Altcoin prices dropped over the weekend, liquidating more than $50 million in long positions overnight

- Altcoin prices declined against Bitcoin, liquidating $54.2 million in long positions overnight.

- Crypto analysts believe the depression phase of altcoins is close to an end and the assets are ready to trend upwards with breakouts in BTC pairs.

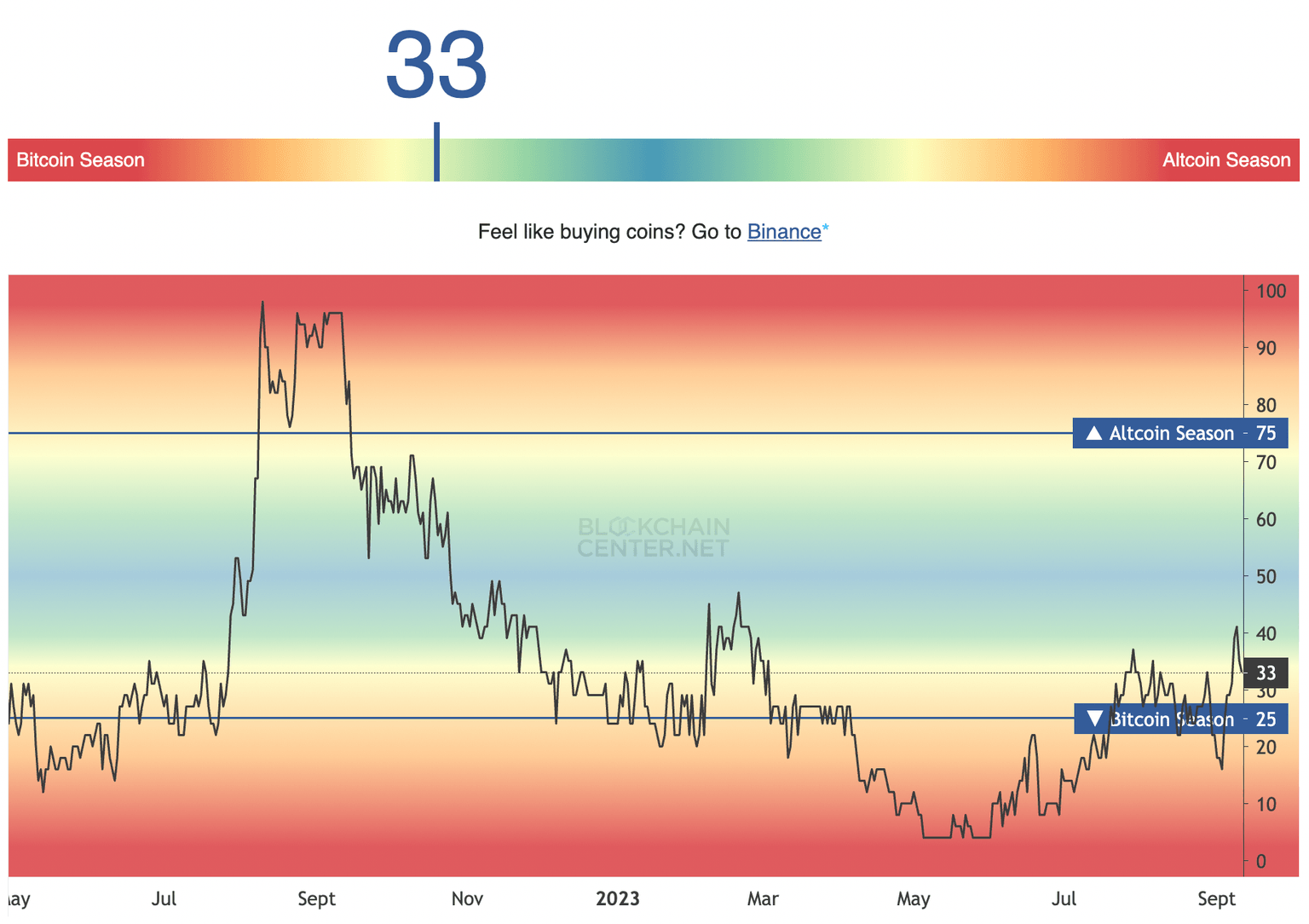

- The altcoin season index tracker noted a break above the Bitcoin season threshold, a key development that supports a recovery thesis.

Liquidation of long positions by altcoin traders are likely the last manipulative move before altcoin prices trend higher. To support this thesis of altcoin recovery, two key indicators are considered: The altcoin season index and the liquidation events in altcoins.

Also read: Arbitrum community sees new proposal for ARB staking and incentive distribution to users

Why altcoin price recovery is likely

Altcoins in the top 30 assets by market capitalization witnessed a decline in their prices over the weekend. This resulted in mass liquidations of derivatives. Approximately $54.2 million in long positions were liquidated in altcoins (setting aside the $8.27 million in BTC long liquidations). Liquidations are often followed by heightened volatility in asset prices in either direction. This makes long liquidations a key metric to watch.

Total liquidations chart for September 10, as seen on Coinglass.com

The last time long liquidations in altcoins exceeded the $50 million mark is September 1. While liquidations in long positions typically occur when altcoin prices are in a downward trend, crypto analyst Michaël van de Poppe says that altcoins are closer to their lows. Poppe believes this could mark the last phase before altcoin recovery.

The thesis is supported by the Altcoin Season Index by Blockchaincenter.net. The altcoin season compares the top 50 altcoins over the past 90 days. The value is between 0 and 100, and below the 25 mark it is Bitcoin season, while above 75 makes it alt season.

As seen in the chart below, the index has climbed to 33 at the time of writing. Potential advancement toward the alt season is likely on the horizon, according to the indicator.

Altcoin Season Index as seen on Blockchaincenter.net

Bitcoin price crash could derail altcoin recovery, delay alt season

The alt season is characterized by traders rotating profits from Bitcoin to altcoins. However, this may be delayed by a decline in Bitcoin price. Analysts predicted a breakout in BTC pairs of altcoins. However, typically, a BTC price crash could derail the progress of these assets.

Bitcoin price crashes are characterized by large volumes of capital flowing out of BTC pairs and exchanges, not typically rotating into altcoins. BTC declines drag altcoin prices down with them, and this could potentially delay the alt season narrative. To find out Bitcoin price targets and what’s next for BTC, check this post.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.