About $1.2 billion worth of Litecoin could turn profitable if LTC rallies to this price level

- Litecoin has been stuck between the same support and resistance levels for three months, oscillating between $65 and $46.5.

- According to price indicators, Litecoin is witnessing a bullish squeeze release, which could propel it towards the 23.6% Fibonacci level.

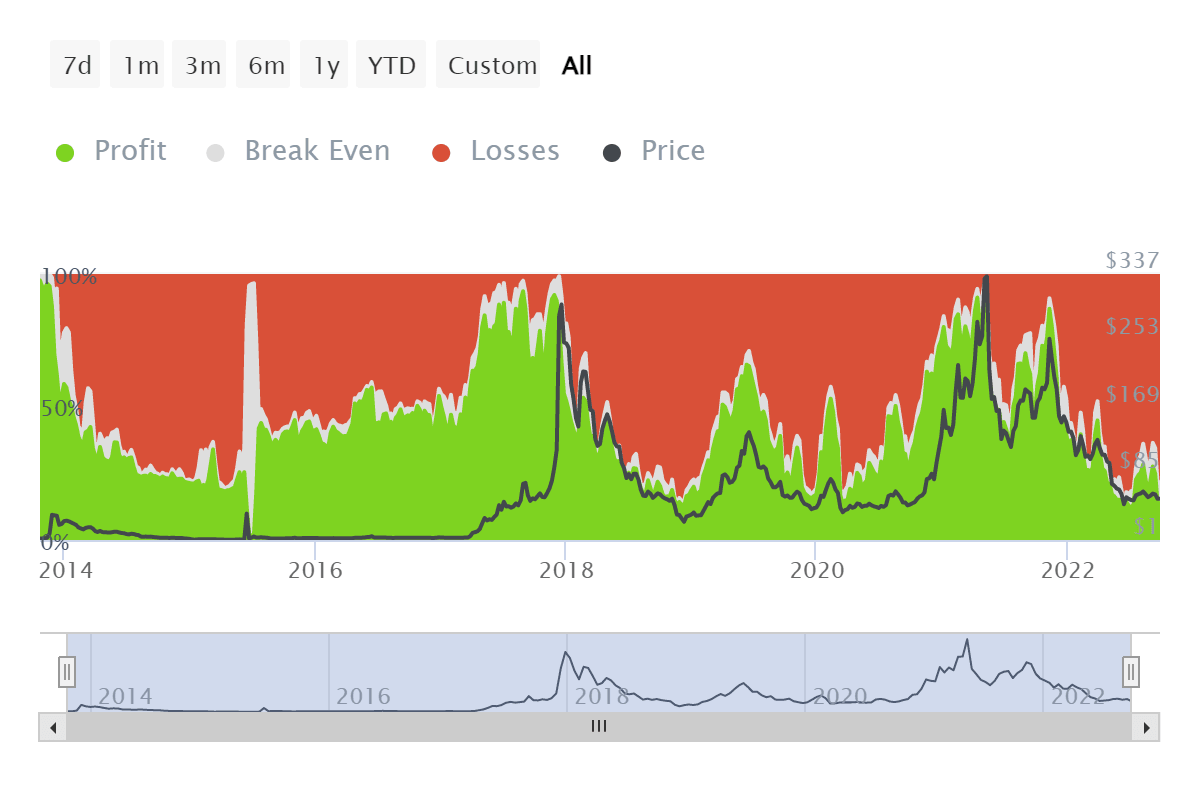

- The lack of recovery has led to over 78% of all Litecoin investors witnessing losses on their holdings.

Litecoin might not be the flagbearer of the crypto market like Bitcoin or the constant center of attention like Ethereum and Cardano. However, LTC still manages to make it into the list of cryptocurrencies held by the majority.

However, the lack of aforementioned factors does make it difficult to induce direct bullishness into LTC’s price action, resulting in an increase in loss-bearing investors.

Litecoin investors continue to wait

After hitting its all-time high (ATH) back in May 2021, LTC’s price has been conditioned to a downtrend, bringing the altcoin from $334 to trade at $53.43 at the time of writing.

During this period, the investors that held on to their LTC started incurring losses. As of today, over 5.81 million holders, representing 78.27% of all investors, are holding LTC below the purchase price.

Litecoin investors in loss

Only 1.02 million addresses are still in profit since these people bought their LTC at a price below $53 anytime before June 2020.

However, a significant amount of investors could witness profits soon, provided LTC can climb up to $67. About 2.52 million addresses, holding close to 20.3 million LTC combined, are sitting in hopes of a run up to $55 to $67.

Litecoin's profitable price levels

Since these price ranges are the average price at which these 20.3 million LTC were purchased, a price rise to this point would directly flip $1.2 billion worth of LTC into profit.

When can it happen?

Answering when would be premature since the market is not facing any volatile conditions. In the case of Litecoin, a rally amounting to 21.95% would bring LTC to the critical resistance level, which has been in place for almost five months now.

This resistance level also lies just above the 23.6% Fibonacci Retracement of the $131 to $43 decline. Since this level is considered as crucial support for a bounce off towards recovery of said range, it would certainly bring profits to trapped investors if sustained.

Squeeze Momentum Indicator is currently highlighting a bearish squeeze release (white dots) on the charts, although with declining bearishness. Historically such squeeze releases have been the first sign of trend reversal, and if the same happens this time around as well, it will prove to be beneficial for Litecoin investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.