A snapshot view of last week's money flow and technical notes for the week ahead.

KEY EVENTS THIS WEEK:

ALL: Jackson Hole Symposium

AUD: Monetary Policy Meeting Minutes; RBA Stevens speaks; CB Leading Index

CAD: Wholesale sales m/m; Core CPI; Core Retail Sales;

CHF: Trade Balance

CNY: HSBC Flash Manufacturing PMI

EUR: HSBC Flash Manufacturing and Serives PMI (FRA, GER, EUR) ; Draghi Speaks;

GBP: CPI y/y; MPC votes; Retails Sales;

JPY: Trade Balance

NZD: PPI Input; Inflation Expectations q/q; Visitor Arrivals

USD: Building Permits; Core CPI; FOMC Minutes; Employment; Home Sales; Philly Fed Manufacturing; Fed Yellen Speaks

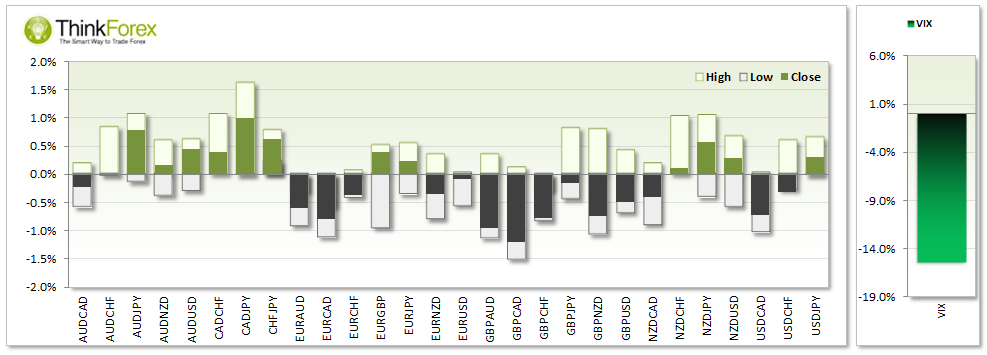

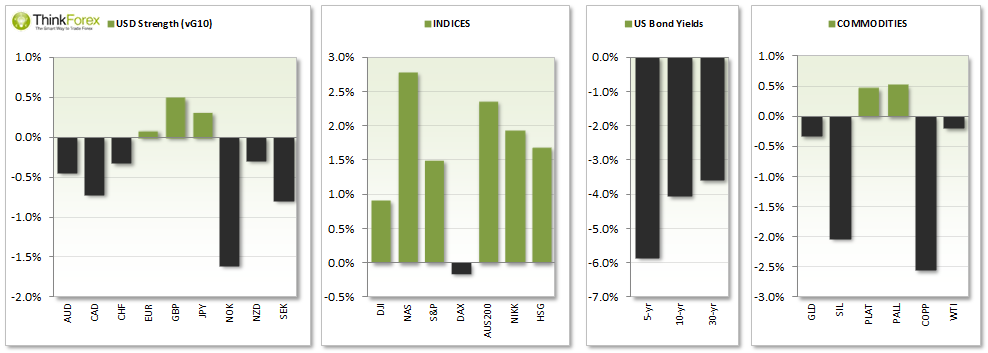

DXY Gravestone Doji and Inside week; D1 remains neutral whilst W1 suggests potential for a retracement but trend remains bullish

AUDUSD Bullish Inside week but lower volume to suggest this is corrective to bearish decline; D1 also suggests weakness

EURUSD Inverse to DXY also suggests an interim reversal; Near-term bullish targets 1.50 but W1 remains below 200 MA

GBPUSD 1.67 target achieved however COTS positioning suggests bearish sentiment extreme; W1 trend remains bearish below 1.684

USDCAD W1 Dark Cloud Cover but trend remains bullish; D1 support at 1.089, 1.080-81 and favour buying the dips; D1 saw Rikshaw Man Doji respect bullish trendline

USDCHF D1 remains within bullish channel with support around 0.900-916; Early days but D1 may be trading within a Bearish Wedge as opposed to a bullish channel

USDJPY Failed to break above 103 but above 102 favours an upside break; Below 102 favours intraday bearish setups down to 101.40

NZDUSD Remains above 0.84 swing low and tested 0.8515 resistance; Bias remains neutral between these 2 key levels but above 0.8515 targets 0.856

INDICES European and US Equities continue to diverge with CAC, DAX and FTSE favouring bearish swing traders and NASDAQ, S&P500 and DJI favouring bullish setups as they break to new highs.

GOLD Bullish wedge target $1345 remains in play but Friday's sharp decline puts this on the side-lines; Bias remains neutral around $1300

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.