Gold has been tricky to trade since the vaccine news from Pfizer and BioNtech was announced. Gold futures fell the most in one day for over 7 years on that news/ Why? Well because if the world gets back to normal then interest rates will rise and the appeal of gold is no longer necessary. Now, on top of the Pfizer news, Moderna’s vaccine has also helped that recovery picture as it appear to be more effective and easier to store than Pfizer’s. COVID-19 will most likely be well under control sometime next year. It could be as early as Spring 2021.

So, is gold a buy, a sell, or a hold?

Here are some of the factors to consider:

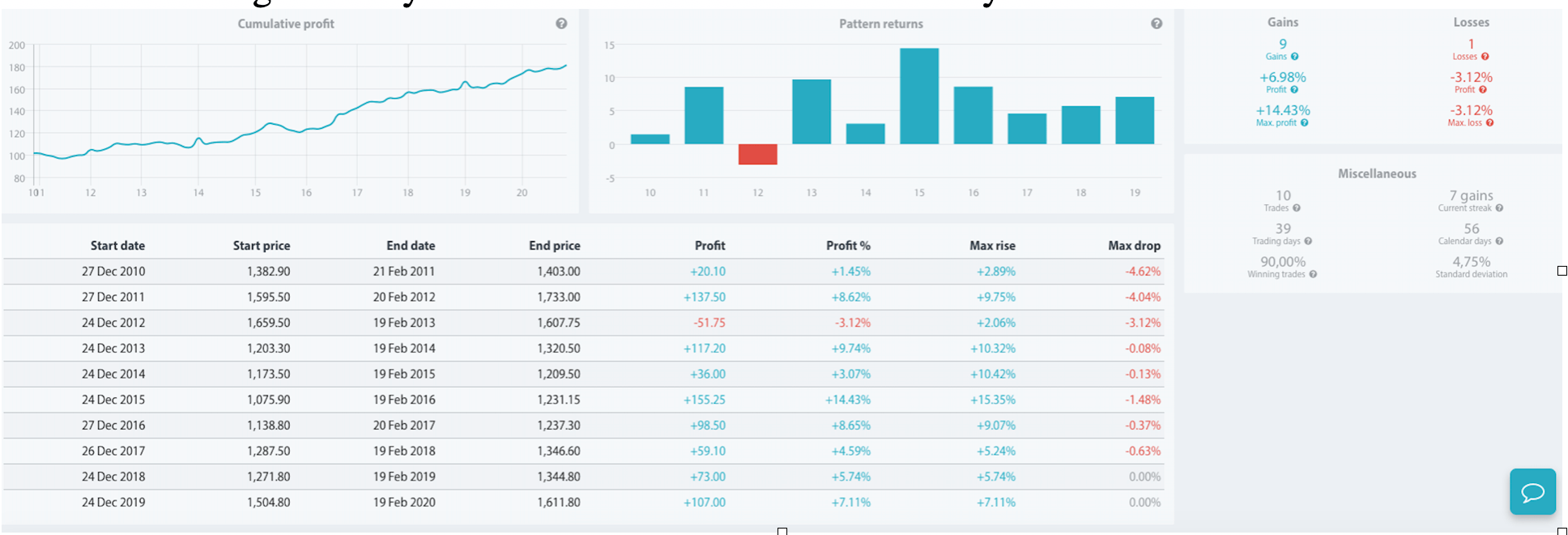

1. Consumer demand may pick up in the near term. China and India are the world’s largest buyers of gold. China’s purchases reliably come for the Lunar New Year and prices pick up from the end of December through January. See the stats on that for the last 10 years below:

Gold should pick up at this time as China should be able to celebrate their Lunar New Year. The Golden Week holiday started from October 1 -7 in China and it saw 637 million people travel across the country without any rise in cases. This is a very good precedent for a ‘normal’ New Year celebration in China and at least a short term pick up in gold regardless of the longer term picture.

2. Global risks still remain – Brexit, US administration gridlock, and the broader impact of COVID-19 on the economy remains. This can boost gold’s appeal if one of these crisis flares up.

3. Loose monetary policies are set to stay. The Federal Reserve is set to keep rates at their present low levels through to 2023, so rates are not going up in the short term for sure.

4. Some etf buyers have thrown in the towel on gold and dumped their gold longs. SPDR Gold shares, the largest ETF in the US, lost 26 tons last week. This was the biggest outflow since 2016. So, some investors are ditching gold on the vaccine news seeing the end of the crisis.

5. 10 year Treasuries are heading higher and this reduces gold’s appeal.

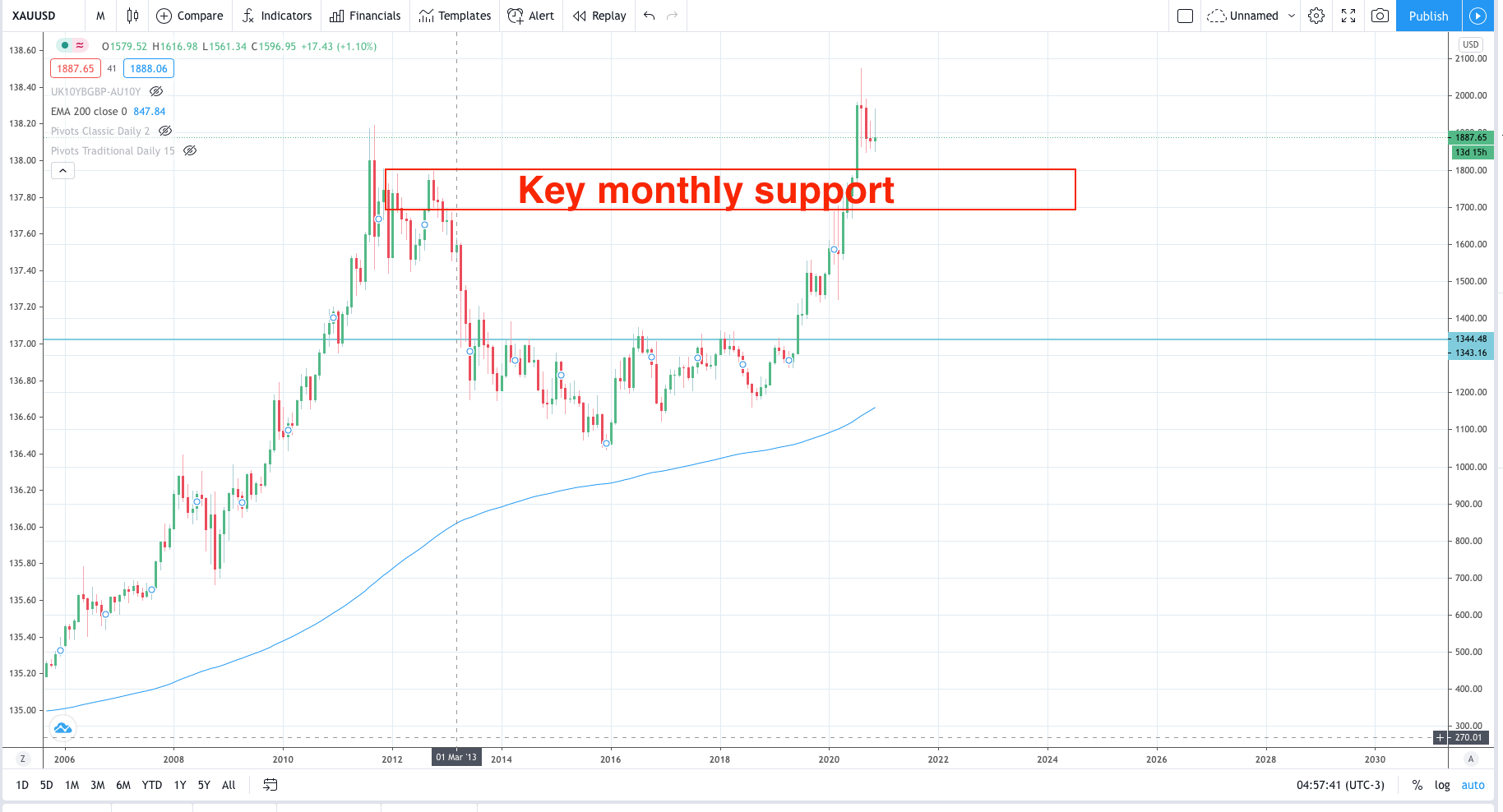

One area that stands out to is a potential month long buy in gold around December 23 potentially through to the end of January. Investors closing ETF’s in large volumes sends out a message. They think the strong rally in gold is done.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.