Ethereum price likely to reach $2,000, according to these bullish on-chain metrics

- Returns of Ethereum long-term traders active over the past year have increased 14.9% on average.

- ETH trades at $1,895, below the psychological barrier of $2,000, while altcoins like XRP and Chainlink grab the spotlight.

- Less than 7% of Ethereum supply is on exchanges with a large percentage being held in self custody, reducing the selling pressure on ETH.

Ethereum price has decreased around 5% in the last seven days despite the rally in other altcoins such as XRP and Chainlink (LINK). Still, several on-chain metrics point to an upcoming increase in ETH price, which is likely to revisit the $2,000 psychological threshold soon, according to analysts at intelligence tracker Santiment.

Also read: Ethereum founder Vitalik unveils account abstraction that could onboard billions of users

Ethereum network’s bullish on-chain metrics

Ethereum price declined from its peak of $2,139.44 in April to $1,889 at the time of writing, within a three-month period. The $2,000 level is considered a key psychological support level and analysts at Santiment say traders are becoming increasingly optimistic about the altcoin.

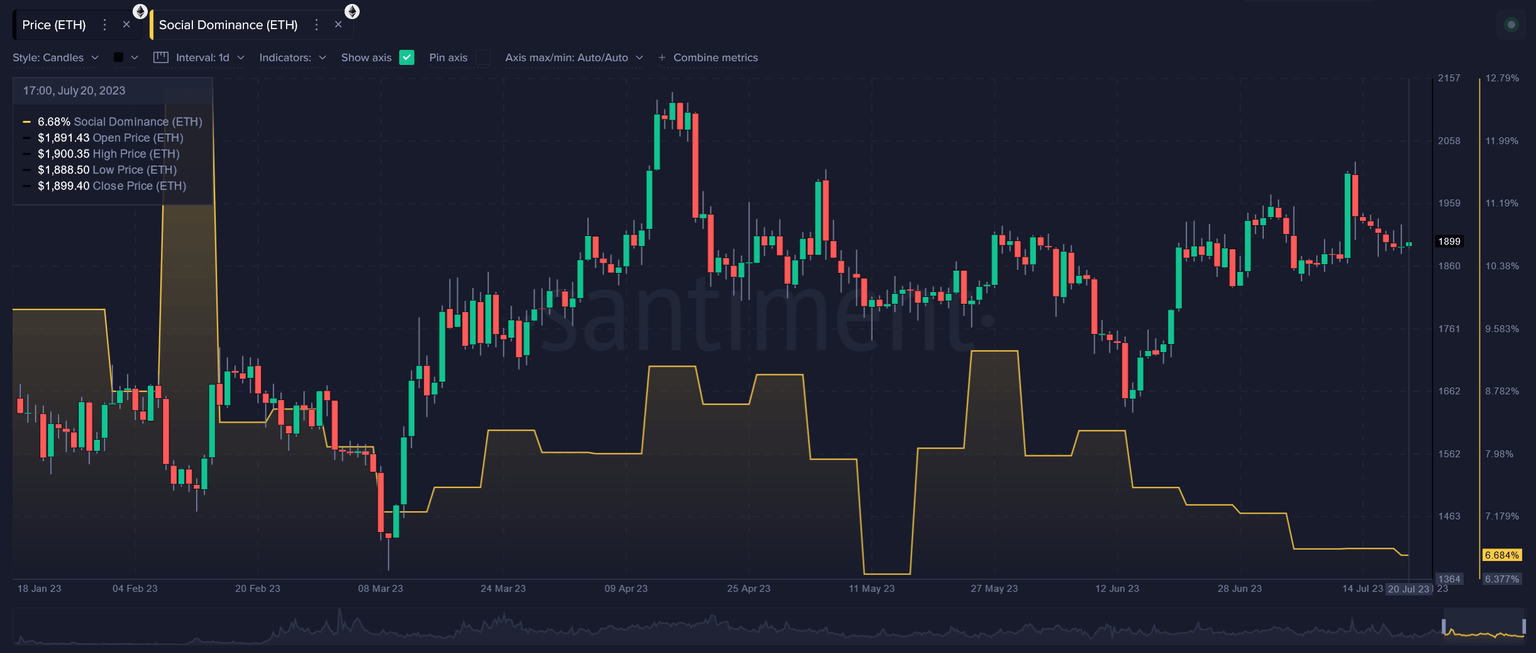

While discussions in social media about Ethereum among traders have declined to the 2023-low observed in mid-May, analysts are bullish on ETH price recovery.

Ethereum social dominance

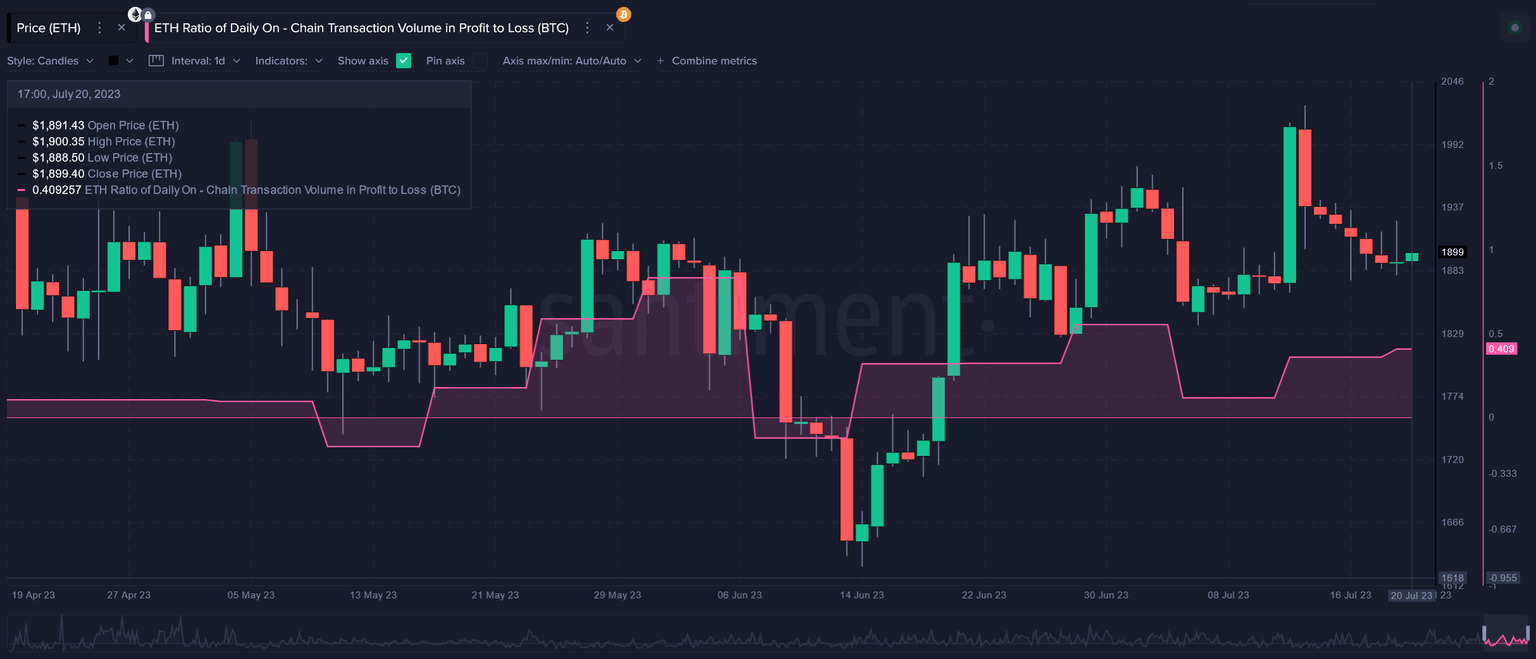

Analysts note that the ratio of on-chain transaction volume in profit to loss is still favoring profit takes in Ethereum, though by a relatively small margin. If Ethereum price drops from the current level to $1,800, panic selling is expected. Santiment analysts said that price declines in response to panic selling would justify higher demand for the altcoin.

Ratio of Ethereum’s daily on-chain transaction volume in profit to loss

Ethereum long-term traders and holders, or those who have hold ETH for at least a year, are currently registering an average of 14.9% gains. However, ETH wallet addresses that have been active in the past 30 days are registering minor losses of 0.35%.

Santiment analysts note that when these percentages are closer to zero than in extremely negative territory, it opens up profitable opportunities for ETH holders and reflects a bullish potential in the asset.

Another key on-chain metric is the percentage of Ethereum tokens on exchanges and in self-custody. According to data from Santiment, less than 7% of Ether is on exchanges, meaning that the likelihood of a huge sell-off is lower than usual.

This metric is considered one of the long-term bodes of confidence for Ethereum, paving the way for the altcoin’s return to the psychological level of $2,000.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.