Algorand Price Prediction: ALGO plummets enormously despite newly launched public chain

- The massacre in the crypto market is leaving no stone unturned as ALGO dives under $1.

- The critical 200 SMA has been lost, leaving open-air for further losses.

- Developers can access the Algorand network without running or maintaining a node.

- Recovery will begin if ALGO regains the ground above the 200 SMA on the 4-hour chart.

The cryptocurrency market is in bloodshed on Tuesday during the European session. Algorand has not been spared from the battering, which has led to massive losses. ALGO recently hit an all-time high of $1.86, but the token has lost more than 50% to trade at $0.9, despite some Algorand network developments being announced. The least resistance path is downwards until meaningful support is established.

Algorand launches first public chain-owned BSN portal

Blockchain-based Service Network (BSN) has since September 2020 been working on the integration of Algorand into its international portal, aiming for global reach. Over the six months, Algorand worked closely with BSN while leveraging the vast government resources in China.

Algorand debuted the first self-owned BSN portal on December 30, 2020, on both the testnet and mainnet. Users across the words can access low-cost blockchain solutions. On the other hand, developers have been permitted to access the Algorand network without running and maintaining a node.

In addition, they can utilize interoperability of decentralized applications (DApps) that are deployed on the BSN. The new chain also provides cutting-edge security solutions for DApps, using two sets of private keys.

Algorand giving power to developers

Algorand seems to be focusing on developers by providing them with easy access to resources. For instance, with the introduction of “AlgoDEA IntelliJ,” – a plugin allows “end to end development life-cycle on the Algorand blockchain using IntelliJ IDE.” Developers can use this plugin to build both stateful and stateless smart contracts. The plugin offers “editor support for “TEAL & PyTeal files, ASA management, Atomic Transfers, Test account management.”

Algorand bulls battle to regain control

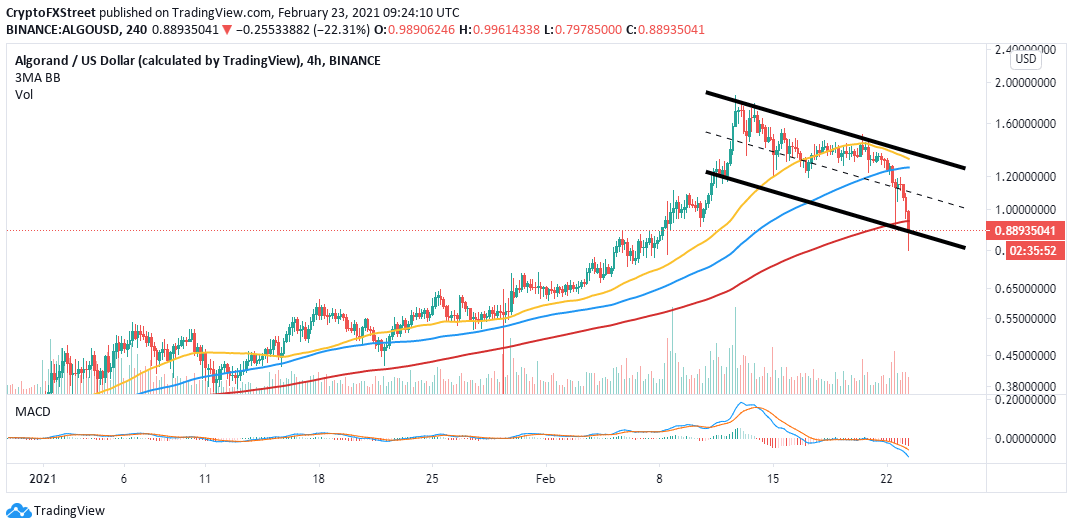

Despite these developments, Algorand is trading at $0.9 after losing support at the ascending channel’s middle boundary. The drop triggered massive sell orders accentuated by the widespread losses in the market, which pushed ALGO below the 100 Simple Moving Average (SMA) on the 4-hour chart.

At the time of writing, Algorand is holding at the channel’s lower boundary. Sticking to this support is critical to avoid potential losses to the tentative support at $0.65.

Notably, the Moving Average Convergence Divergence (MACD) adds credibility to the bearish outlook after slicing into the negative region. Moreover, the wide divergence between the MACD line (blue) and the signal line reinforces the firm bearish grip.

ALGO/USD 4-hour chart

Looking at the other side of the fence

If Algorand closes the day above the lower boundary of the channel, recovery will be possible. More buyers will come into play on the brighter side if ALGO reclaims the position above the 200 SMA. Besides, gains above $1 will trigger more buying orders, placing the token on a pathway heading toward $2.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren