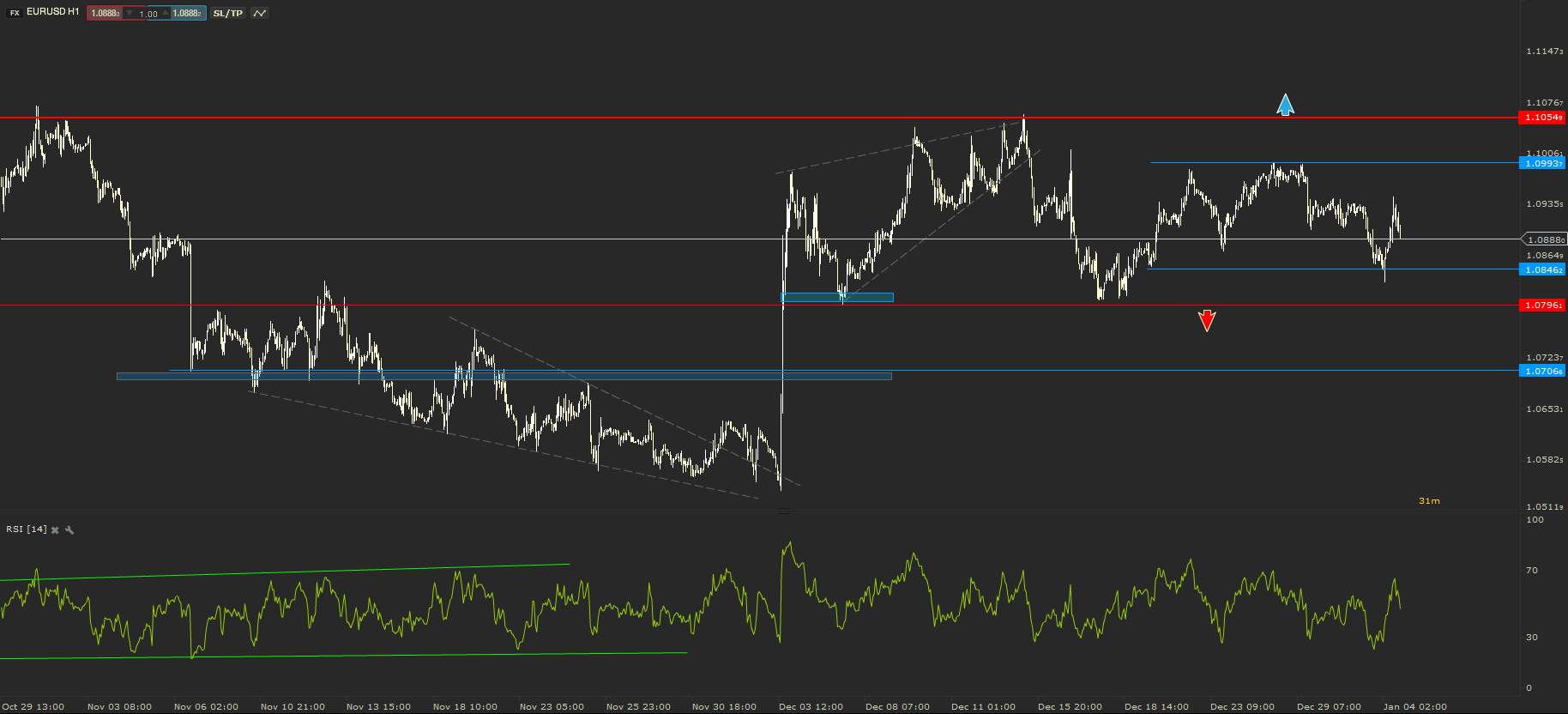

EURUSD - Back in its Comfort Zone

A new year has begun, but the EURUSD is stilltrading in the comfort of December’s range. The side move is limited by the15th of December high of 1.1055 and the 7th of December low of 1.0796. After itbroke above the Fibonacci, set in the past analysis, the price of the mosttraded currency pairs rallied to retest 1.1000.

The 250 pips range may continue to sit strongduring the first half of January. I expect volumes and volatility to startpicking up in the second half of this month. A confirmed break below theintermediate support from 1.0846 would signal a drop back towards the keysupport of the range, while a confirmed break above the round number level(1.1000) would signal another rally towards the key resistance of the range.

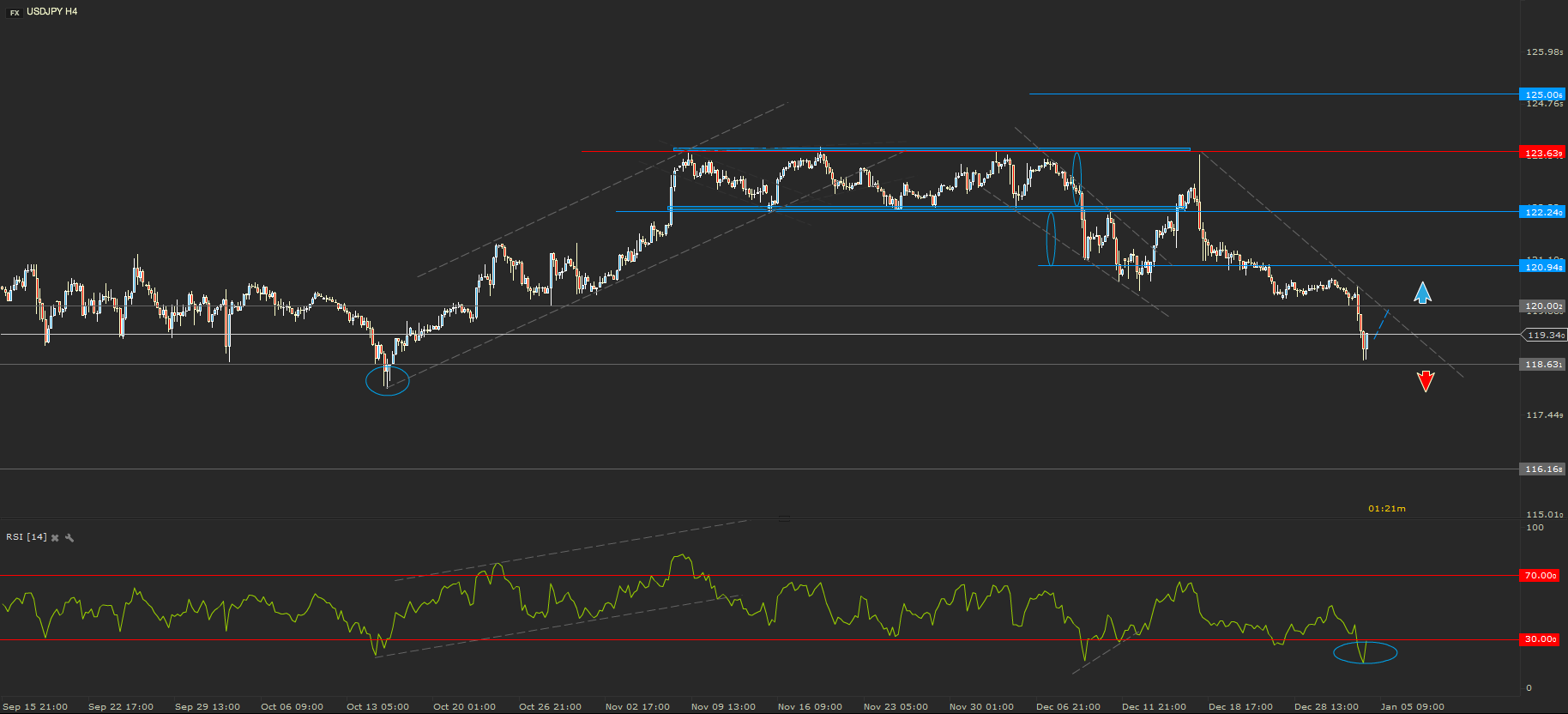

USDJPY - Retesting the Key Support

The New Year’s Eve found the USDJPY almosttouching 120.00. The first day of trading from 2016 pushed the Japanese yen higher.The price of the currency pair dropped below 120.00 and went straight to thekey level support from 118.63.

I am currently expecting for the price to retestor even to make a false break above 120.00. The main move is still sideways onthe daily chart. A considerable break above the round number level accompaniedby a close could signal the possibility of the price to move higher towards thenext resistance from 121.00. If the price will break this week below 118.63 Iwould consider this signal to be a strong bearish one.

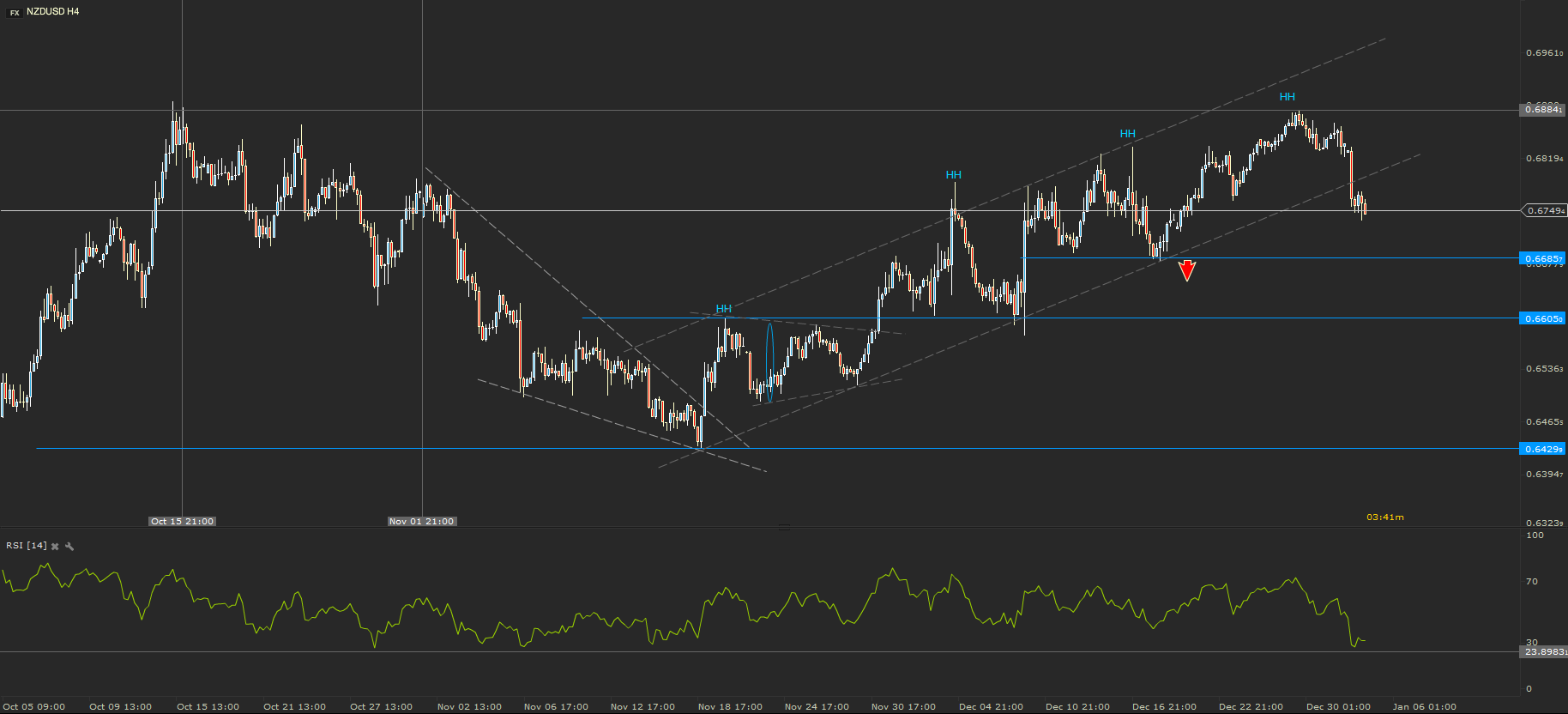

NZDUSD - The Uptrend Continues

The NZDUSD uptrend is still in place. The priceaction of this currency pair has drawn higher high and higher lows throughoutthe entire month of December. The last high has hit the key resistance levelfrom 0.6884. The price bounced back from the resistance and broke the maintrend line. This is considered to be a negative signal in this currentdirection.

Even though there is a negative signal showingthat the trend is weakening, I still believe that there is a good probabilityfor the price to rally again towards 0.6800 or even higher towards the mainresistance. I would consider a strong negative signal the break below thesupport from 0.6685.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.