Algorand price eyes recovery to $1 as ALGO approaches last stable support level

- Algorand price is testing the last weekly demand zone, extending from $0.772 to $0.904 after the recent crash.

- A bounce off this support level is likely to propel ALGO by 44% to the $1.159 hurdle.

- A daily candlestick close below $0.772 will invalidate the bullish thesis for ALGO.

Algorand price been on a steep corrective phase for the better part of the last five months. This downtrend has pushed ALGO to the last stable support level. Therefore, a bounce off this barrier is likely to trigger a massive exponential upswing.

Algorand price eyes recovery

Algorand price has dropped 44% in the past month and is currently piercing the $0.772 to $0.904 demand zone. This area is vital since it is the last support level that is capable of absorbing the incoming selling pressure.

Beyond this, ALGO buyers are non-existent. Hence, there is a good chance sidelined investors are likely to step in, triggering an uptrend. The resulting bounce could push Algorand price by 44% to tag the immediate resistance barrier at $1.15.

ALGO/USDT 1-day chart

Supporting this explosive move for Algorand price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that roughly 403,580 addresses purchased 901.4 million ALGO tokens at an average price of $0.768 and is relatively stronger than hurdles.

Therefore, investors can expect Algorand price to witness a considerable bounce from this area.

ALGO GIOM

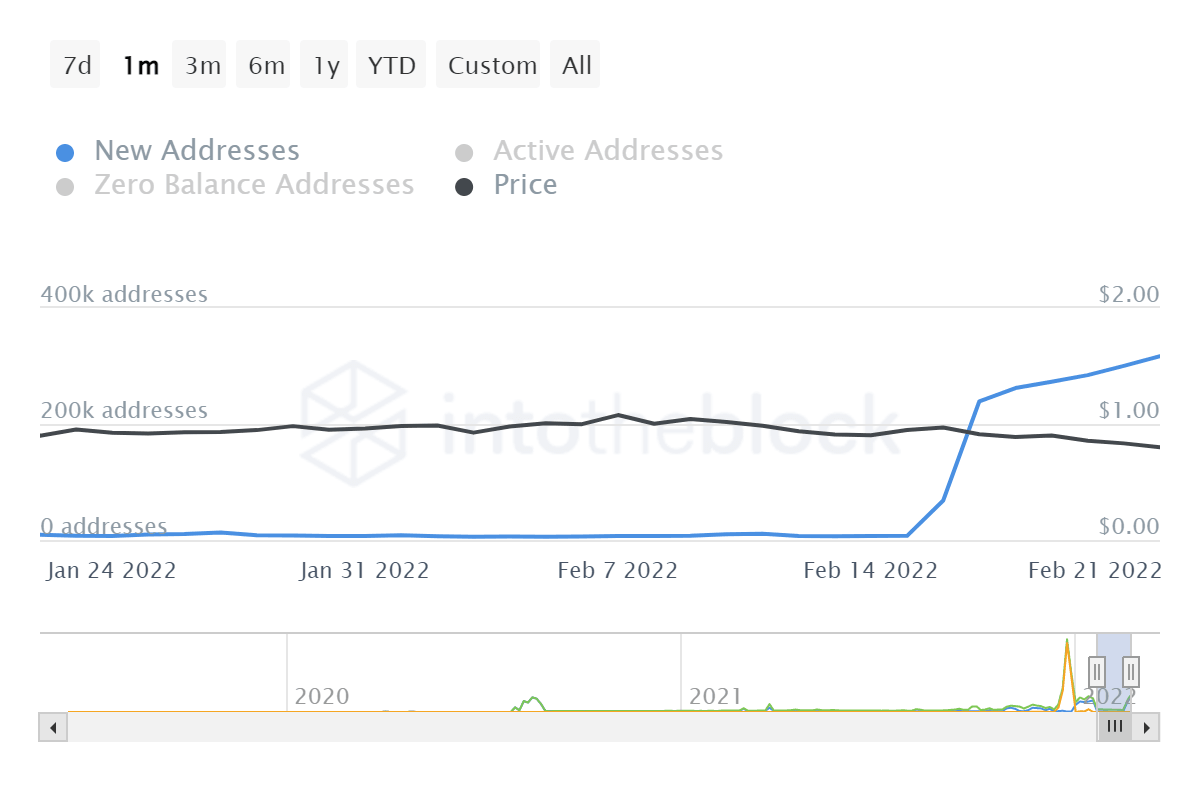

Further solidifying the bullish thesis for Algorand price is the recent uptick in the number of new addresses joining the Algorand network from 9,140 to 316,780 over the past month. This 3,365% increase indicates that investors are interested in ALGO at the current price level and are likely to invest.

AGLO new addresses

While technicals and on-chain drivers are hinting at a bullish outlook, a daily candlestick close below $0.772 will invalidate the bullish thesis for ALGO. In such a case, Algorand price will revisit the daily support level at $0.675.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.