Algorand Market Update: ALGO announced as the official chain for USDC

- Algorand was created by Turing award winner Silvio Micali.

- The protocol uses a unique pure proof-of-stake (PPOS) consensus algorithm.

- ALGO/USD is presently aiming for the $0.50 psychological level.

Circle’s USD-backed stablecoin “USDC,” has now officially launched on Algorand’s mainnet. This makes Algorand the first chain since Ethereum to have the two most popular USD-backed stablecoins – Tether and USDC.

Circle and USDC

Circle is a Goldman Sachs-backed global financial technology firm. USDC has leveraged Circle’s considerable clout to become the fastest-growing stablecoin in the market. USDC’s main aim is to enable companies of all sizes to realize the true power of stablecoins and public blockchains.

What is Algorand?

Founded by Turing award winner, Silvio Micali, Algorand aims to remove friction from global financial transactions through its pure-proof-of-stake blockchain protocol. Algorand uses pure proof-of-stake (PPOS) is a lot faster and fairer than the traditional POS protocol. In traditional POS, a node’s voting power is directly proportional to the size of its stake, creating a wealth disparity within the system. PPOS selects a token holder randomly from the network, regardless of the size of the stake. Every participant gets to be a winner, within this system.

Algorand and USDC

As a part of the partnership, both Algorand and Circle will promote the unique benefits of USDC on the former’s blockchain for institutions looking to build large-scale DeFi applications. Circle's big aim in Q3 2020 is to provide the industry with "a simple and seamless API" for moving payments between USDC on Ethereum and USDC on Algorand. This way, users will be able to enjoy a high level of interoperability and have a seamless experience across digital wallets and exchanges.

How USDC benefits Algorand

- Growing Use of USDC - USDC has crossed $50 billion transaction volume since launch with its $2.5 billion worth of USDC issued. USDC is very popular in platforms like Compound, Maker, REN, Nuo, etc.

- Major Investors - Circle already has an impressive investor portfolio. Investors include Bitmain, Goldman Sachs, Breyer Capital (of Facebook’s Jim Breyer), IDG Capital (of Baidu, Tencent), etc. By associating themselves with these investors, Algorand will receive a major boost.

- Increased Transaction Volume - With the rapidly increasing transaction volume of USDC, Algorand will experience a very high level of chain utilization. This is actually in favor of Algorand, as it is built focusing on handling high throughput and scalability.

- Attract other high-value stablecoins - Adding the top two stablecoins (USDT and USDC) to its blockchain will definitely attract other valuable stablecoins and convince them to adopt the Algorand protocol.

Silvio Micali, Founder of Algorand, said about USDC:

This is a defining milestone for frictionless mainstream payments as well as sophisticated financial applications. This launch brings together the convenience of USDC and an advanced protocol for global financial exchange in which Layer-1 smart contracts are as simple and secure as ordinary payments.

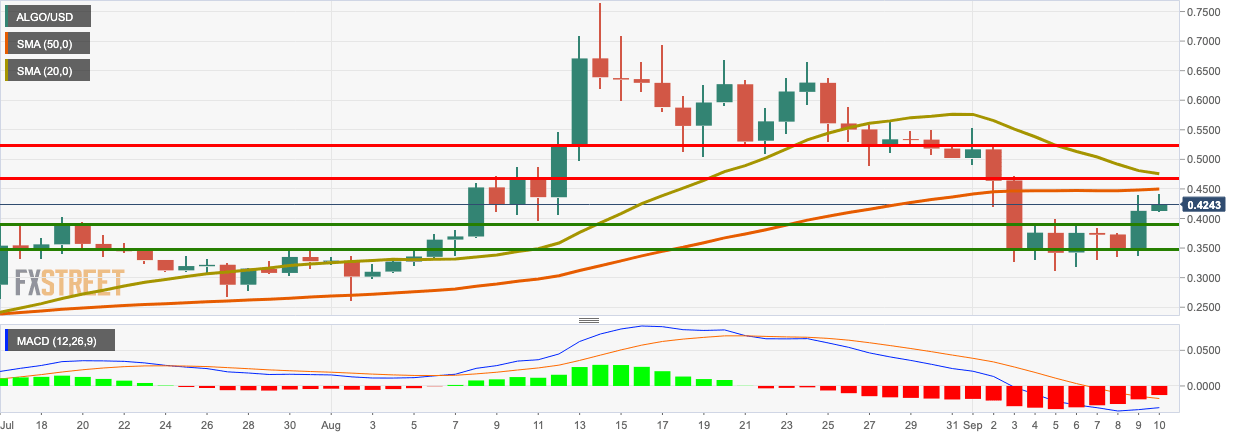

ALGO/USD daily chart

ALGO/USD bounced up from the $0.345 support level and has gone up to $0.424 since yesterday. The MACD shows decreasing bearish momentum following the recent bullish price action. The buyers will want to sustain their momentum and break past resistance at $0.4516 (SMA 50), $0.4685 and $0.4769 (SMA 20). If they manage to do so, then the price should be able to break above the $0.50 psychological level.

ALGO/USD hourly chart

The hourly ALGO/USD price charted seven straight bullish sessions, going up from $0.3545 to $0.4321. Following that, the $0.43 resistance line has repeatedly thwarted the price, preventing any further upward movement.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637353052576523476.png&w=1536&q=95)