What ProAct Forex Target Traders See: We are currently sitting @ 1.2178. Looking to see what reaction we get at the 2.618 Fibo @ 1.2109. A break down here would set up a nice move to the S6 @ 1.1993. The average daily true range (ATR) for the pair currently is 97 pips.

————————————————————————--

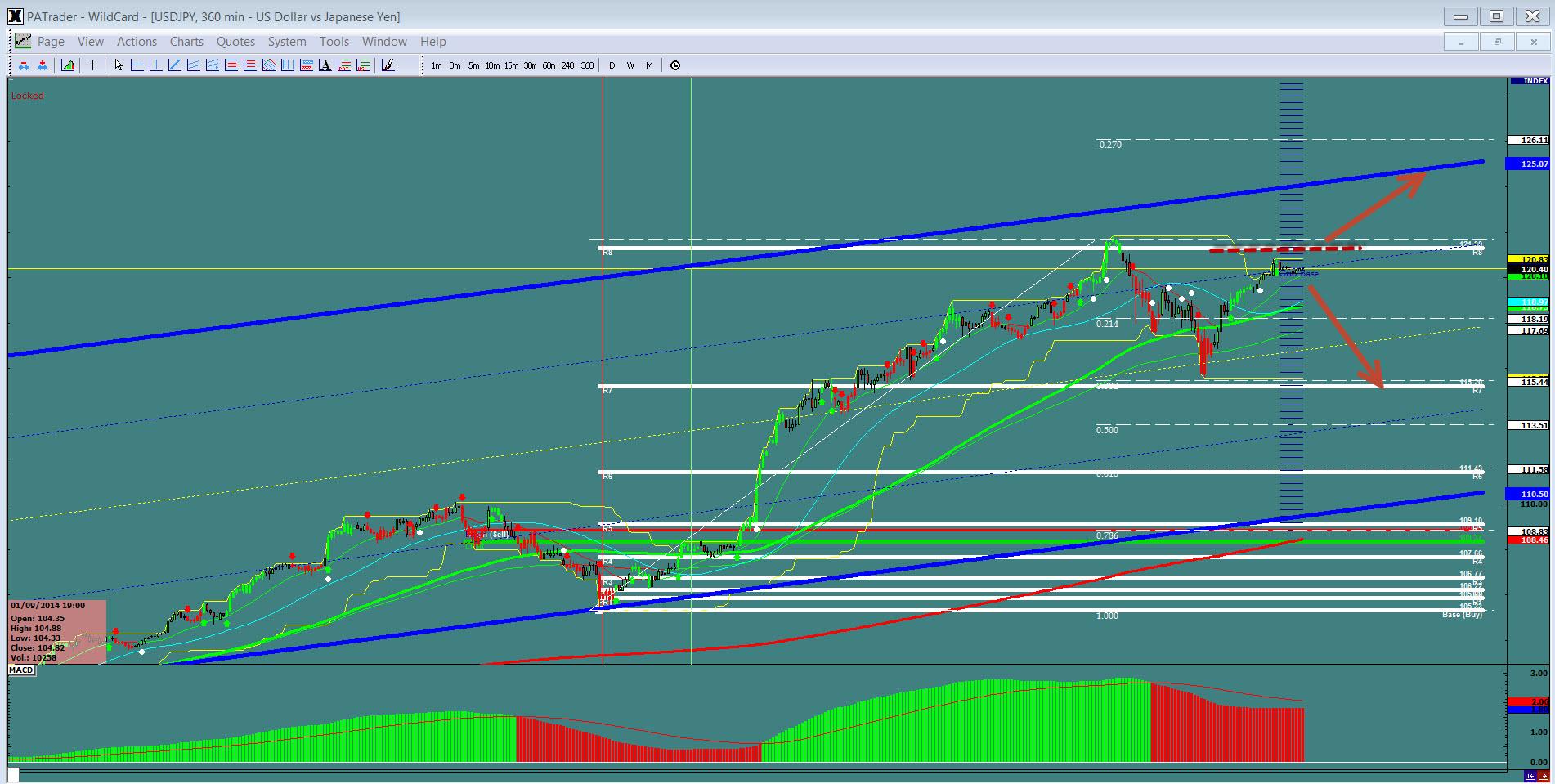

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 120.40. A couple of different scenarios: 1: bullish: A move above 121.50 would signal a continuation to the trend line top around 125.00 . 2: Bearish : A break down here make this an head and shoulders pattern that would set up a move back to the 0.382 Fibo @ 115.44. The average daily true range (ATR) for the pair currently is 150 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently sitting @ 1.5553 after breaking the rectangle which is bearish. We are looking for the1.618 fibo @ 1.5293. The average daily true range (ATR) for the pair is 106 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.8073 in a channel. If we take out the day chart support @ 0.8073, look to the S7 @ 0.7806. A bounce here, look to correct back to the 0.8263 level. The average daily true range (ATR) for the pair currently is 80 pips.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.