Alt season likely in Q3 with declining Bitcoin dominance, July emerges as altcoin month

- Over the past 30 days, 75% of altcoins outperformed Bitcoin, indicating that July is altcoin month.

- Bitcoin’s declining dominance and higher returns on altcoins have fueled the July alt season.

- Altcoins tend to rally when the tech-heavy US Nasdaq index climbs, as it pushes closer to it's all-time high of 15,871 points alt season is kicking in.

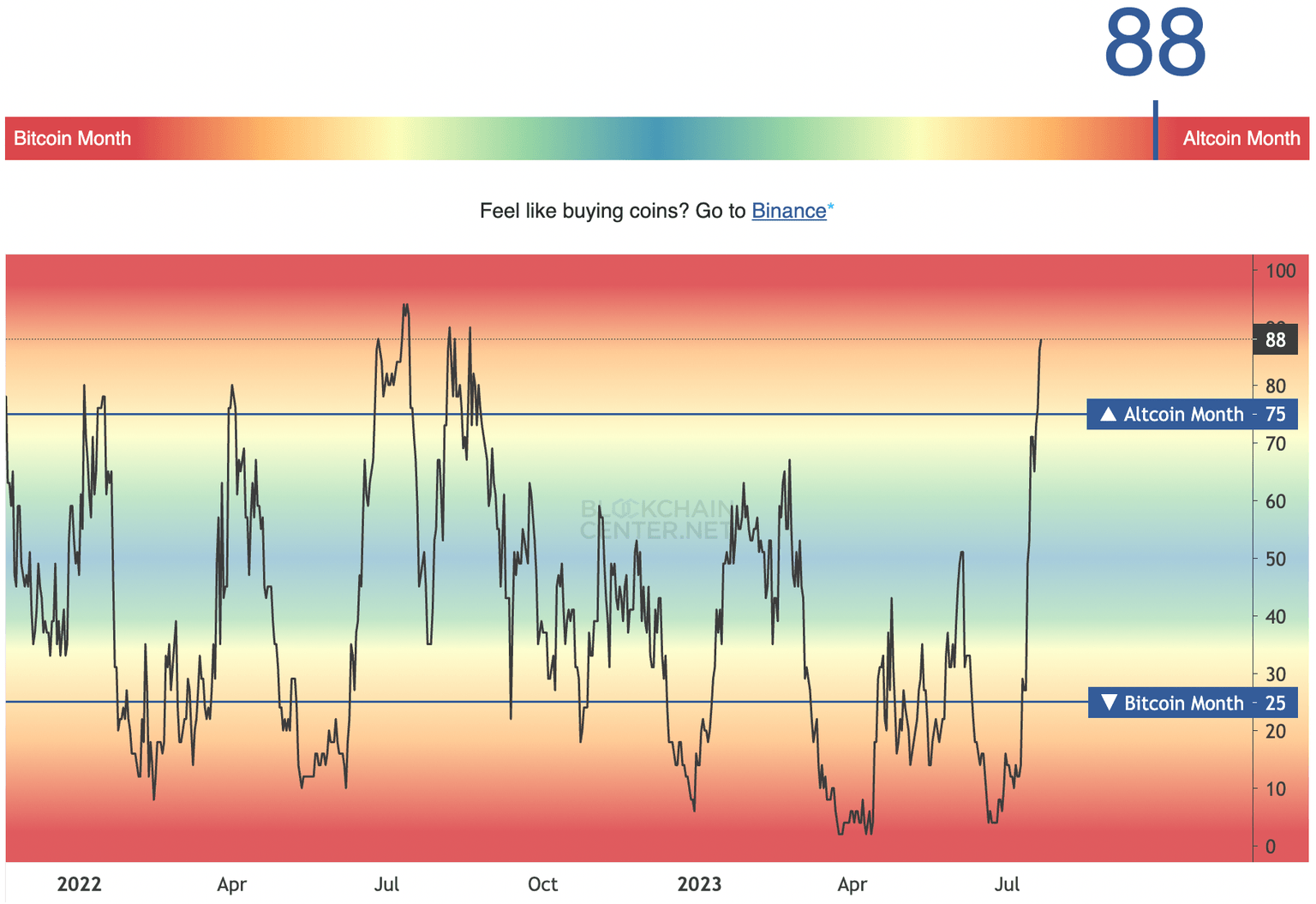

Alt season is a brief period where money flows out of Bitcoin and into altcoins and results in an increase in price for cryptocurrencies. According to a tracker by Blockchaincenter.net, July is altcoin month.

Also read: Ethereum price likely to reach $2,000, according to these bullish on-chain metrics

Altcoins outperform Bitcoin in July, kicking off alt season

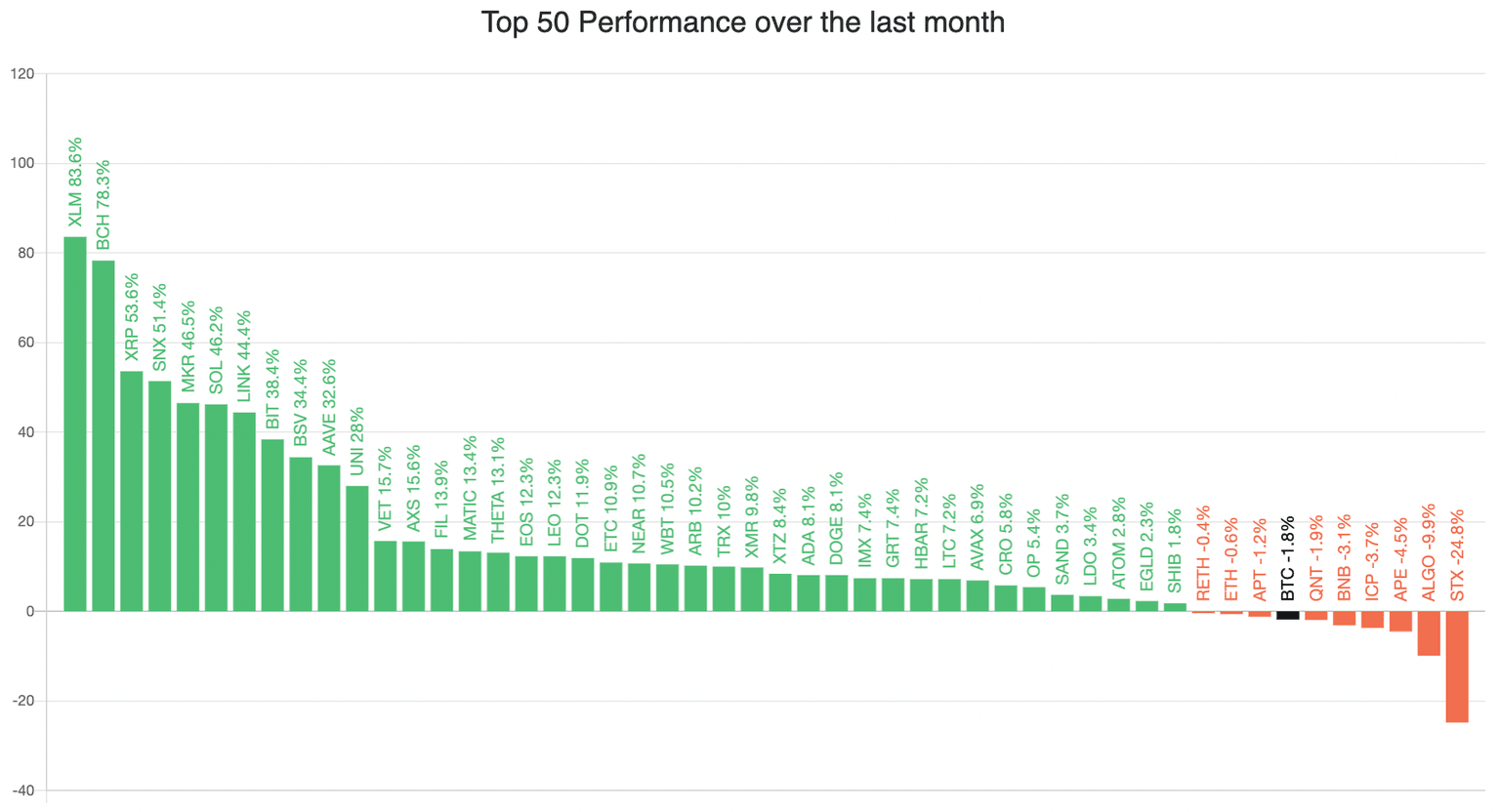

The alt season tracker at Blockchaincenter.net requires 75% of the top 50 cryptocurrencies to perform better than Bitcoin over a 30-day period to confirm that alt season is in. Over the past thirty days, excluding stablecoins and asset-backed tokens, assets in the top 50 have consistently outperformed Bitcoin.

Top 50 altcoins’ performance tracked by Blockchaincenter.net

According to the alt season index, altcoins kicked off the alt season in July 2023. The tracker reads 88 on a scale of 0 to 100. When the value is greater than 75, it is considered altcoin month.

Altcoin month July

Bitcoin’s dominance declined from 48.02% to 46.55% over the past thirty days, acting as a catalyst that drove altcoin prices higher and fueled capital rotation from BTC to alts. Moreover, Ripple’s partial win against US financial regulator Securities and Exchange Commission (SEC) fueled a rally in altcoins like Chainlink (LINK), Solana (SOL) and Polygon (MATIC), among others.

Typically, altcoins have rallied when US tech-heavy Nasdaq rallied. The index is at 14,084 at the time of writing, inching closer to its all-time high of 15,871 from December 2021. This could be a signal of an incoming alt season in Q3 of 2023.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.