Algorand Price Prediction: Is this 25% upswing the start of a new rally?

- Algorand price is recovery mode since the start of the new year, rallying by 25%.

- ALGO’s next bullish targets lie 8% higher at $0.225.

- Invalidation of the uptrend could arise from a breach below $0.20.

Algorand price is displaying a stunning bullish performance. Still, subtle cues of the uptrend show a need for caution to be applied.

Algorand price makes a complete U-turn

Algorand price has forgotten the bearish sentiment lingering around risk assets, including cryptocurrencies. On January 12, the scalable blockchain token stands elevated 25% above the New Year's opening price. While early bulls have yet to secure their profits, the ALGO price displayed subtle cues that merit the question of the uptrend's health.

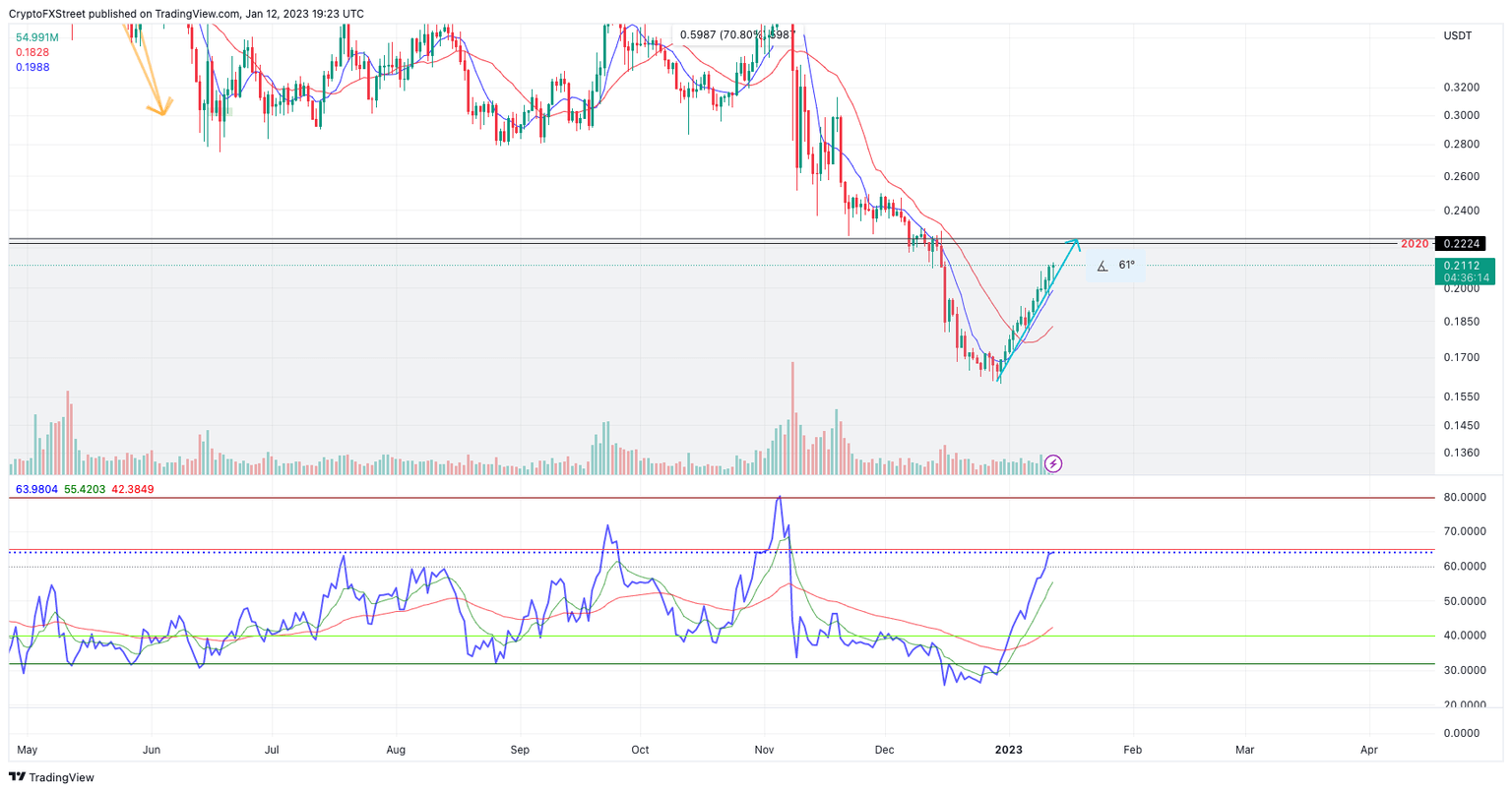

Algorand price currently auctions at $0.21. The ongoing rally, whose biggest pullback was a 4% correction between January 4-5, has an angled slope of 62 degrees. With the exception of the January 5 down day, every day within this month has yielded bullish returns for investors entering the developing trend.

The next bullish target lies at 8% above the current market value at $0.225. The target zone played a role of support in December's final stages before a 29% downswing ensued. Traders should be wary, though, as the volume indicator remains shallow during the current rally compared to the previous decline. A volume indicator is a useful tool to gauge market participants' strength. The lack of buyers displayed could suggest that only retail investors are involved in the current uptrend, an opportunity for smart money market makers to take advantage of.

ALGO/USDT 1-day chart

Invalidation of the uptrend could arise from a breach below the newly established trend line. Currently, the aforementioned level is priced at $0.2010, a 5% decline from the current Algorand price. A tag of the low could induce a retest of the uptrend's origin point near $0.16. The ALGO price would decline by 25% if the bears were successful.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.