Altcoins facing a risk of correction after massive rally: Cardano, Chiliz, Fetch.AI, Lido, The Graph

- Altcoins have observed a surge in their prices in the past four months, several key tokens are facing a risk of a correction.

- On-chain metric MVRV reveals a higher risk than average in buying Cardano, Chiliz, Ethereum, Fetch.AI, Lido, among other assets.

- AI and data coins could correct in the coming weeks as the hype surrounding the narrative declines.

Altcoin prices have climbed in the past four months, offering massive gains to holders beginning October 2023. Except for a few lagging altcoins, a vast majority of assets generated profits for average wallet holders in the mid to long term timescale.

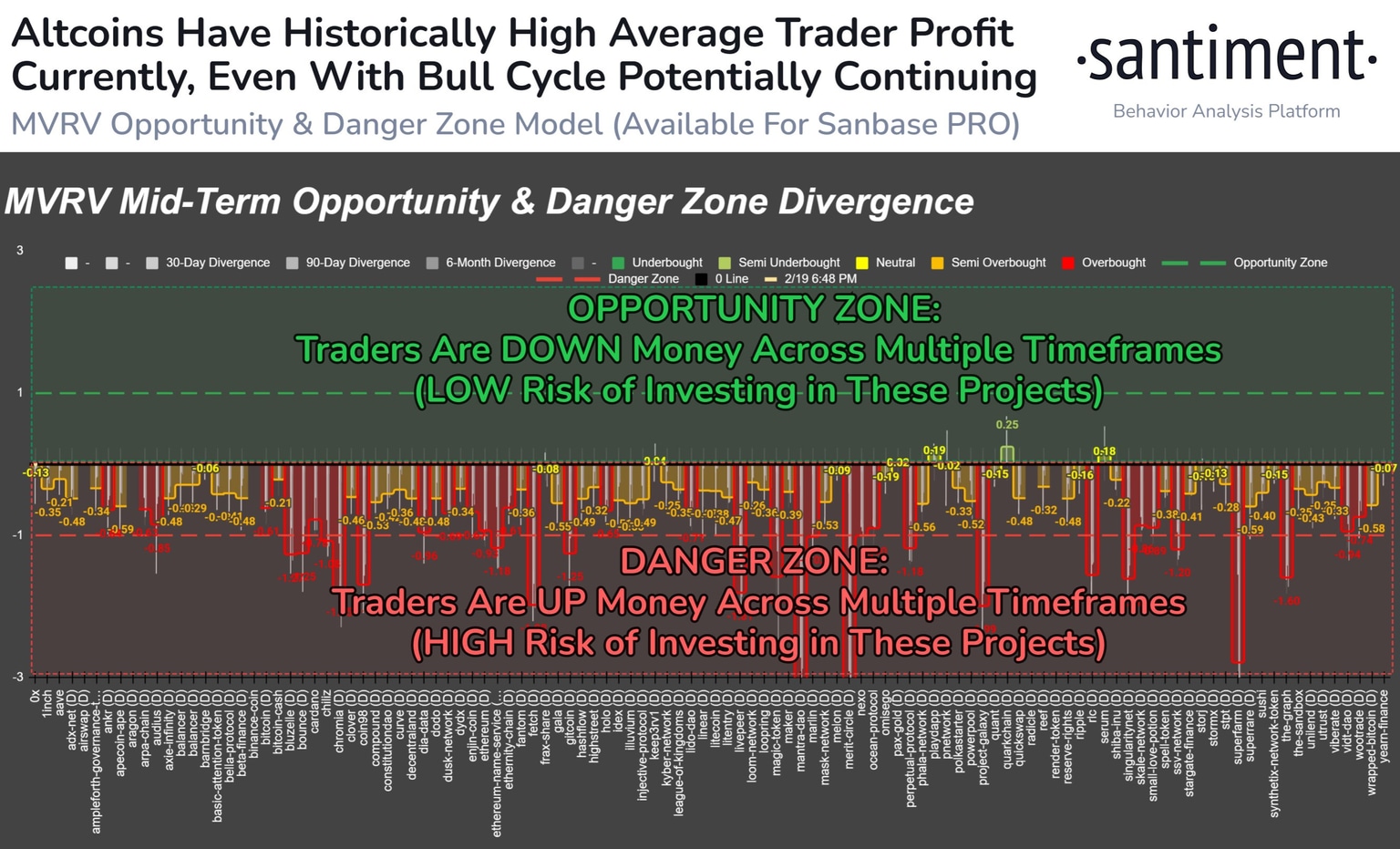

Crypto intelligence tracker Santiment’s predictive model uses Market Value to Realized Value (MVRV) metric to determine whether an altcoin is in an opportunity or danger zone. The model identified several assets in the danger zone, most notable ones including Cardano, Ethereum, Lido and Fetch.AI, among others.

Also read: AIT, GRT, OCEAN: Crypto data coins see massive rally alongside Bitcoin and AI tokens

Altcoins in the danger zone: ADA, CHZ, ETH, ENS, FET, HNT, LDO

Santiment’s MVRV model places several altcoins in the danger zone. Santiment’s analysts believe that these assets are at a high risk of “correcting.” After four months of rallying higher, several assets have reached at a point where they typically correct, increasing the risk associated with opening a trade or a long position in these cryptocurrencies.

The notable cryptocurrencies that are currently in the MVRV danger zone include, Cardano (ADA), Chiliz (CHZ), Ethereum (ETH), Ethereum Name Service (ENS), Fetch.AI (FET), Holo (HNT), Lido (LDO), Nexo (NEXO), Ocean Protocol (OCEAN), Singularity NET (AGIX) and The Graph (GRT).

MVRV model by Santiment. Source: Santiment

The altcoins identified using the MVRV model are fairly “overbought,” while this does not mean that they are set to witness a massive correction, it means that there is a higher than average risk of purchasing these assets after a four-month rally in their prices.

AI hype could die down soon

The hype generated in Artificial Intelligence (AI) tokens with the launch of text to video generator tool Sora fueled gains in several assets like AGIX, FET, GRT. The hype could die down soon, if the narrative fails to gain traction, these cryptocurrencies could witness a correction. The launch of further tools from OpenAI or Sam Altman’s projects could see the “sell the news” effect at play as market participants anticipate a spike in AI token prices.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.