Algorand bulls in shape again to try and book 24% gains

- Algorand bulls got painfully rejected against a trend line and saw a complete paring back of gains.

- ALGO price action is back on its feet and looks set to recover the losses from Thursday.

- As investors will have bought the dip, expect ALGO to overshoot target, hitting $1.10 and 24% gains.

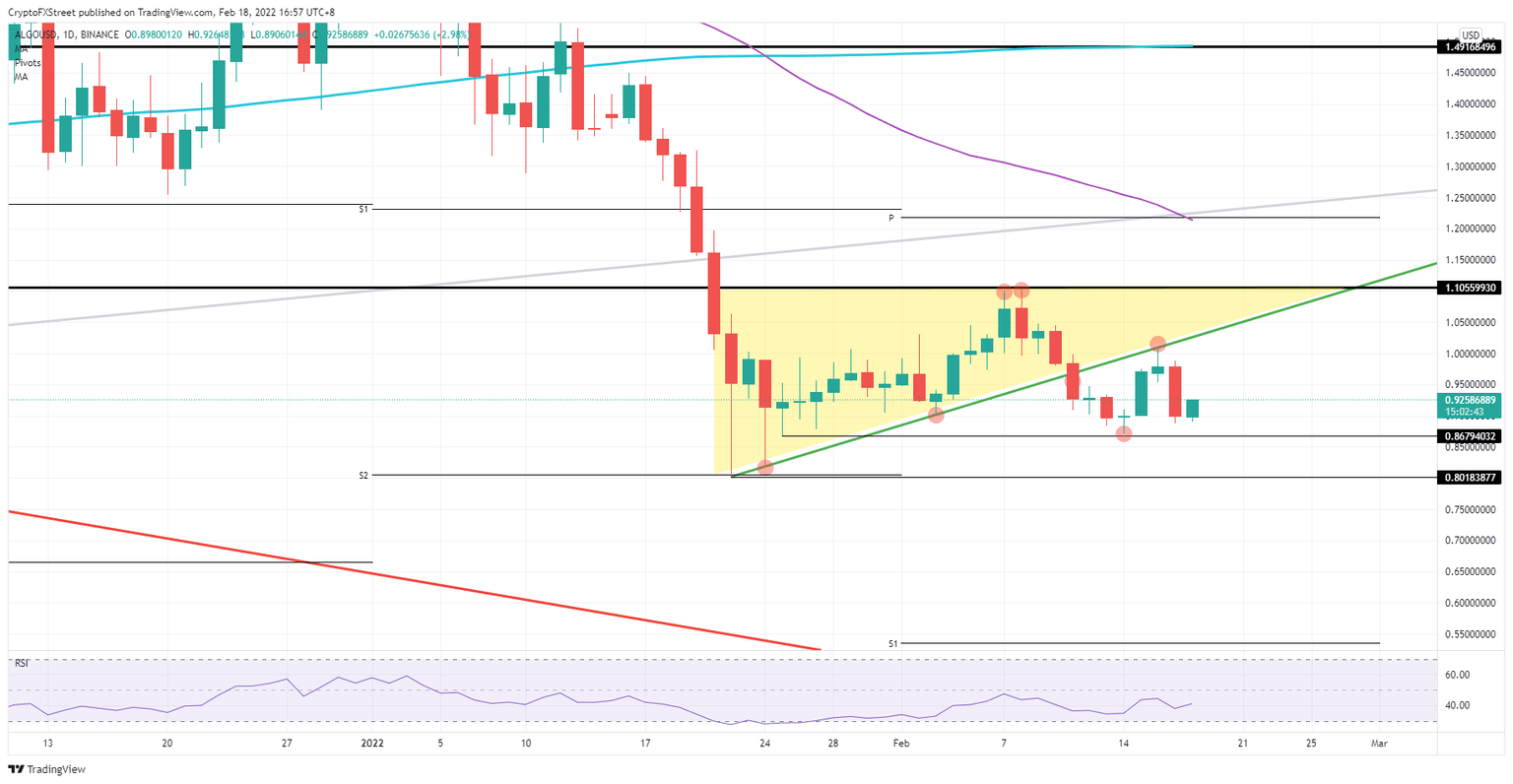

Algorand (ALGO) is back on its feet after kissing the canvas as geopolitical tensions eased igniting a relief rally earlier this week. Now bulls could be set for a double whammy as not only is ALGO price action set for another relief rally, but the dollar is backing off as well, opening the gate for even more gains. The initial profit target would be at around $1.01, but with the weakening of the Greenback, expect possibly $1.10 to be hit over the weekend.

Double supportive tailwinds make ALGO set for a big pop

Algorand bulls got smacked against the floor on Thursday after reports that a local school got hit by mortar shells in the Donbass region in Ukraine. Markets went into safety mode with risk assets on the back foot. For Algorand, this got translated into heavy losses and a complete paring back of the earlier relief rally to $0.89.

ALGO price action, however, has sprung back to life today and is already partially erasing the losses from yesterday, tying back up with the relief rally from earlier this week. The profit target looks to be set again towards the green ascending trend line rejected on Wednesday. But price action could be overshooting this level as the dollar is also backing off, with the DXY on the back foot, opening room for ALGO to rally even further and possibly book 24% of gains towards $1.10, at the double top of February 07 and 08.

ALGO/USD daily chart

Should, for some reason, dollar strength kick back in this afternoon, expect to see a slight push back towards $0.87, around the low of Monday and January 25. Should more headwinds emerge with, for example, again more negative headlines out of Ukraine or if diplomatic talks are stopped, expect a nervous decline with investors puzzled about what to do. ALGO price action could then rely on $0.80 with the S2 support from January – and the low of January 22, as a plateau for bulls to buy the dip.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.