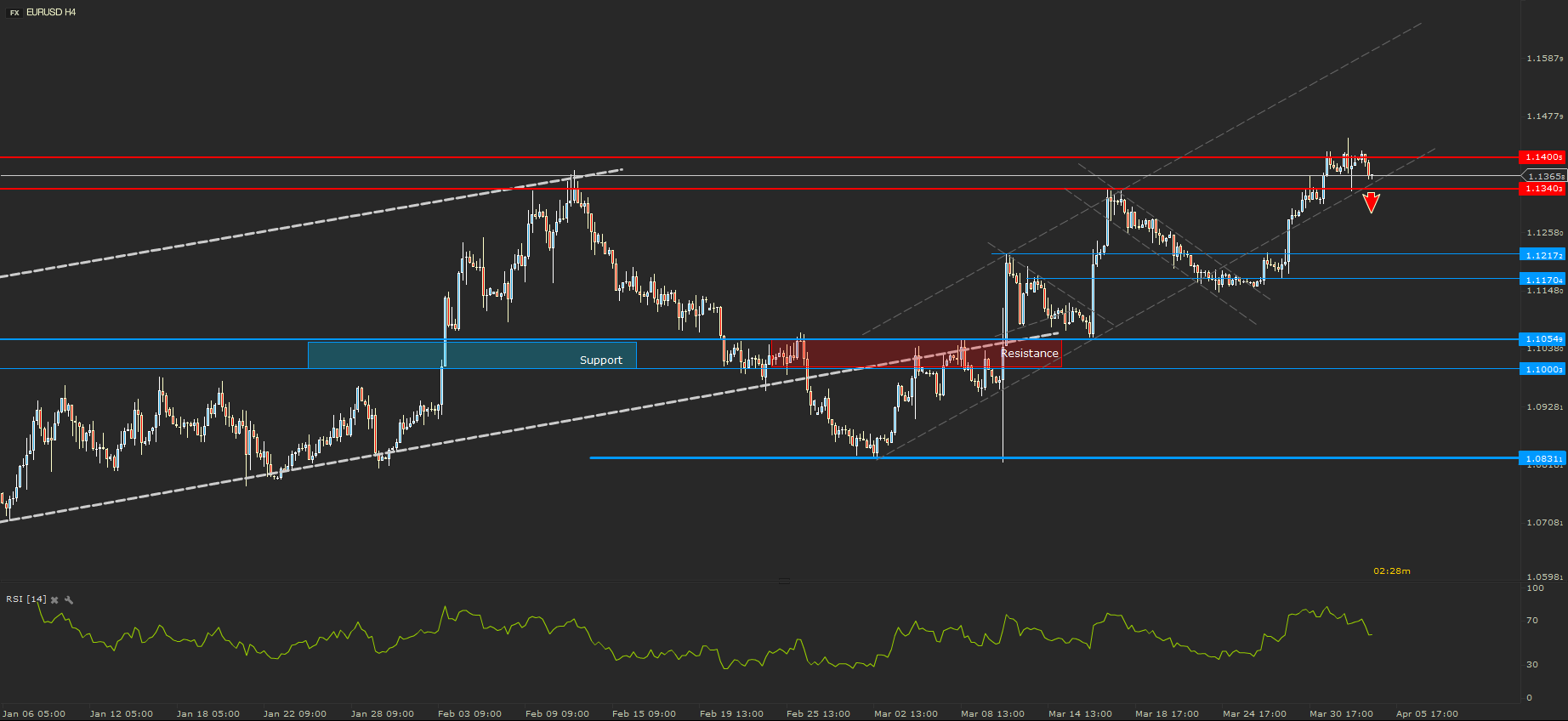

EURUSD – Pushing forward

Bulls managed to keep the EURUSD on the uptrend. After the price retested the support from 1.1170, it bounced back with high volatility. It rallied all the way to 1.1400 where it found a pretty strong resistance.

For the past several trading days, it moved sideways around 1.1400. A break below 1.1340 could signal a short term drop, towards the next support from 1.1217. On the other hand another rally, followed by a 4 hour close above the current resistance could signal a continuation of the uptrend towards the next round number level, 1.1500.

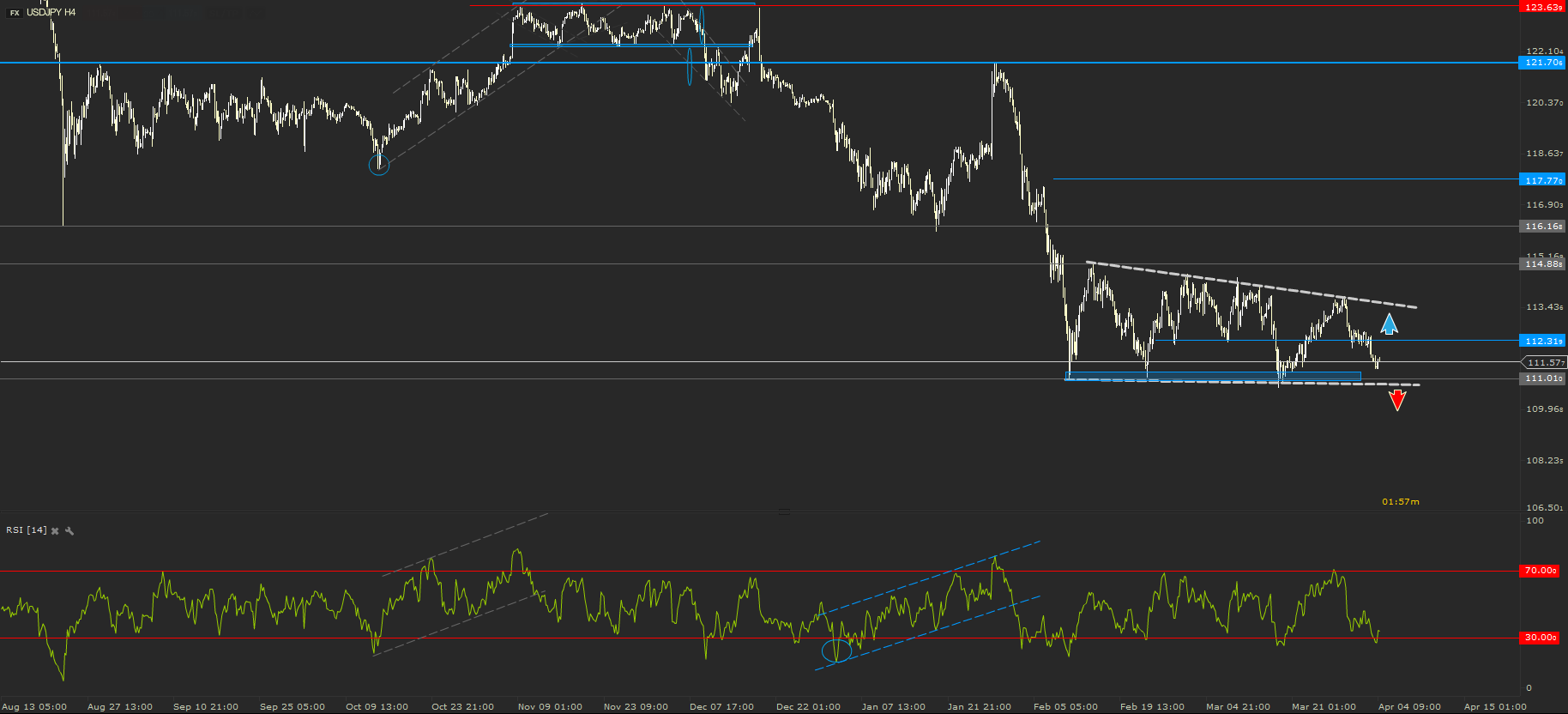

USDJPY – Everlasting

There is nothing more boring than USDJPY in this half of the year. The price move sideways between 111.00 and 113.50. Nothing from the latest fundamental news threw the currency pair outside this range.

Taking into consideration only Technical Analysis, I would say that this range might just be a continuation pattern. A break consistently below 111.00 could trigger a bigger drop for the US dollar. On a shorter period of time a break above the local resistance from 112.31 would signal another rally of the greenback towards the upper line of the range.

NZDUSD – Continuing the Uptrend

The New Zealand dollar remained strong against the US dollar. NZDUSD continued the uptrend. Last week it hit the upper line of the channel and bounced back towards a previous resistance, which now seems to be acting like support.

A break below 0.6821 could signal a continuation of the corrective move towards the next support from 0.6746. On the other hand a bounce from the current level and a rally above 0.6885 would be a strong signal that bulls are aiming for 0.7000.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.