ApeCoin: How likely is a new all-time high?

- ApeCoin price shows resilience after crashing 44% from its all-time high at $17.47.

- A bottom formation suggests that APE is ready for a quick 20% recovery rally.

- The $9.52 support breakdown will create a lower low and invalidate the bullish thesis.

ApeCoin price shows signs of recovery after it forms a makeshift base. This foothold will likely serve as a launching pad, allowing APE to rally higher and recover its losses.

Also read: AMC stock surges on the return of retail, GME pops 30% as Ryan Cohen buys

ApeCoin price reveals bullish intent

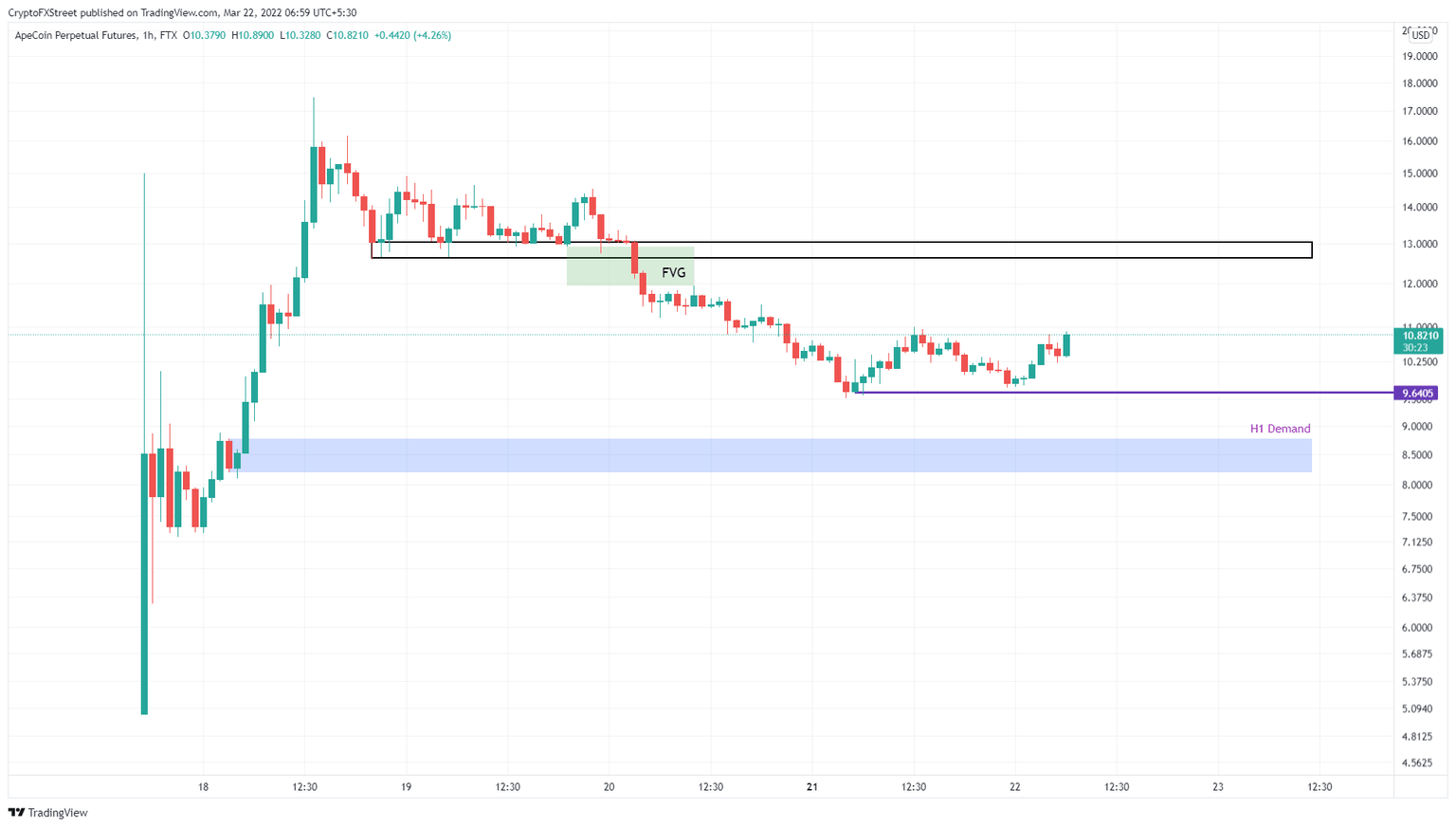

ApeCoin price dropped roughly 44% from its all-time high at $17.47 and set a swing low around $9.52. This cessation of the downward move was followed by a quick run-up with a higher high formation at $11 relative to the March 21 swing high.

Such a formation indicates willingness from bulls to move higher. This 15% rally was followed by a retracement to form a higher low at $9.73, indicating the continuation of the uptrend. Therefore, investors can expect ApeCoin price to sustain this trend in the coming days.

From the current position at $10.82, there is an opportunity for a 22% ascent to $13. The area extending from $12.63 to $13.04 is a resistance zone and is likely where the upside will seize for ApeCoin price.

Although unlikely, there is a chance for ApeCoin price to retest the old-all-time high at $17.47 if bulls manage to breach the $15.81 resistance barrier. In some cases, the run-up might extend and set a new all-time high at $20 if the crypto market remains optimistic.

APE/USDT 1-hour chart

On the other hand, if ApeCoin price fails to maintain the momentum, there is a good chance it will return to the $9.52 support level.

Here, buyers have another chance at recovery by forming a double bottom setup. However, failing to do so will result in a further downtrend. If this move produces a decisive candlestick close below $9.64, it will create a lower low and skew the odds in the bears’ favor.

This development will invalidate the bullish thesis and trigger a further correction for the ApeCoin price to revisit a one-hour demand zone, extending from $8.19 to $8.76.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.