Aave whales go into buying spree sending prices beyond the moon

- Aave price remains bullish as it hints at another massive rally soon.

- On-chain metrics reveal that whale activity is picking up and could propel prices even higher.

- Transaction history shows the presence of a stable support level at $310.

Aave price has seen a parabolic rally since early November 2020 and shows no signs of exhaustion. At the time of writing, AAVE has generated over 16x gains in 90 days and indicates that more is yet to come.

Aave price looks unstoppable

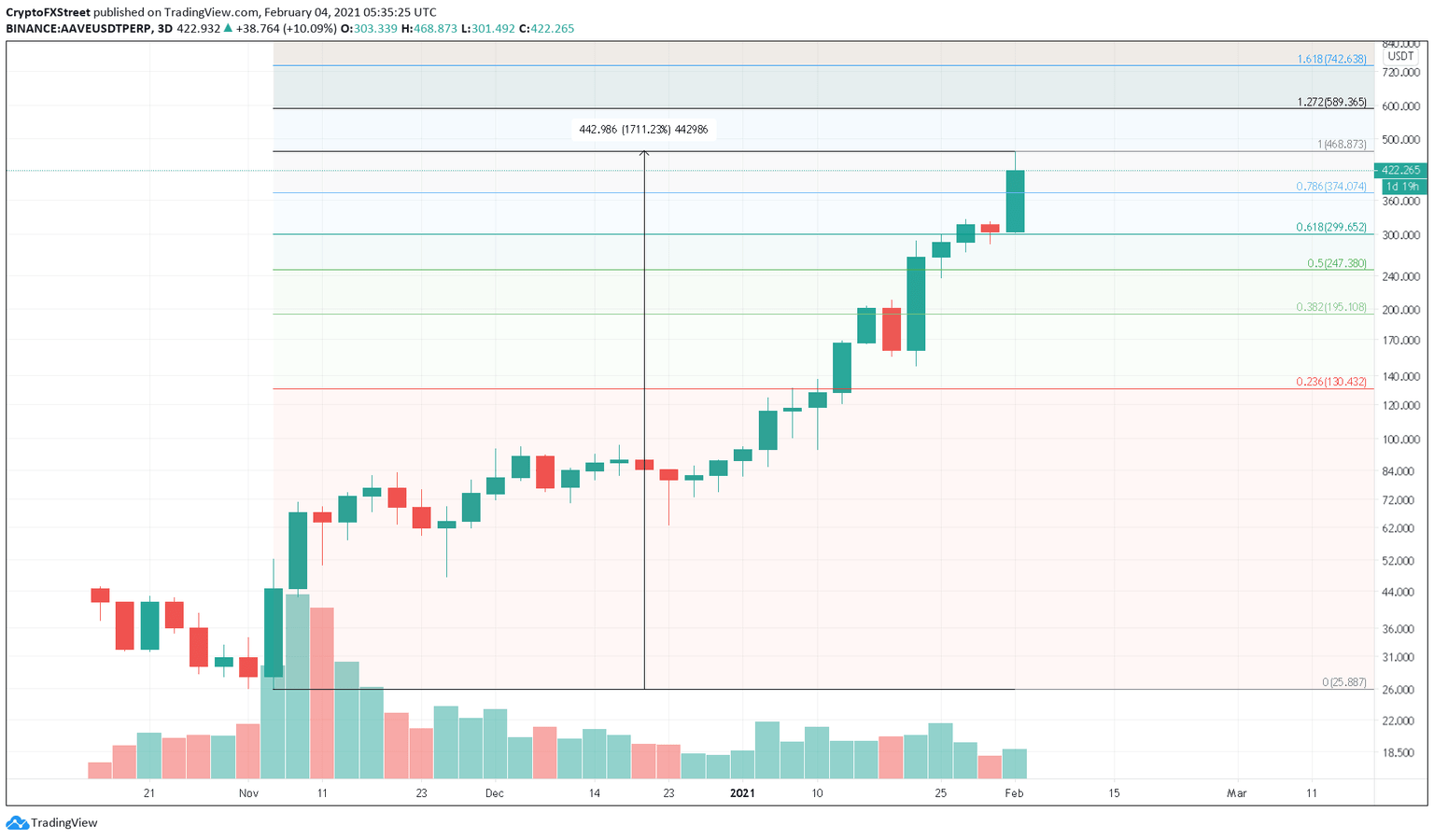

Aave price is trading just above $400 on the 3-day chart after a 40% increase in the last 24 hours. Despite this dramatic surge, on-chain data indicates that the DeFi token could double in value as it heads towards the 161.8% Fibonacci retracement level.

AAVE/USDT 3-day chart

Whales holding between 1,000 and 10,000 AAVE have gone into a buying spree helping prices surge at the current rate. Since January 31, these large investors have increased their holdings by more than 6%.

The last time these whales filled up their bags by 7.50% in mid-January, Aave price surged by a whopping 32%.

Now, similar price action could take place due to the rising demand.

%2520%5B11.44.57%2C%252004%2520Feb%2C%25202021%5D-637480319699329064.png&w=1536&q=95)

Aave Holders Distribution Chart

Since Aave price is currently hovering around all-time highs, IntoTheBlock's In/Out of the Money Around Price model shows that 100% of the addresses holding this token are 'In the Money'.

The IOMAP cohorts also reveal that Aave price sits on top of stable support at $310, where 7,000 addresses purchased 1.80 million AAVE. Holders around this price range may buy more tokens if prices were to correct to avoid seeing their investments go 'Out of the Money.'

Aave IOMAP chart

Regardless, if the support level at $310 is breached, investors should expect a downswing towards the next important interest area at $265. Here, 5,400 addresses previously purchased 1.34 million AAVE.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.