Algorand may become the standard smart contracts protocol fuelling ALGO price uptrend

- The USDC stablecoin created by Coinbase is now available on the Algorand Blockchain.

- Algorand will also support another stablecoin thanks to OpenDAO Protocol.

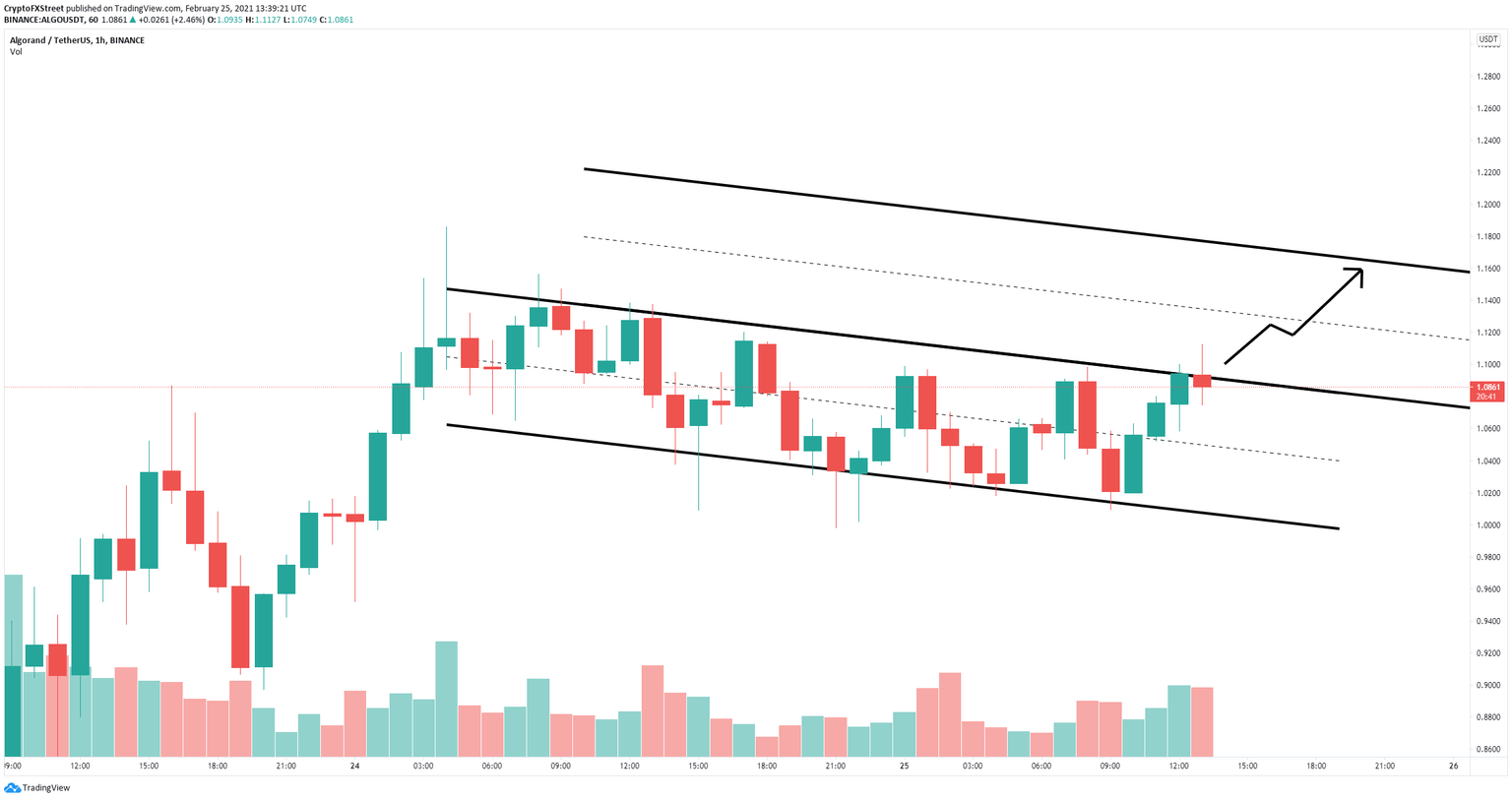

- The digital asset looks poised for a massive bullish breakout to $1.14.

In the past two months, Ethereum has seen a lot of competition as the massively high fees forced investors to look for better alternatives. Algorand has announced several positive developments and aims to become a solution by providing faster and cheaper transactions.

Algorand aims to become the better Ethereum

The first major development for Algorand happened back on February 19 when the team announced that one of the most used stablecoins, USDC, and perhaps the most trusted, will be supported on the Algorand mainnet. Using the Circle API, Algorand enables users to transfer funds between its blockchain and traditional bank accounts.

More recently, Algorand announced that it will support yet another stablecoin thanks to a partnership with OpenDAO:

OpenDAO is happy to announce that we are welcoming Algorand into our DeFi family! We’ve already begun the process for creating the $wAlgoO stable coin with wAlgo as collateral!

Algorand's efforts to build open source software for an inclusive ecosystem have created a cascade of opportunity throughout the cryptospace...

— OpenDAO (@opendaoprotocol) February 24, 2021

We're excited to be part of it!

-Sean Qian

OpenDAO Cofounder

New #stablecoin Coming Soon!@Algorand $ALGOhttps://t.co/T1Q5QYF2iq pic.twitter.com/KrJBTwmvT0

Besides supporting USDT and USDC stablecoins, among others, Algorand also allows users to buy and sell gold thanks to a partnership with Meld Gold which issues decentralized gold tokens based on the Algorand technology.

It is reported that more than 500 companies are currently developing on the Algorand platform, with an average daily transaction volume of 500,000.

According to Algorand, the Algorand Standard Asset (ASA) is better than the ERC-20 standard because it can cover all types of assets while providing users with faster transactions and lower costs.

As the asset standard on the Algorand chain, ASA assets are directly built on Algorand Layer-1, so it has unparalleled high speed and security; in addition, due to the extremely low cost of the Algorand platform itself, the operating cost of ASA assets is also very high.

Algorand price aims for $1.16 if key level cracks

On the 1-hour chart, Algorand price has established a descending parallel channel which is on the verge of a significant breakout. If the bulls can push ALGO above $1.10, the digital asset can quickly jump to $1.12 and $1.16 eventually.

ALGO/USD 1-hour chart

On the other hand, if Algorand price gets rejected from the upper trendline at $1.10, it will quickly dive towards the lower boundary of the descending channel at $1.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.