Bitcoin Weekly Forecast: Assessing likelihood of 80% rally for BTC before 2023

- Bitcoin price produced a higher high after 18 days of consolidation and could indicate the start of a bear market rally.

- Historical seasonal patterns suggest a high chance BTC will rally in December, bringing the average return in 2022 close to 2021’s.

- A breakdown of the $16,700 support level will be the first sign of trouble, but losing the $15,550 support level will invalidate the bullish outlook.

Bitcoin price action over the last 72 hours indicates that a massive bullish move is coming. In the last two articles, we have taken a look at why this is possible from a technical and on-chain perspective.

In this weekly forecast, however, we will take a look at Bitcoin’s monthly performance for the last decade and determine if this bullish outlook is possible.

Bitcoin price and its performance over the years

Bitcoin price performance depends on what phase of the cycle it is in. If it is in a bull run, monthly returns tend to be positive, but during bear markets, the average yield tends to decline. Currently, BTC is yet to produce a bottom.

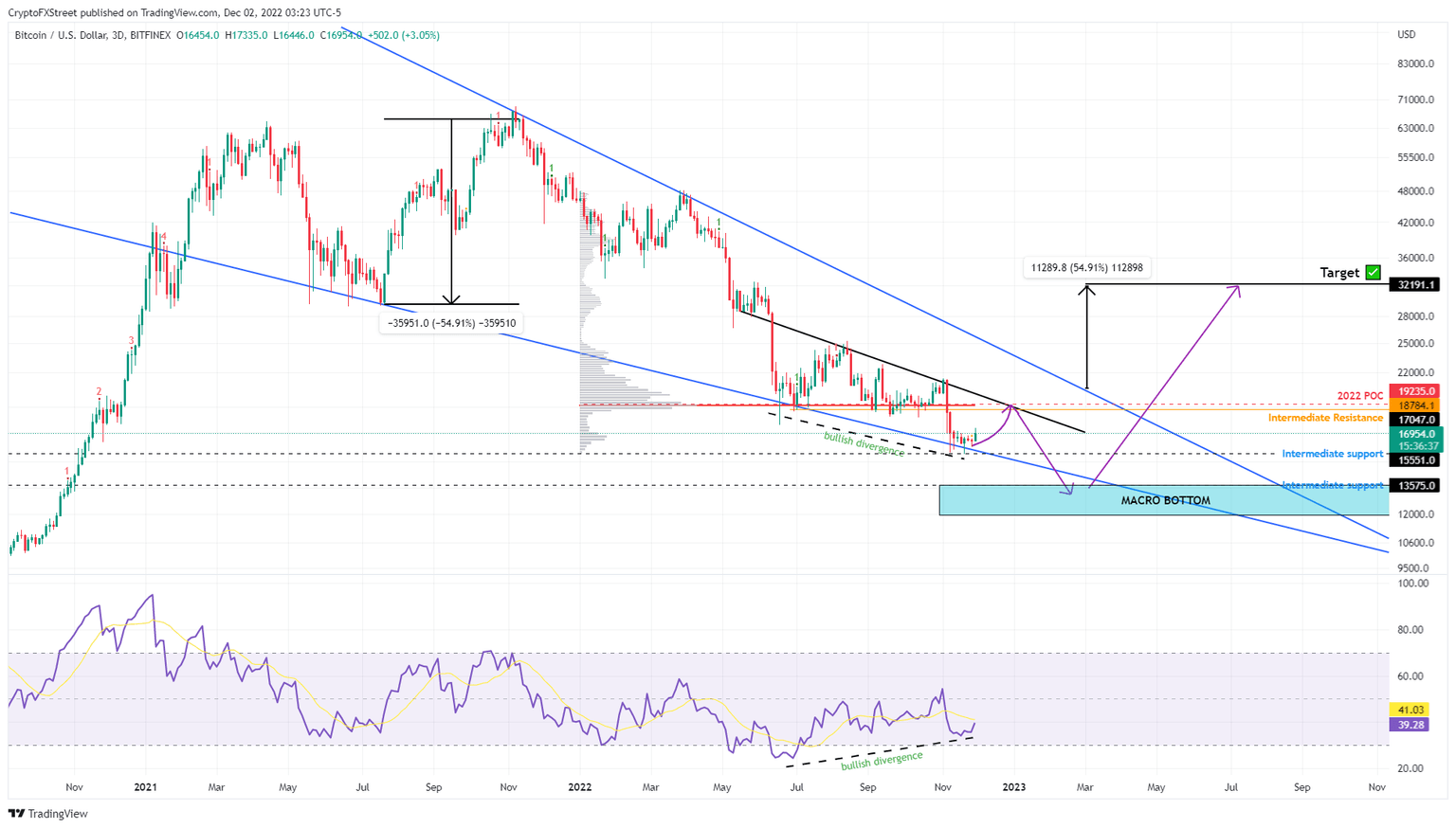

As discussed in previous articles, the $15,550 low could be a bottom for the market, but it is impossible to know for sure. Judging from previous cycles and Bitcoin price action, a further decline actually seems likely. An ideal place for a macro bottom would be the range, extending from $31,575 to $11,898. Due to volatility, a retest of $10,000 could also be possible.

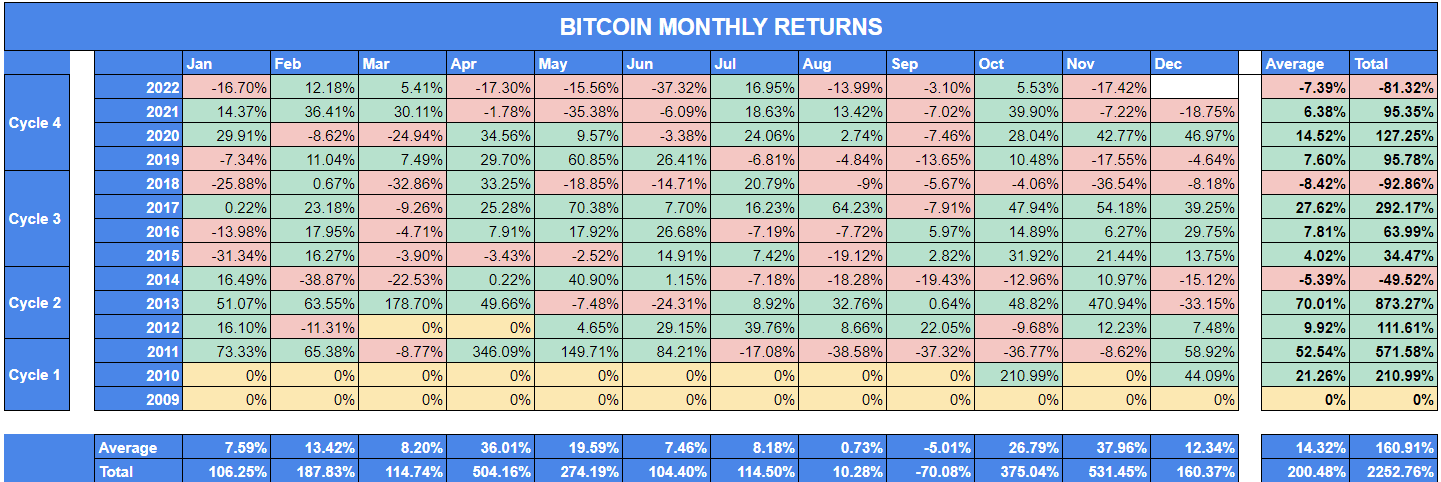

What insights can Bitcoin’s monthly and yearly performance shed? For the last 13 years, Bitcoin price has mostly up with an average monthly return of 14.32% over the period.

In 2022 alone, the average monthly return was -7.39%, well below the 13-year average of 14.32% for BTC price. Based purely on speculation, Bitcoin price needs to rally approximately 81% from the current position at $17,000 for 2022’s average return to merely reach 0%.

BTC monthly return

Is an 81% upswing likely in December 2022?

It is highly unlikely that Bitcoin price will surge 81% in under 30 days. Judging from the 13-year history, the average monthly return for BTC in December is only 12.34%. From a conservative standpoint, only a 10% to 15% upswing is probable.

If such an outlook plays out, Bitcoin price should tag $19,500. Interestingly, this level coincides with the target forecasted in the previous weekly forecast.

Outliers in the decade-long lifespan of the big crypto show that the highest return in December was 470%, which happened in 2013 when BTC was extremely volatile. 2017, however, saw a 54% upswing, so it is not outside the realm of the possibility that Bitcoin price will rally to $30,000.

In fact, the technicals present a bullish falling wedge pattern, a breakout from which could trigger a 54% upswing in Bitcoin price to $32,191. Furthermore, three critical on-chain metrics that focus on investor health, selling pressure and smart money actions point to all the conditions required for BTC price to kick-start a bear market rally as the year comes to an end.

BTC/USDT 1-day chart

While the bullish outlook for Bitcoin price makes sense, investors should consider the other side of the argument - uncertainty. With the United States Federal Reserve looking to cut down interest rate hikes from 75 basis points (bps) to 50 bps, things could take a turn for the worse.

Every time the Fed has pivoted from hawkish to dovish, the markets have suffered a bearish fate. The last time this happened was after the Great Recession of 2008, which led to a 35% drop in the S&P 500.

Fed pivot vs S&P 500

Since Bitcoin price and the stock market are highly correlated, the big crypto could follow suit and trigger a massive crash. Investors should note that a breakdown of the $16,700 support level will be the first sign of trouble or waning interest from buyers.

However, losing the $15,550 support level will create a lower low and skew the odds in the bears’ favor. This invalidation of the bullish outlook could trigger another Bitcoin price sell-off to the potential macro bottom region, extending from $13,575 to $11,898.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.