ApeCoin price could rise an additional 20% to $16.50

- ApeCoin price shows bullish momentum in the Heiken-Ashi chart

- Especially now that APE has broken through critical resistance

- A sustained close above $13.76 can result in a 20% breakout

ApeCoin price is displaying momentum on the 4-hour Heiken-Ashi chart. Traders should keep this asset on their watchlists for intraday scalps.

ApeCoin price isn't done yet

ApeCoin price has had all the hype in the crypto market lately as traders love the idea of a tokenized index for the entire NFT market. Since its launch earlier this month, ApeCoin price has made an impressive 2,700% increase. APE currently trades at $13.14, 1,200% above the lows.

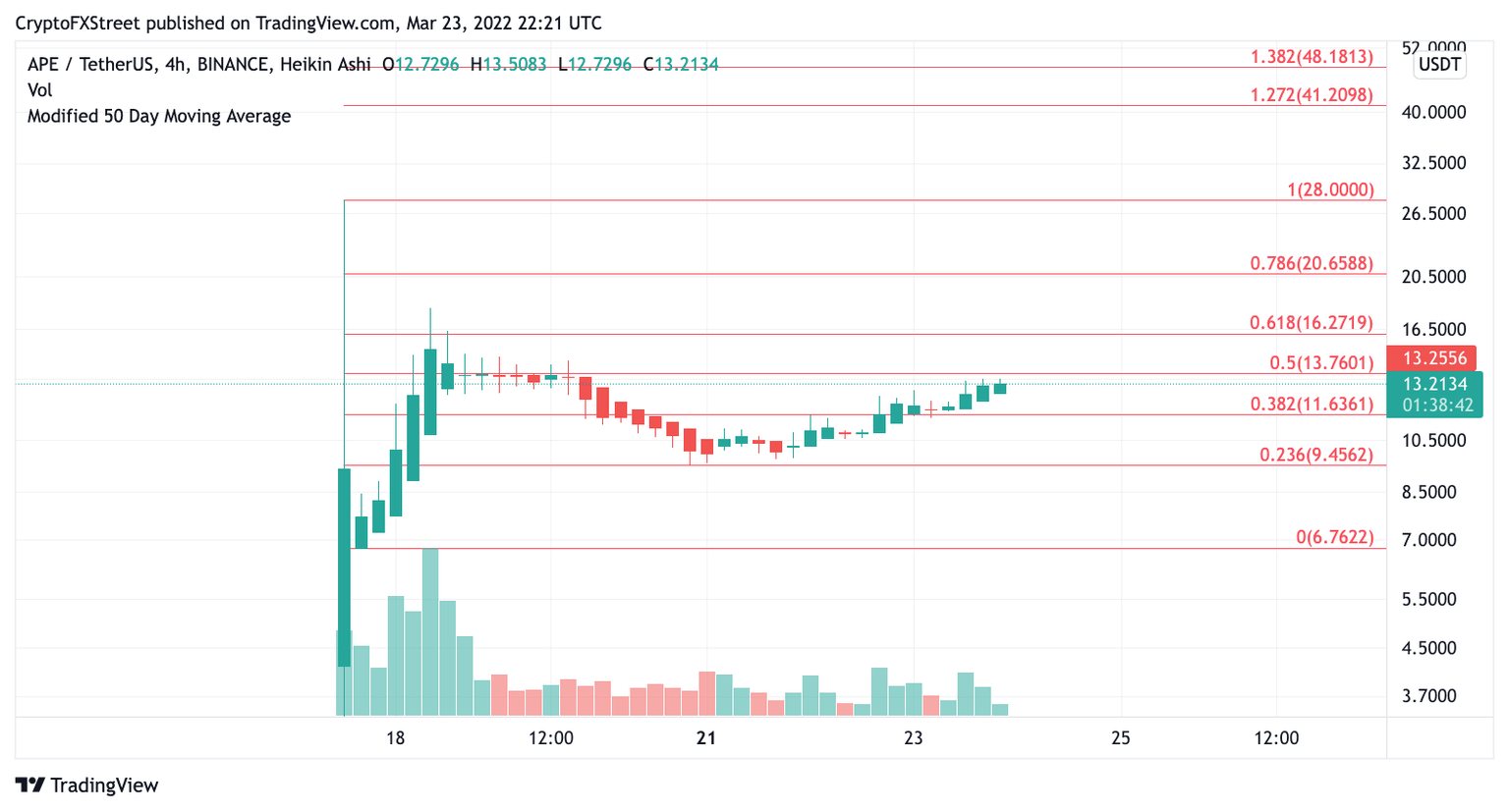

Even after the significant gains, ApeCoin price continues trending upwards on the 4-hour Heiken-Ashi chart. This can be considered an excellent bullish momentum signal. Secondly, APE price broke past the .382 Fibonacci level marked from the all-time high to the first bottom.

Now ApeCoin price faces strong resistance at the .5 Fibonacci level. If bulls can maintain strength by closing above $13.76, then the next target for the APE price will be $16.50, representing a 20% increase from the current levels.

APE/USDT 4-HR Heiken-Aishi Chart

Still, there is always a possibility that ApeCoin price could reverse. A failure to close above the .5 Fibonacci level can spell trouble.

If this were to happen, ApeCoin price could fall back into the .382 level at around $11.60, or the .236 level at $9.45, representing a 30% retracement.

Author

FXStreet Team

FXStreet