XAU/USD

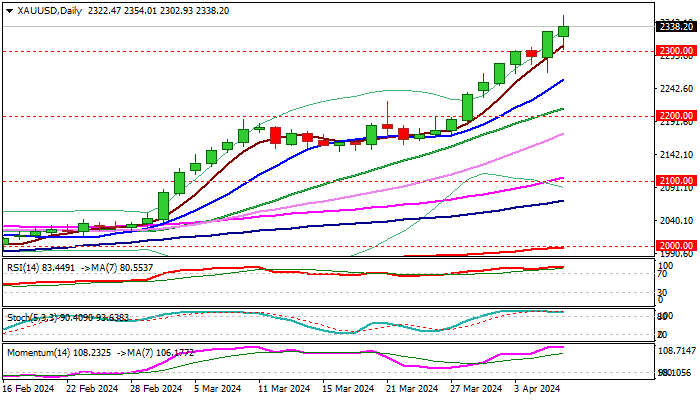

Gold continues to trend higher and posted new record high ($2354) in early Monday trading, in extension of last week’s 4% advance, which generated strong bullish signal on weekly close above psychological $2300 barrier.

The metal remains well supported by strong safe-haven demand, as well as expectations that the Fed will cut rates (as early as June) which deflates dollar.

Gold gained almost 14% since the start of the year, with the strongest acceleration higher seen in March, when the price rose nearly 10%, marking the biggest monthly gains since July 2020.

Bulls firmly hold grip despite strongly overbought technical studies (day/week/month) and eye next target at $2400, but some corrective action should be anticipated.

Broken $2300 barrier reverted to initial support, followed by rising 10DMA ($2256) and strong supports at 2200 zone (rising 20DMA / psychological) which should contain dips and mark a healthy correction of a larger uptrend.

Res: 2354; 2400; 2426; 2500.

Sup: 2300; 2256; 2222; 2200.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range near 1.0800 after US PPI data

EUR/USD continues to fluctuate at around 1.0800 in the second half of the day on Tuesday. The data from the US showed that the annual producer inflation rose to 2.2% in April as expected, helping the USD stay resilient against its rivals and limiting the pair's upside.

GBP/USD holds steady at around 1.2550 ahead of Powell speech

GBP/USD struggles to build on Monday's gains and trades near 1.2550 on Tuesday. The UK data showed that the Unemployment Rate edged higher to 4.3% in the three months to March as forecast. Meanwhile, annual producer inflation in the US rose to 2.2% in April.

Gold clings to daily recovery gains above $2,340

Following Monday's decline, Gold stabilizes in positive territory above $2,340 on Tuesday. The benchmark 10-year US Treasury bond yield stays below 4.5% after April producer inflation data, allowing XAU/USD to hold its ground.

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

Entering a crucial run of data for financial markets

We are entering a crucial period for financial markets and forecasters as Americans' near-term inflation expectations rise again. Upcoming reports on the CPI and PPI for April, along with new data on retail sales and industrial production, will provide valuable insights.