US CRUDE OIL

WTI oil holds within narrow consolidation on Wednesday after strong 3.5% rally previous day, which marked the biggest one-day gains since 22 June.

Rising fears about the impact of Hurricane Florence which is moving towards the US east coast, boosted oil prices, along with persisting concerns about supply shortage on US sanctions on Iran.

Release of API crude stocks report on Tuesday which showed 8.63 million barrels draw in oil stockpiles, much stronger than expected, added to strong bullish sentiment.

Release of EIA crude oil inventories report later today is in focus, with forecast for 1.3 million barrels fall in oil inventories vs previous week’s draw of 4.3 million barrels.

Another surprise on stronger fall in crude stocks could further inflate oil prices.

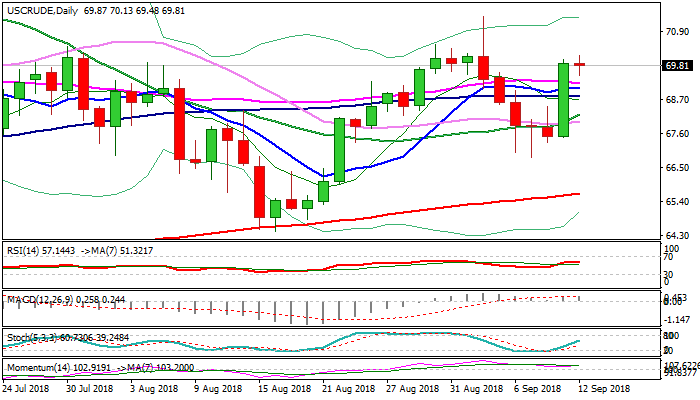

Tuesday’s strong rally retraced over 61.8% of $71.38/$66.85 bear-leg, probed above top of thin daily cloud ($69.85) and cracked psychological $70 barrier, showing scope for further advance.

Bullishly aligned daily techs are supportive, but flat momentum warns of extended consolidation.

Sustained break above $70 barrier would open way towards key barrier at $71.38 (04 Sep spike high), while cluster of converged daily MA’s (10/55/100) formed strong supports within $69.24/$68.84 zone, which is expected to protect the downside.

Res: 70.13; 70.48; 71.00; 71.38

Sup: 69.24; 68.84; 68.22; 68.00

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.