Aave Price Forecast: AAVE primed to retrace before liftoff to $160

- AAVE price might experience near-term bearishness due to a sell signal presented by TD Sequential indicator.

- Invalidation of this bearish outlook might present AAVE with an opportunity to surge to $160

AAVE price is trading under $120 after hitting a new all-time high of $124 on January 5. However, the digital asset recently flashed a sell-signal that may see it retrace before the uptrend resumes.

AAVE price hovers at overbought territory

The TD Sequential indicator presented a sell signal in the form of a green nine candlestick on AAVE’s daily chart. The bearish formation forecasts a one to four candlesticks correction that could see Aave price dive before it rises to new highs.

The RSI indicator adds credence to the pessimistic scenario as it sits in the overbought zone while the Stochastic RSI formed a new bearish crossover.

AAVE/USDT 1-day chart

Moreover, Santiment’s holder distribution chart shows that whales aren’t buying AAVE at the current price levels. Holders with 10,000 to 1,000,000 tokens have remained on the sidelines waiting for prices to make a definite move before adding fuel to the downward or upward pressure.

AAVE holders distribution chart

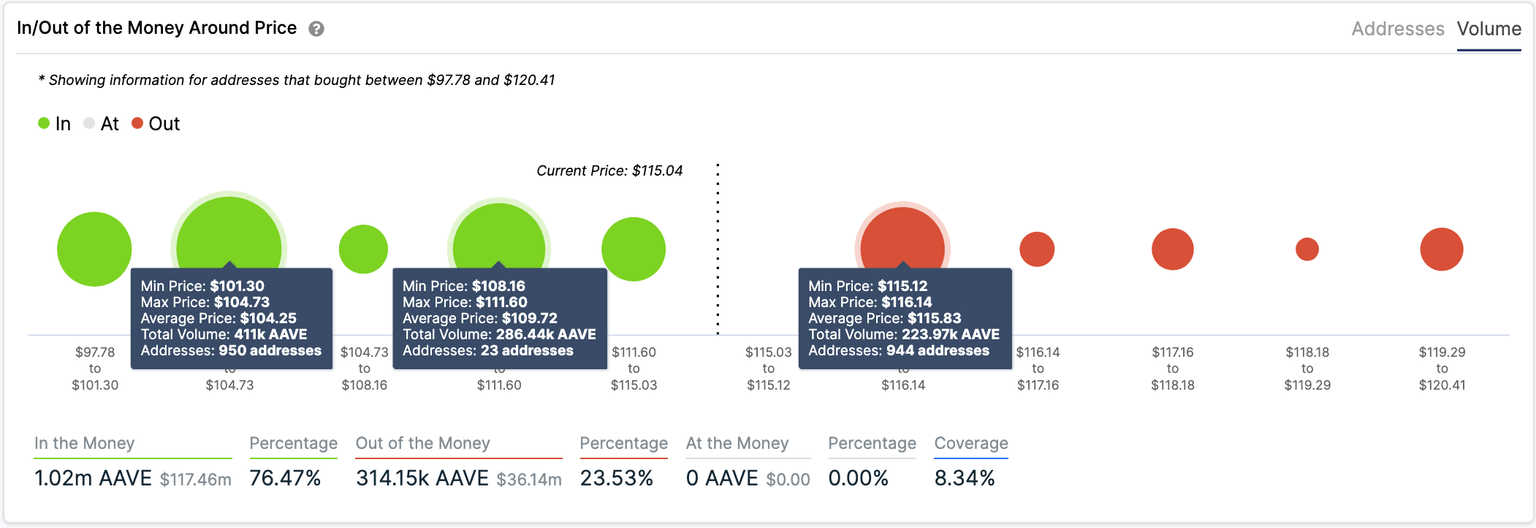

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model suggests there is strong support around the $100 level. More than 20 addresses had previously purchased 286,000 AAVE between $108 to $111, while 950 addresses hold over 400,000 tokens, around $104.

If selling pressure mounts behind the DeFi token, such a significant demand wall between $111 and $104 may contain prices from depreciating further.

AAVE IOMAP

On the flip side, a total of 944 addresses bought about 223,000 AAVE at $115. A daily candlestick close above this price hurdle may be significant enough to invalidate the bearish outlook.

If this were to happen, Aave price would likely aim for a new all-time high of $160.

Author

FXStreet Team

FXStreet

%2520%5B01.17.03%2C%252007%2520Jan%2C%25202021%5D-637456226698051374.png&w=1536&q=95)