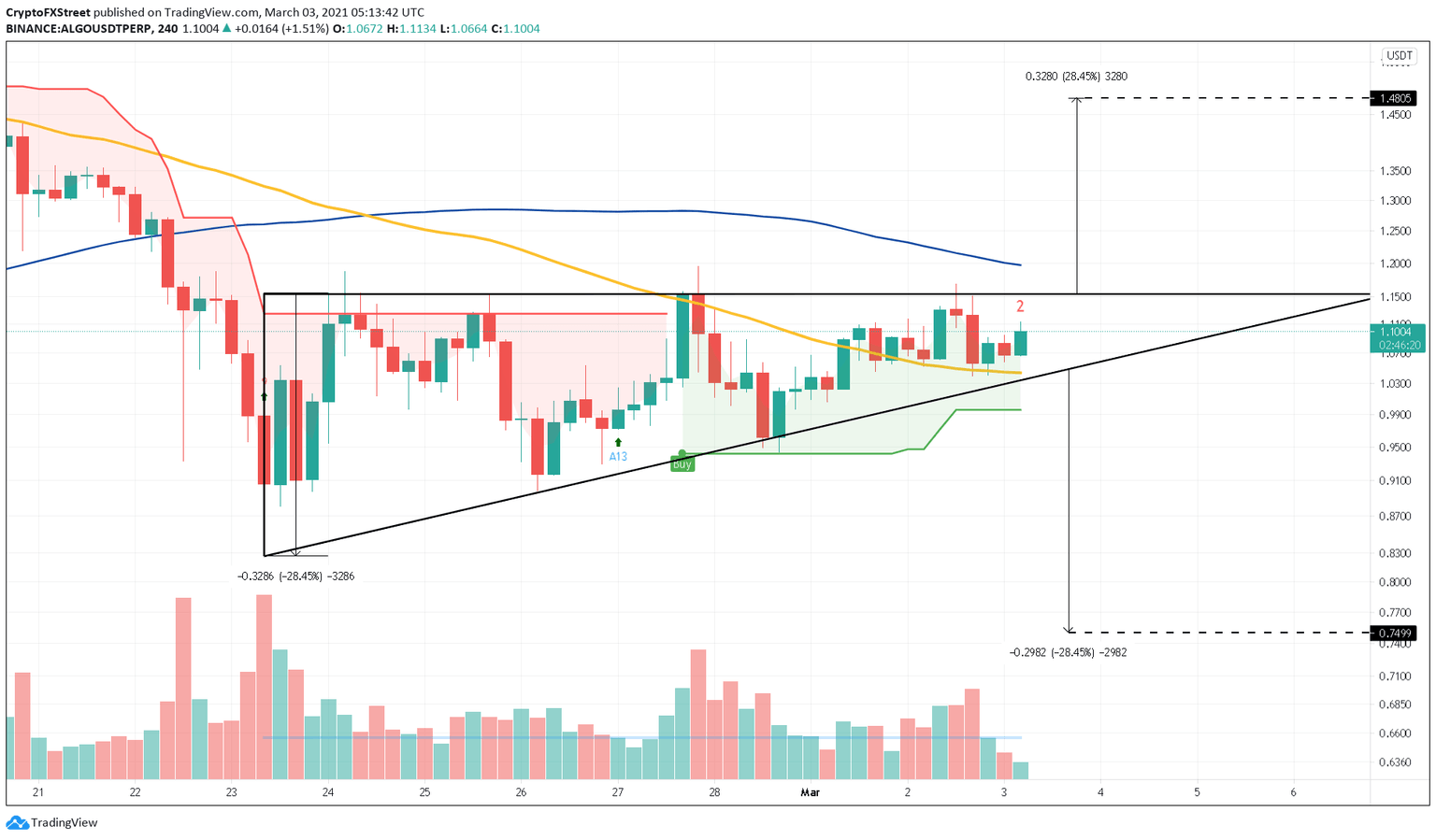

Algorand Price Forecast: ALGO primed for a 28% upswing from an ascending triangle pattern

- Algorand price is stuck between 50 and 100 four-hour moving average on the 4-hour chart.

- SuperTrend indicator’s buy signal falls in line with the ascending triangle pattern's bullish bias.

- A decisive close above $1.15 would confirm a 28% upswing in ALGO price to $1.48.

Algorand price entered consolidation after dropping nearly 45% between February 20 and 23. The recent upswing has pushed ALGO above the 50 four-hour moving average (MA), indicating a surge in bullish momentum, but it is still trading under the 100 four-hour MA.

Algorand price aims for a higher high

Algorand price shows the presence of aggressive buyers scooping up almost every drop resulting in a series of higher lows. On the other hand, sellers have rejected virtually every upswing until now, which has led to the formation of a horizontal resistance barrier at $1.15. By connecting these swing lows and the supply barrier using trendlines, an ascending triangle pattern forms.

This technical formation predicts a 28% upswing, determined by measuring the distance between the pivot high and the first swing low and adding it to the breakout point at $1.15. So, a four-hour candlestick close above the aforementioned level puts ALGO at $1.48.

Adding credence to this bullish outlook is the SuperTrend indicator’s buy signal, which flashed on February 27.

ALGO/USDT 4-hour chart

Investors should note that a four-hour candlestick close below the $1.04 will invalidate the ascending triangle pattern and the 50 four-hour MA. In such a case, Algorand price would continue its trajectory and correct by 28%. This pullback would place ALGO at $0.75.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.