most plausible outcome of this range tightening would be a minor correction to rebalance the imbalance present to the downside. After this move, investors can expect a surge in buying pressure that kick-starts a massive run-up for BTC.

Bitcoin price ready to make its move

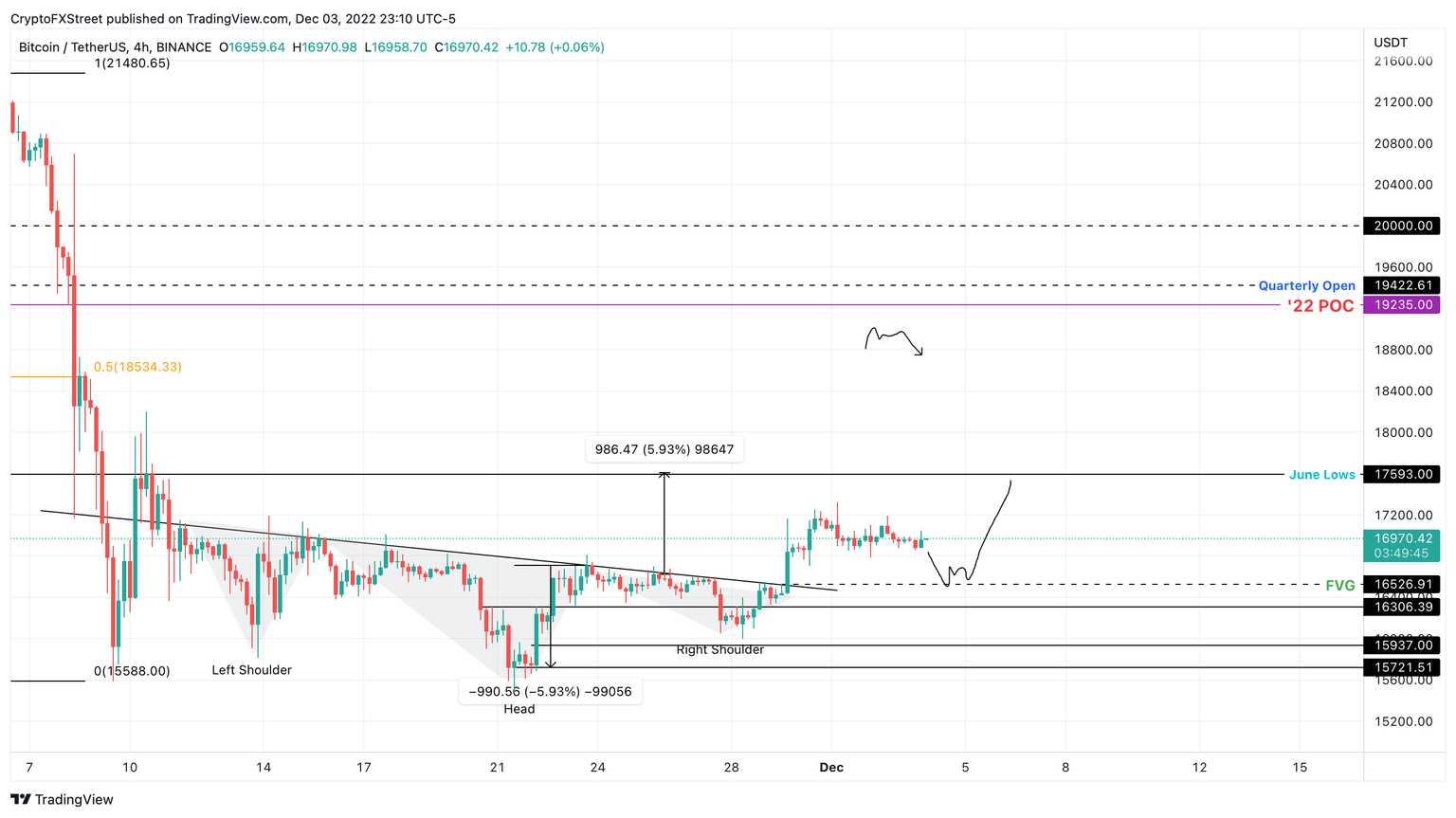

Bitcoin price breached its inverse head-and-shoulders pattern on November 29 and rallied nearly 5% to set up a local top at $17,324. Since then, BTC has been in a tight consolidation that will likely result in a bearish move.

A quick pullback to retest the $16,526 level should provide sidelined buyers with an incentive to push the big crypto at a discount. In such a case, a spike in buying pressure could trigger a reversal in Bitcoin price.

As for the targets to the upside, Bitcoin price needs to flip the $17,593 hurdle into a support floor to ensure that this upswing will continue. In such a case, BTC will eye the $19,253 hurdle; the highest volume traded level in 2022. This point is where the big crypto might form a local top, but there is a good chance that residual bullish momentum could allow Bitcoin price to wick up to the $20,000 psychological level.

BTC/USDT 1-day chart

While the bullish outlook makes logical sense, Bitcoin price must overcome many hurdles to make $20,000 happen. A breakdown of the $16,306 support level will be the first sign of weakness. But a four-hour candlestick close below $15,721 will create a lower low and invalidate the bullish thesis for BTC.

In this situation, Bitcoin price could revisit the next stable support level at $13,575.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.