Target Trading in the Forex week of May 8th, 2016 EU,UJ,GU,AU

$EURUSD

What ProAct Forex Target Traders See: We are currently sitting @ 1.1404 in a potential reversal. As long as USDX is strengthening we are looking for a continuation move down to the 0.500 Fibo@ 1.1148 after a wave 2 is printed. A failure to break the 0.382 Fibo @ 1.1223 would indicate more ranging. The average daily true range (ATR) for the pair currently is 86 pips.

————————————————————————--

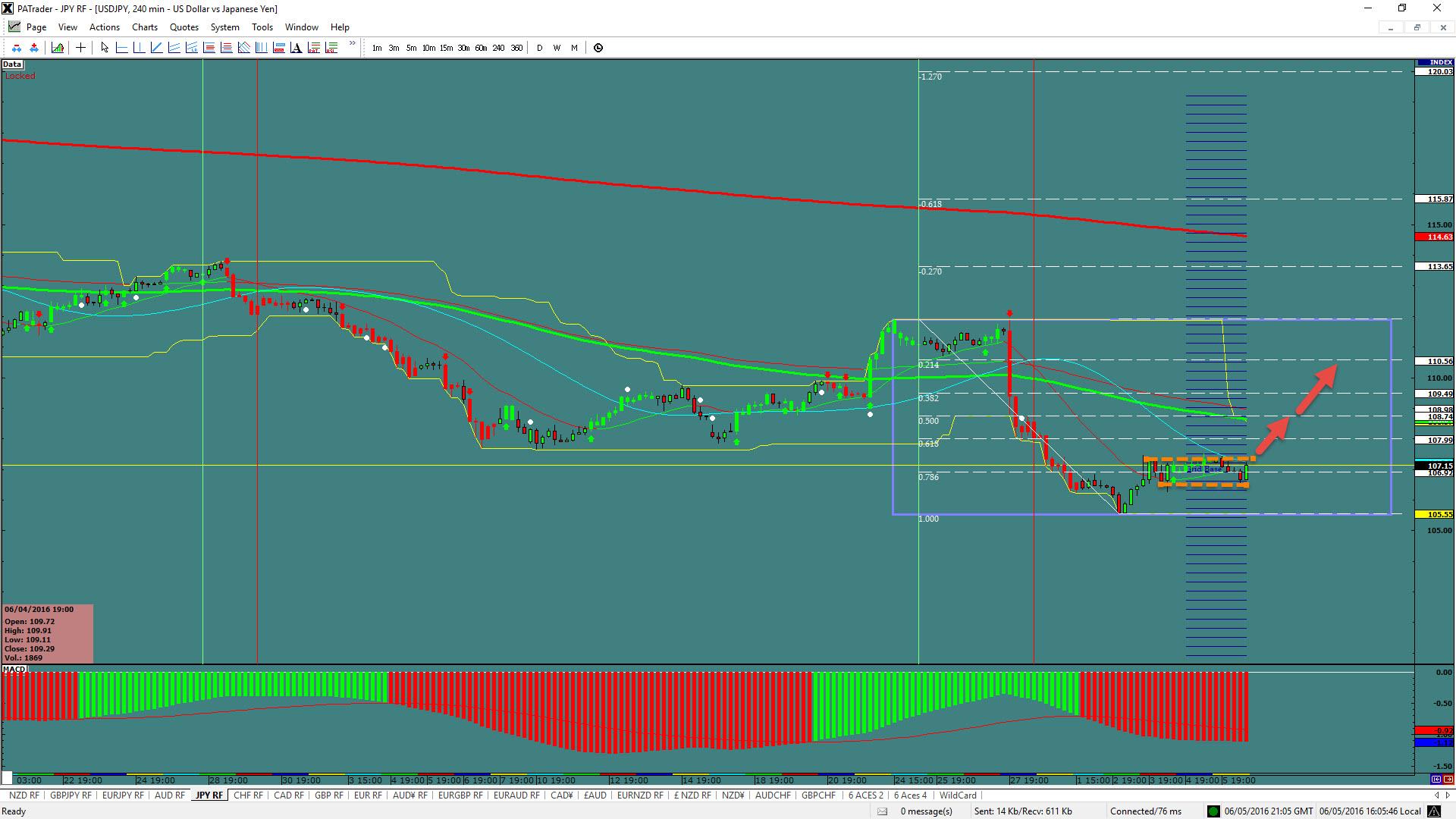

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 107.15 with a bottom in place. We are looking initially to the 0.500 Fibo @ 108.74 with a continuation to the 0.214 Fibo@ 110.56. The average daily true range (ATR) for the pair currently is 126 pips.

——————————————————————————–

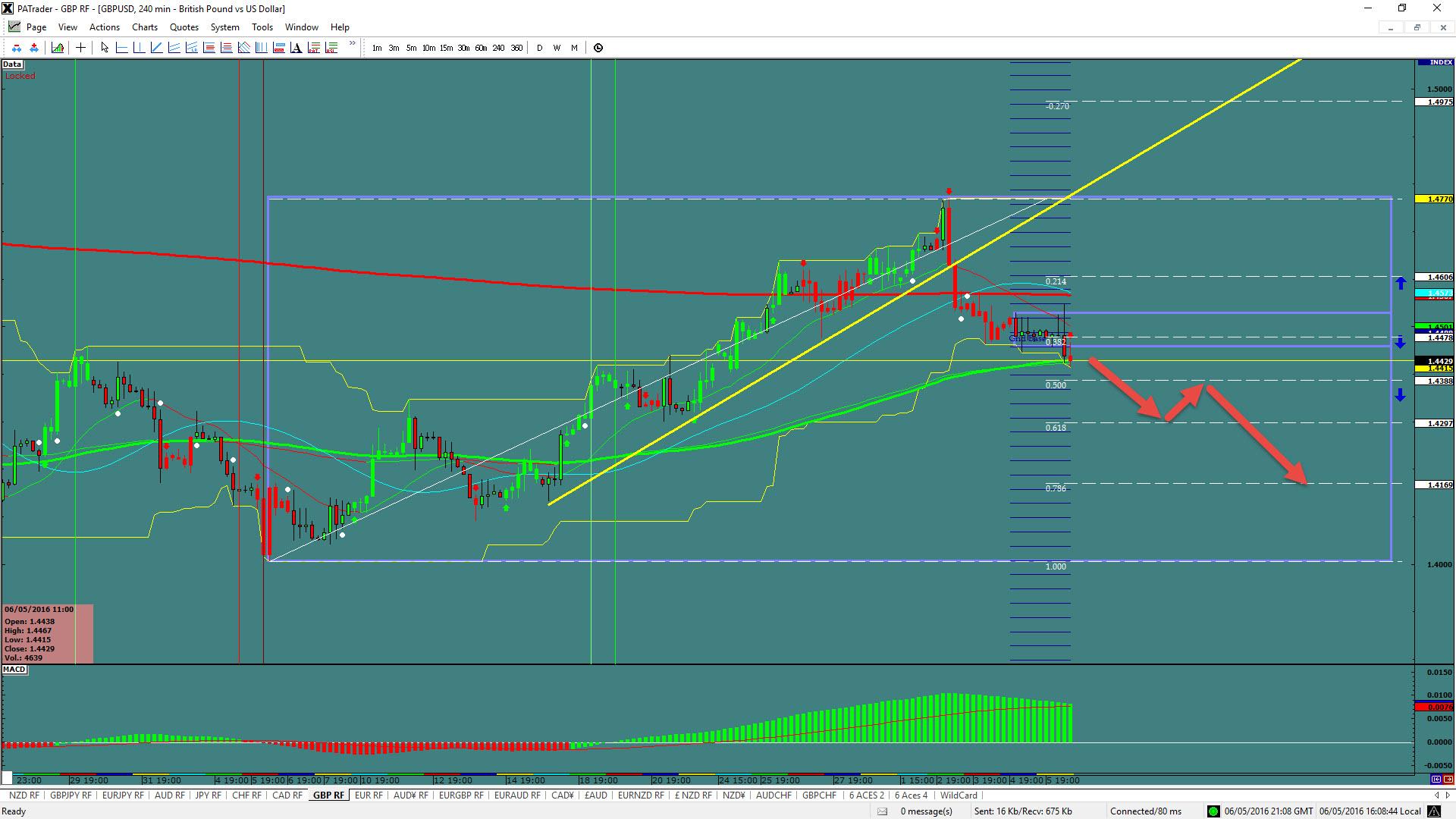

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4429 and in a large range. We are looking initially to the 0.618 Fibo @ 1.4297 and a bounce there before a continuation to the 0.786 Fibo@ 1.4169. The average daily true range (ATR) for the pair currently is 119 pips.

——————————————————————————–

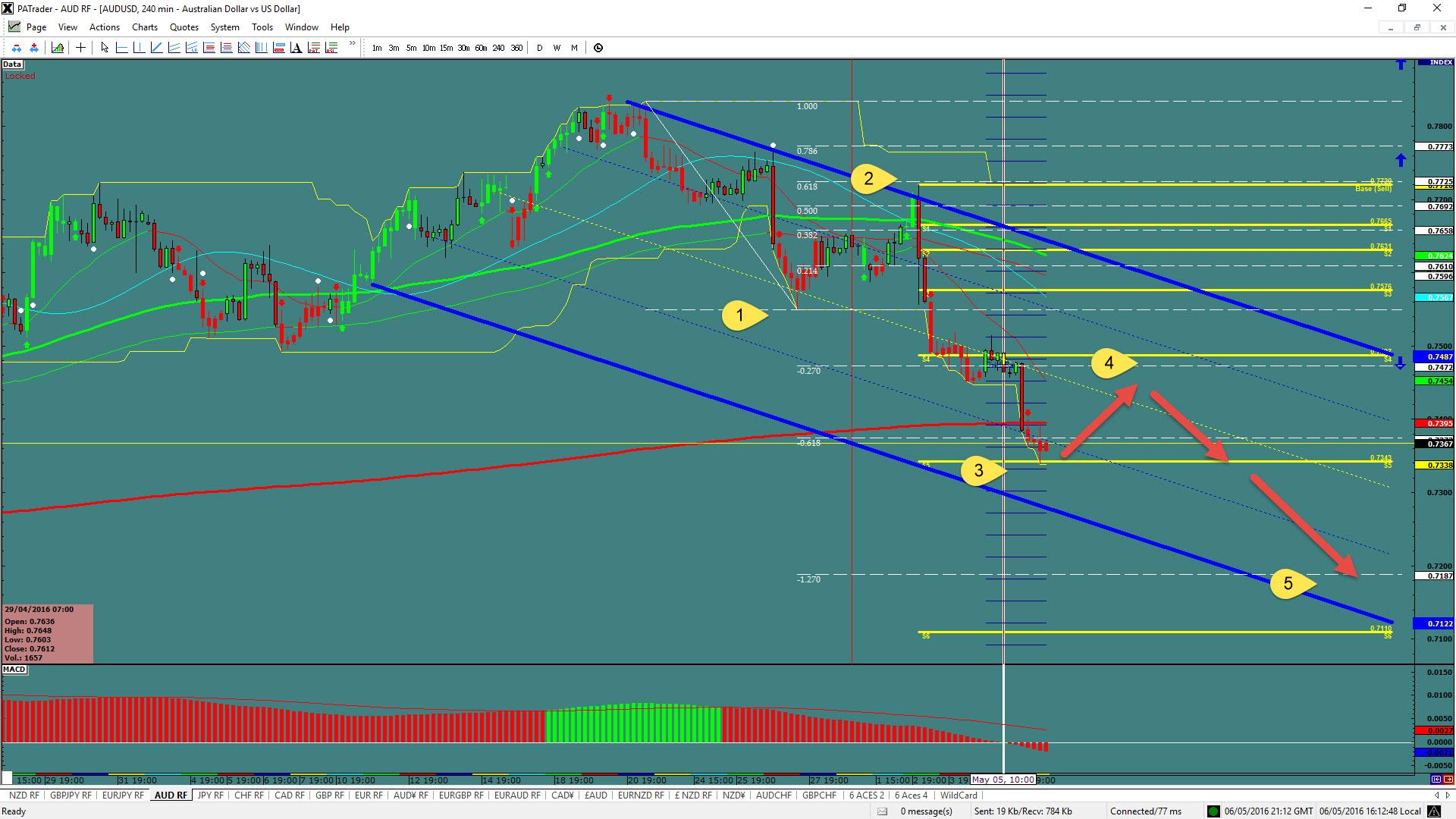

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7367 and in possibly finishing a 3rd wave. We are looking for a bounce to complete the 4th wave and then a continuation move down to the bottom @ 0.7187. The average daily true range (ATR) for the pair currently is 97 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.