Aave Price Analysis: AAVE price discovery continues, almost clocking $300

- Aave soaring network growth suggests that the price is nowhere near the local top.

- A spike in social media mentions is a red flag, a reversal could be around the corner.

- AAVE swings to a new all-time high at $292 after rallying 235% since January 1.

Aave joined the likes Uniswap, Ethereum and SushiSwap to lead recovery during the weekend session. This decentralized token has grown in value by 235% in January alone. A new record high has been achieved at $292, leaving the vital $300 level untested. As bulls fight for higher support, on-chain metrics suggests that the uptrend is intact.

Aave mission of breaking new barriers holds

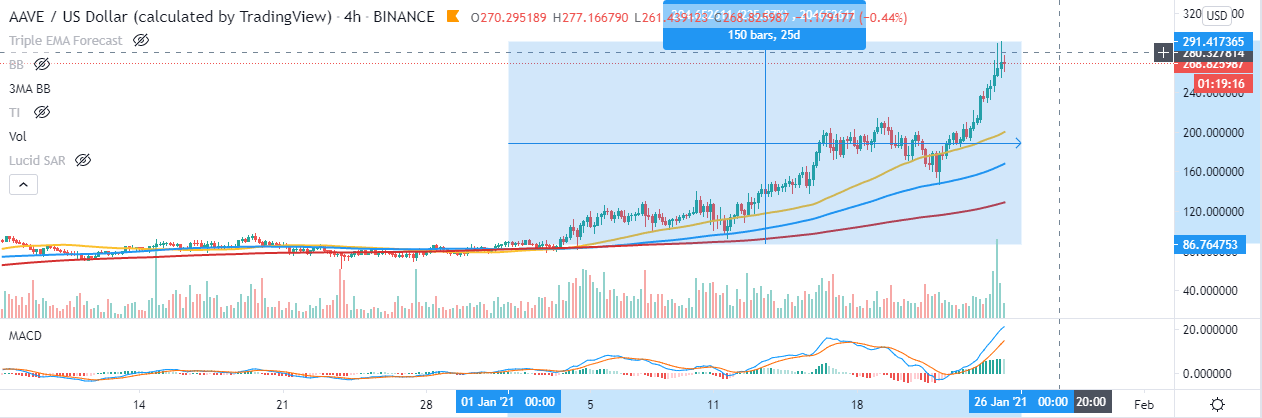

At the time of writing, AAVE is trading at $268 after retreating from the new record high. Despite the drop, buyers seem to have control over the price, as reinforced by the Moving Average Convergence Divergence or MACD.

The indicator follows an asset’s trend and calculates its momentum as well as direction. With the 12-day moving average above the 26-day moving average, it is clear that the least resistance path is upwards.

AAVE/USD 4-hour chart

Santiment, a behavioral analysis platform, confirms that Aave’s network has been improving over the last two weeks. The number of newly-created addresses rose from 711 on January 11 to 1,395 at the writing time, representing a 49% upswing. Such a positive growth suggests that AAVE price may continue to rally in the near term while the project’s adoption increases.

AAVE network growth

Data shows that the number of Aave-related mentions on different social media networks surged in the past days. The rising chatter around the token allowed it to rise to Santiment’s top ten trending topics.

Increased attention is not necessarily a good sign for the continuation of the uptrend. When prices pump, and the crowd starts paying attention, then the dump usually follows shortly after. Therefore, increased crowd attention can be considered a leading indicator of a short-term price correction.

AAVE social media mentions

Meanwhile, it is essential to note that the uptrend may be abandoned altogether if the AAVE closes the day under $270. Moreover, overhead pressure will rise if investors begin to dump, as indicated by the social media related mentions. On the downside, support is envisaged at $200, as highlighted by the 50 SMA, the 100 SMA, and the 200 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B09.53.38%2C%252025%2520Jan%2C%25202021%5D-637471556654815654.png&w=1536&q=95)

%2520%5B10.04.50%2C%252025%2520Jan%2C%25202021%5D-637471556716202318.png&w=1536&q=95)