Ethereum scaling solution Arbitrum passes improvement proposal AIP-2

- Arbitrum Improvement Proposal AIP-2 has been officially passed by the community to simplify development of smart contract wallets.

- AIP-2 implementation would allow users to pay gas fees using any ERC-20 token, and outside entities could offer subsidized gas fees to users.

- Arbitrum’s update is likely to catalyze ARB price recovery in the short term.

Arbitrum, a suite of Ethereum scaling solutions, has officially announced that AIP-2 was passed by the community. The protocol attempts to scale the Ethereum blockchain, and with its new update it addresses user concerns surrounding smart contract wallet usage and gas fees.

Also read: Arbitrum unlocks Layer 3 chains as Ethereum Layer 2 wars intensify

Arbitrum officially passes AIP-2

Arbitrum has officially launched an Arbitrum Improvement Proposal (AIP-2) tackling several user experience level challenges for market participants. Three key concerns of users are wallet recovery, payment of gas fees and bundling transactions together.

AIP-2 tackles these challenges and provides the desired benefit to users through social recovery, payment of gas fees through any ERC-20 token (not just Ether) and more control over batched transactions through session keys.

Arbitrum Improvement Proposal #2 has officially passed

— Arbitrum (,) (@arbitrum) July 20, 2023

AIP-2 improves support for Account Abstraction, making development around Smart Contract Wallets easier than ever.

The frontier of improving web3's UX starts here, so let’s explore some use cases pic.twitter.com/GfBd4rmN0Y

The Total Value of Assets Locked (TVL) in the Arbitrum network surpassed $2.747 billion, according to DeFi intelligence tracker DeFiLlama. During previous launches and releases from Arbitrum developers Offchain Labs, there has been a notable increase in the TVL and ARB price.

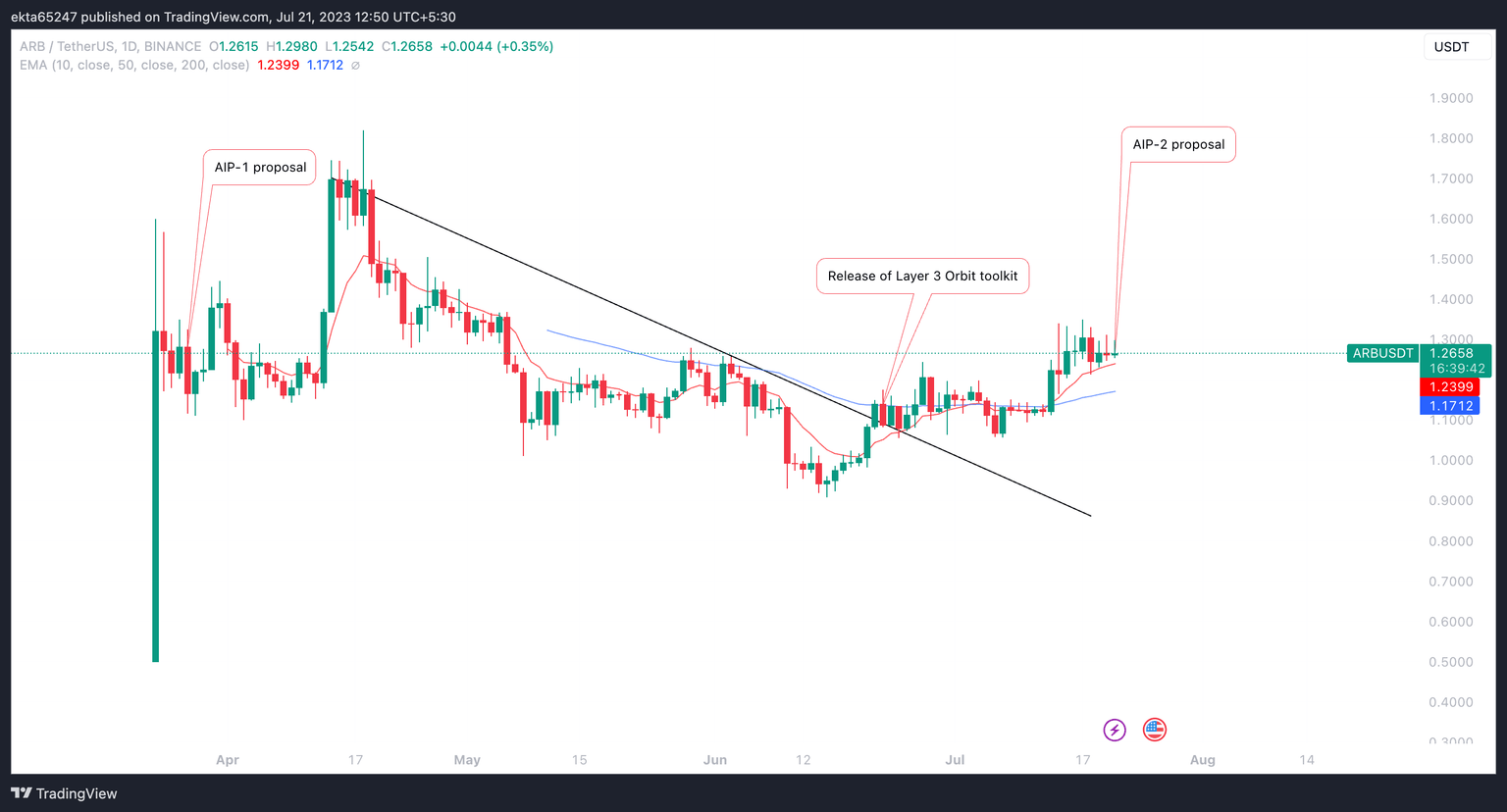

ARB/USDT one-day price chart on Binance

If history repeats, it is typical for Arbitrum price to climb in response to an AIP-2 approval by the community. At the time of writing, ARB price trades at $1.266 against USDT on Binance. The Ethereum scaling token is up 11.46% between June 21 and early on Friday. It is likely that ARB price rallies in the short term, yielding further gains for holders.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.