ApeCoin Price Prediction: Is APE setting up a smart money trap?

- ApeCoin price rallied by 10% on January 25.

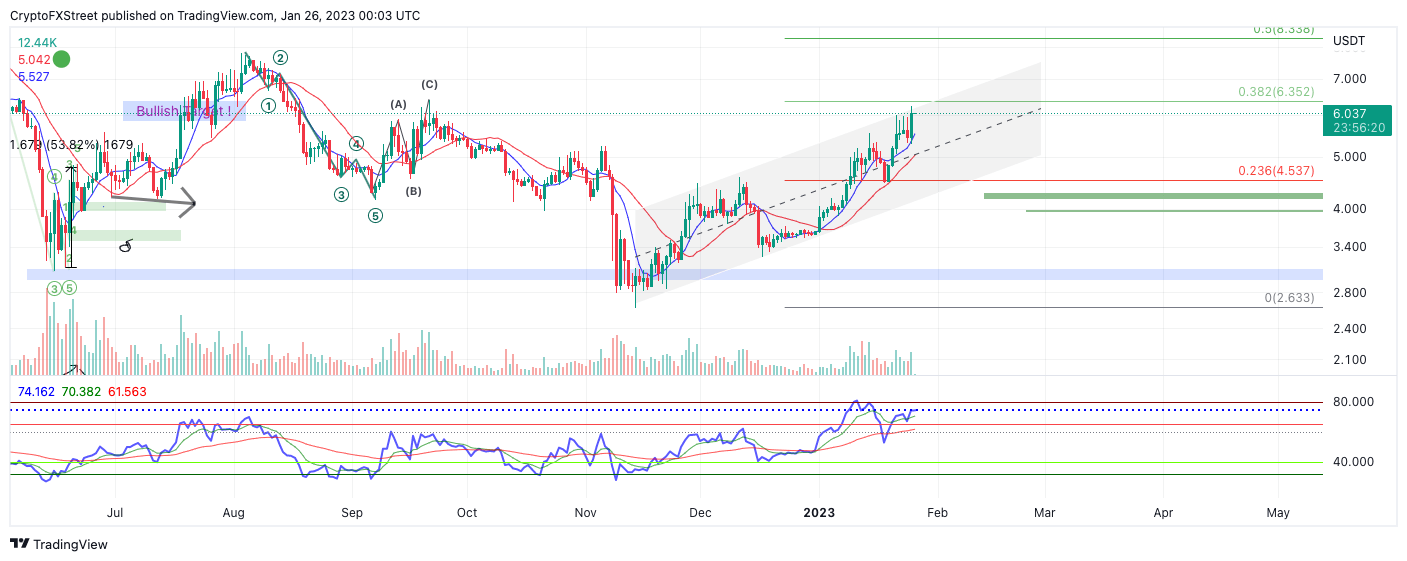

- The Relative Strength Index shows the uptrend is weakening.

- A breach of $5.29 could induce a much stronger decline.

ApeCoin Price is in question as the uptrend move is not delivering the same amount of strength witnessed in the trend prior. Traders should be on the lookout as a sudden dip could be the start of a much larger decline.

ApeCoin setting up a trap?

ApeCoin price has risen by 10% on the day as the bulls are aiming to solidify a daily close and candlestick above the $6 price zone. The Ethereum-based NFT token shows promise that the uptrend can continue but keen attention should be applied to risk management.

APE price currently auctions at $6.02. Earlier in the week, the APE price showed a bearish signal on the Relative strength Index (RSI), printing a strong bearish divergence at a key level. Despite the 10% spike, the RSI remains suppressed beneath 70. This significant reading merits the need for caution moving forward. Traders may want to call it quits if the daily low at $5.29 is pierced.

APE/USDT 1-day chart

Invalidation of the bearish thesis could arise from a spike above the September high at $6.40. The breach could see further upside to challenge the $7 liquidity zone. ApeCoin price would rise by 17% if the bulls were persistent.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.