What do chess and the epidemic have in common? What is the difference between linear and exponential growth? Should we really worry about this pandemic? And last but not least, how will the COVID-19 crisis affect the gold prices? We invite you thus to read our today's article and find out answers to these questions!

According to the legend, a ruler, who liked very much the new game of chess, wanted to reward an inventor of chess. So, he asked him about his wish. The inventor requested his king to give him one grain of rice on the first square of the chessboard, two grains on the second square, four on the third square and so on. The ruler was amazed at the modesty of the request – until it turned out that there was not so much rice in the whole kingdom!

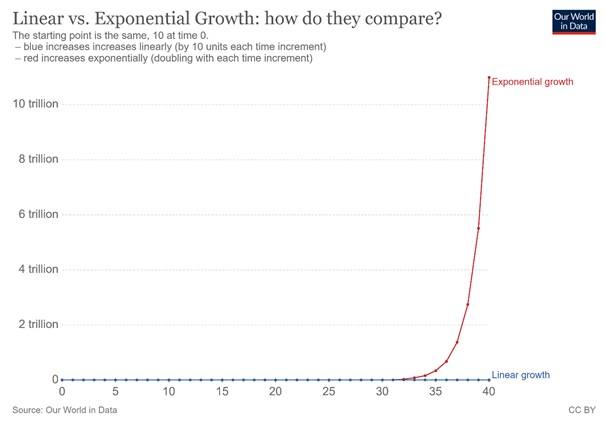

Why I'm telling you this old legend in the article about COVID-19 pandemic and gold? Well, the reason is that it shows the power of exponential growth. You see, the total number of requested grains equals 18,446,744,073,709,551,615, much more than most people with the exception of mathematicians would expect. The problem is that people don't grasp exponential growth. They are used to thinking in linear terms. The differences between the linear and exponential growth are clearly seen on the chart below.

Chart 1: Linear growth (blue line) and exponential growth (red line)

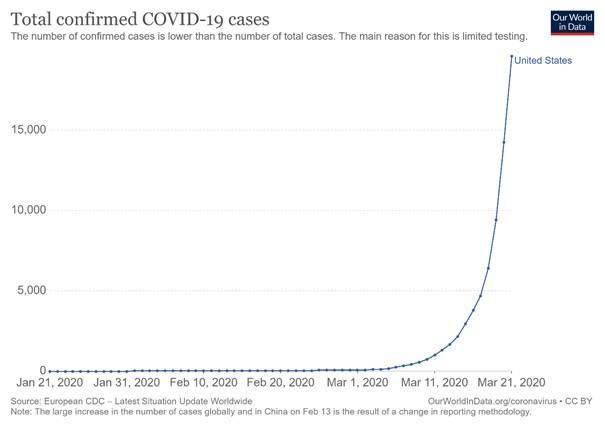

The key here is that epidemic is an exponential phenomenon. The epidemiological curve is an exponential curve, not linear curve (actually, it is a logistic curve, but let's aside this – you can watch this excellent video for more details). This is why all the comparisons between COVID-19 and flu are misguided. It's true that seasonal flu kills more people than COVID- 19 – so far. But it can change very quickly due to the exponential growth of the current epidemic. It's true that still the total number of cases in the US is moderate. But it can change soon. Just look at the chart below: does it look like a linear or exponential growth? This is how the latter works – it starts slowly but at some point, it escalates quickly.

Chart 2: Total confirmed COVID-19 cases in the United States by March 21, 2020

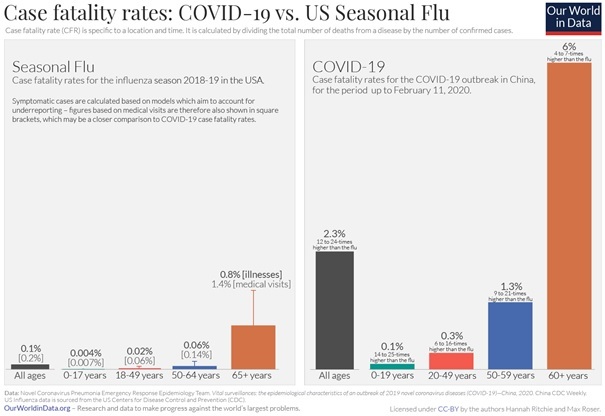

Another issue is that COVID-19 is more contagious (one person infects on average 2- 2.5 person versus 1.3), it has longer incubation period (so people can infect others because they even do not know that they are infected themselves as they have no symptoms), higher hospitalization rate (19 versus 2 percent) and higher case fatality rate, as the chart below shows.

Chart 3: Comparison between COVID-19 and US seasonal flue in terms of case fatality rates

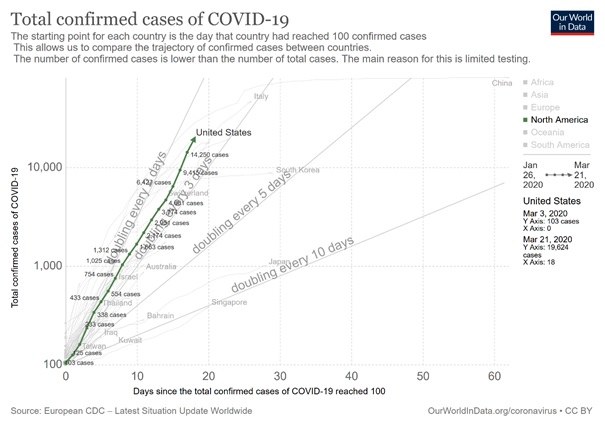

Unfortunately, many Americans still underestimate the gravity of the situation. But they shouldn't. As the chart below shows, the epidemiological curve for the US is actually steeper than in Italy, the worst hit country in Europe.

Chart 4: Total confirmed cases of COVID-19 in the US and other countries since the country reached 100 confirmed cases

To make matters worse, the US has only 2.8 total hospital beds per 1000 inhabitants, fewer than not only in Japan (13.1) but also than Italy (3.2). It means that the US healthcare system is not prepared for the pandemic and that it would be overwhelmed. When the healthcare system collapses, the mortality rate goes up, because hospitals cannot efficiently care for all the patients.

What does it all imply for the gold market? Well, we want to be wrong, but we are afraid that the US will be severely hit. When Americans realize that the worst is yet ahead of the States, the stock market can plunge even further. Given the fact that equity investors liquidate gold holdings to raise cash, gold can follow the S&P 500 Index. But after the fall, the safe-haven nature of gold should reemerge. When people start to appreciate the dangers of the increased money supply, inflation, and expanded public debt, they should turn to gold, as they did in the aftermath of the Great Recession.

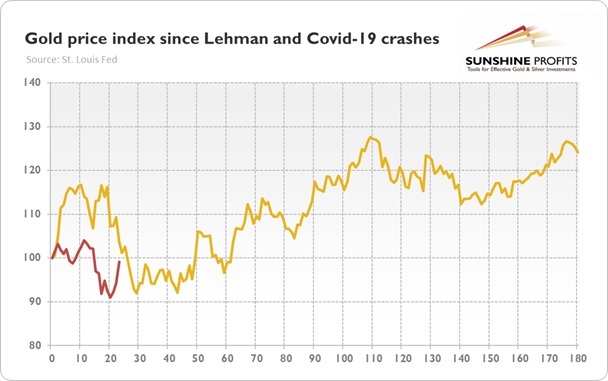

Of course, the replay is not guaranteed, as the current crisis is different from the financial crisis of 2008, but so far the gold price index behaves since the COVID-19 stock market crash very similar to its performance since the Lehman Brothers stock market crash, as the chart below shows.

Chart 5: Gold price index since Lehman Brothers and COVID-19 crashes for several dozen days (starting points normalized to 100 for September 15, 2008 and February 20, 2020)

If history is any guide, it means that although it can go lower first, gold should start rallying within weeks. The gold market is volatile right now and we can see more selling in the hunt for liquidity, but the fundamentals have not been this positive for a long time: the world entered global recession, central banks slashed interest rates to zero and reintroduced quantitative easing, while the governments expanded their expenditures, fiscal deficits and public debts. When fundamentals come to the fore, gold should go up.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.