Aave V3 taps Aptos blockchain for first non-EVM integration

- Aave Labs announced the deployment of its V3 on the Aptos testnet, marking its first non-EVM integration.

- The testnet process aims to evaluate Aave V3's security and performance on Aptos ahead of a potential Mainnet launch.

- AAVE is down nearly 10% in the past 24 hours.

AAVE declined nearly 10% on Tuesday despite deploying its V3 software on the Aptos testnet, marking its first-ever non-Ethereum Virtual Machine (EVM) integration.

AAVE declines despite integrating its lending protocol on Aptos testnet

Aave Labs launched its decentralized lending protocol, Aave v3, on the Aptos testnet following an announcement on its governance platform. This marks the protocol's first non-EVM integration, leveraging Aptos's Move programming language for its v3 functionality.

With the testnet phase, Aave aims to evaluate the reliability, security, and efficiency of Aave V3 on Aptos before considering a potential Mainnet launch.

"Aave Labs will leverage the testnet phase to rigorously validate the Move implementation of Aave V3's safety, stability, and performance before the Mainnet launch, subject to governance approval," Aave Labs stated.

The deployment on Aptos also requires a partnership with the decentralized oracle network Chainlink for a production-ready price feed upon its Mainnet launch.

The partnership between Aave and Aptos dates back to July 2024, when the Aptos Foundation's temperature check (TEMP CHECK) governance proposal on Aave's V3 software deployment on its chain received approval from its community.

After testing, the proposal will advance to the Aave Request for Comments (ARFC) stage for further assessment. If endorsed at this stage, it will move to the Aave Improvement Proposal (AIP) phase for the governance team's final review and approval.

Meanwhile, AAVE witnessed double-digit losses of 10% in the past 24 hours following the general crypto market decline. This could be a temporary pullback before the lending token continues its impressive record over the past months, as its price is still up by over 210% on the yearly timeframe.

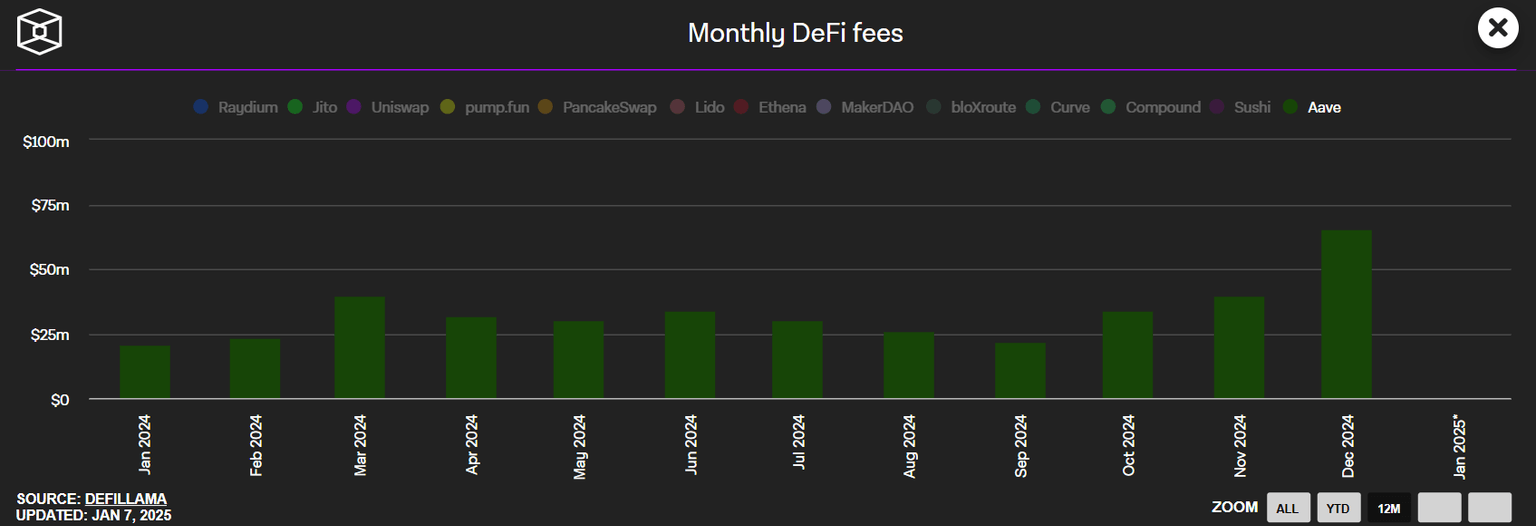

According to The Block's data page, Aave witnessed significant growth in 2024, with its revenue reaching $60.9 million in December, just near its 2021 peak of $65.39 million. During the year, the protocol generated $389 million in fees, with an average of $32.4 million per month — a 14% monthly growth rate.

Aave Monthly Fees. Source: The Block

If Aave continues generating high revenue in the coming months, it could boost investors' appeal for its token.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi