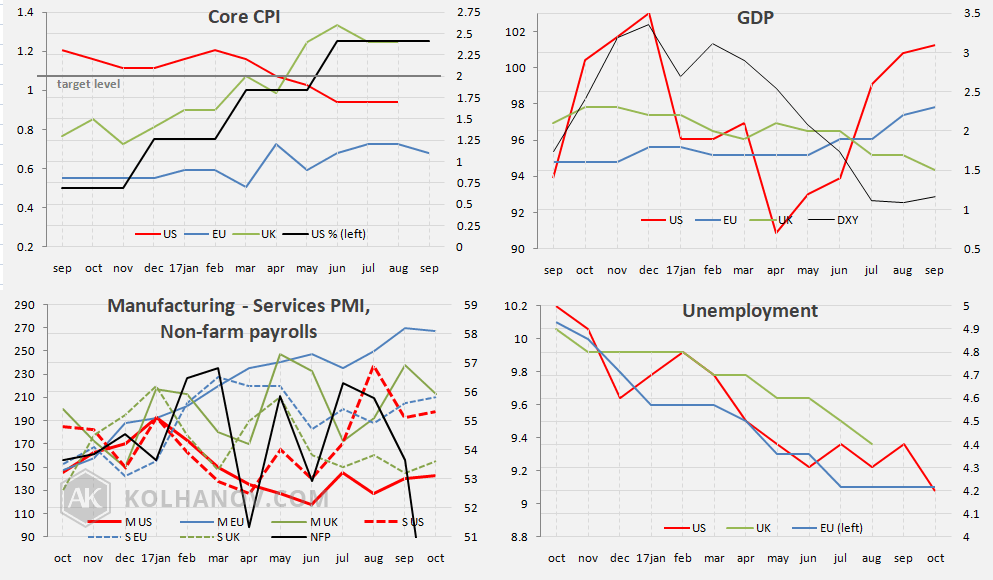

LEADING INDICATORS

Main news of this week:

Wednesday: US - FOMC Minutes

Thursday: EU - Draghi; Oil - Inventories

Friday: US - Core CPI

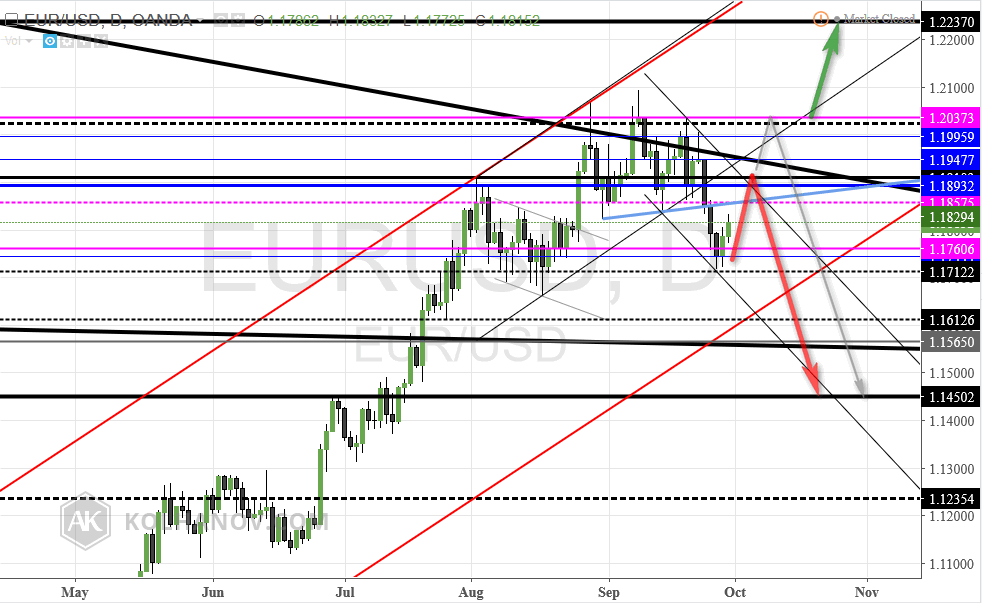

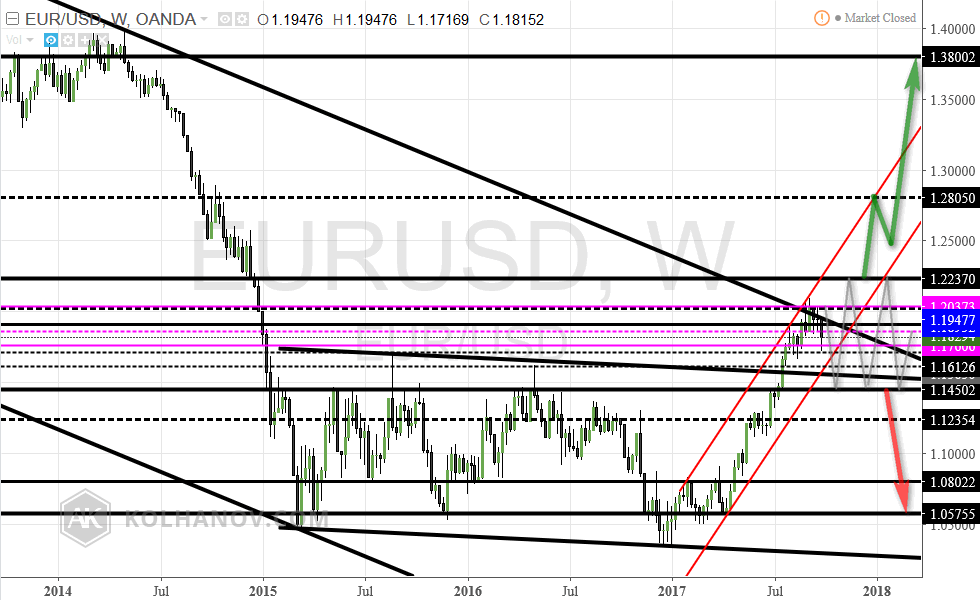

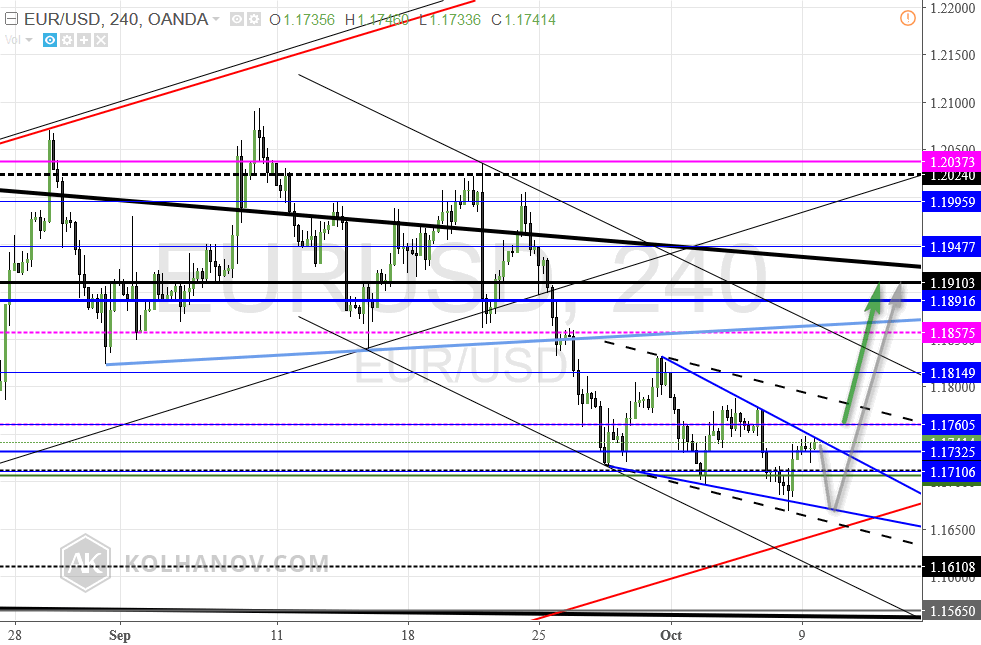

EURUSD

Weekly forecast, October 9 - 13

Previous week was closed on main support 1.1760, so market still have a chance to rebound up to the resistance level 1.1910 (technically). Contribute to this scenario fundamental factor of very weak US "Non-farm payrolls" news, that was published on friday and felt suprisingly low from previous 156K to -33K, that can be a very strong signal for market correction to technical level 1.1910.

By history of this news indicator, we can see, that negative NFP market have once per 7-8 year cycle and after we started to have negative NFP, this crysis period is going over 12-18 month, where last of them was on 2001 and 2008 years. But sometimes its happens when NFP became negative, but if after this one we will have more again - this signal will became very dangerous. But before this apocalyptic scenario we do not have any other economic signals for such possible situation, so looks that negative NFP we had just because US economy is already fully loaded by working places, because unemployment is felt from 4.4% to 4.2%, that is very good sign.

The market is trading along a sideways trend between resistance 1.1760 and support 1.1650 - 1.1610.

An uptrend will start as soon as the market rises above resistance level 1.1760, which will be followed by a move up to resistance level 1.1910.

chart from previous week forecast, october 2 - 6

Weekly chart from October 2

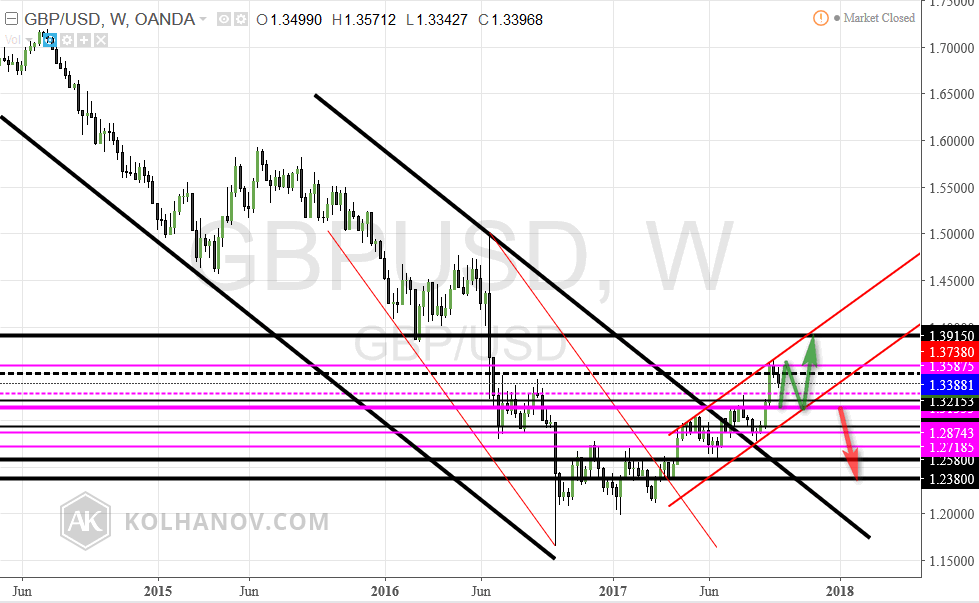

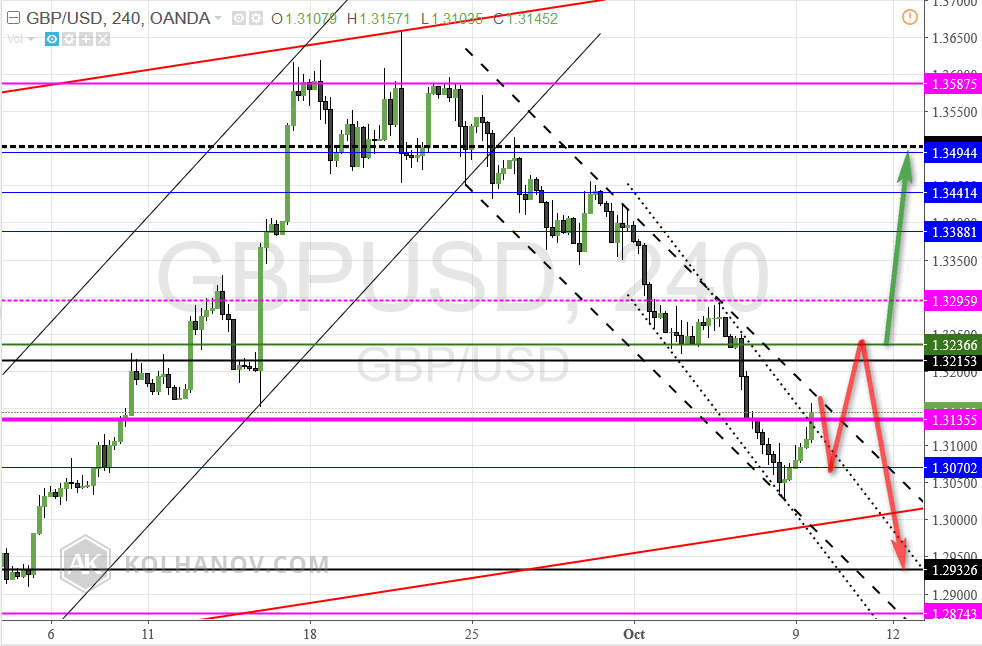

GBPUSD

Weekly forecast, October 9 - 13

Market is trading in downtrend, but on main support level 1.3135, from that can have a correction to resistance 1.3236, from that we can expection continuation of downtrend to the next support 1.2932, because pound is still looks weak.

An uptrend will start as soon as the market rises above resistance level 1.3236, which will be followed by a move up to resistance level 1.3494.

chart from previous week forecast, october 2 - 6

Weekly chart from October 2

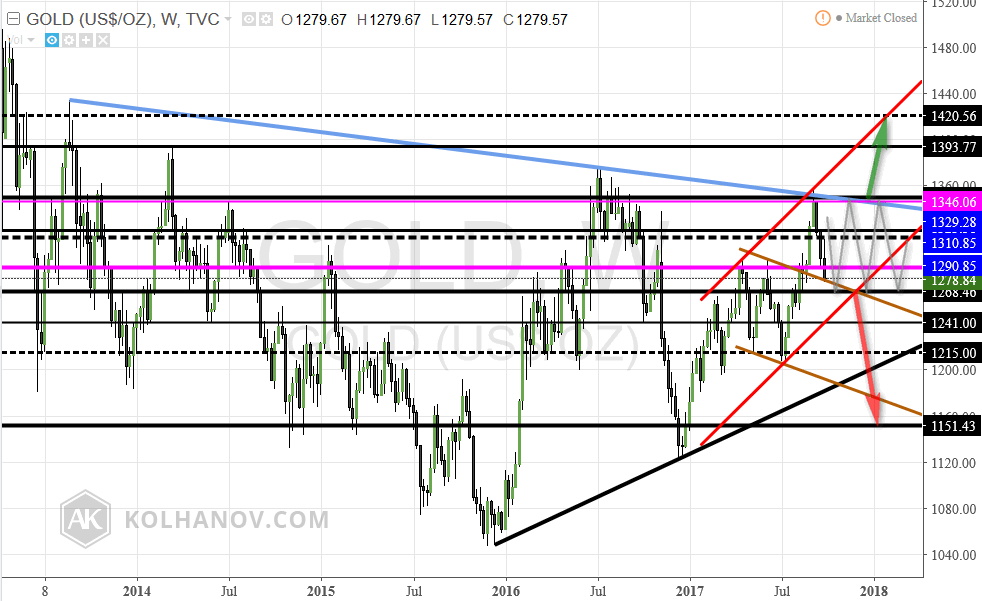

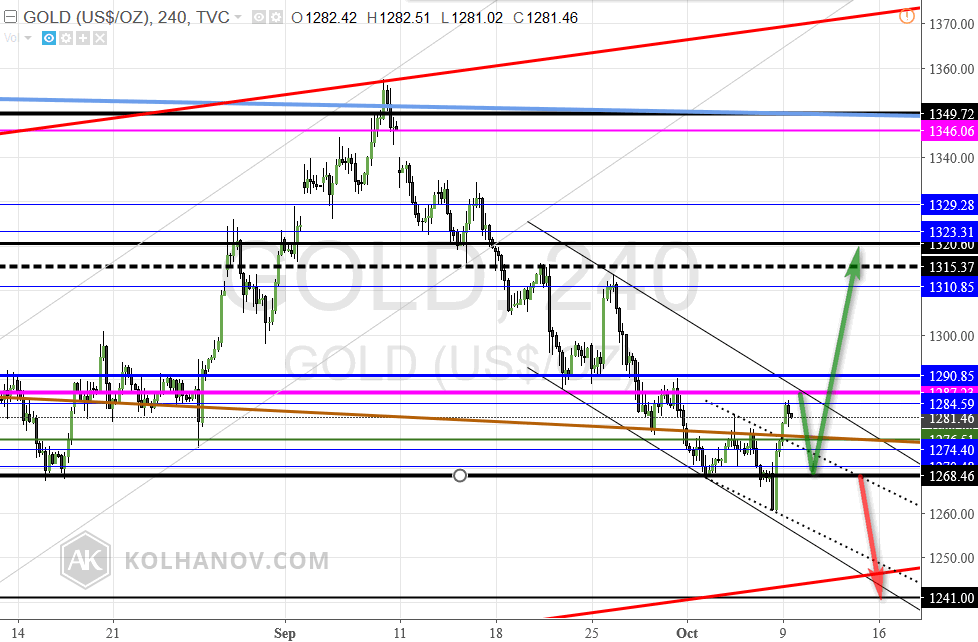

GOLD

Weekly forecast, October 9 - 13

The market is trading along a sideways trend between main support 1268 and resistance 1287.

An uptrend will start as soon as the market rises above resistance level 1287 (or from support 1268), which will be followed by a move up to resistance level 1315 - 1320.

An downtrend will start as soon, as the market drops below support level 1268, which will be followed by a move down to support level 1241.

chart from previous week forecast, october 2 - 6

Weekly chart from October 2

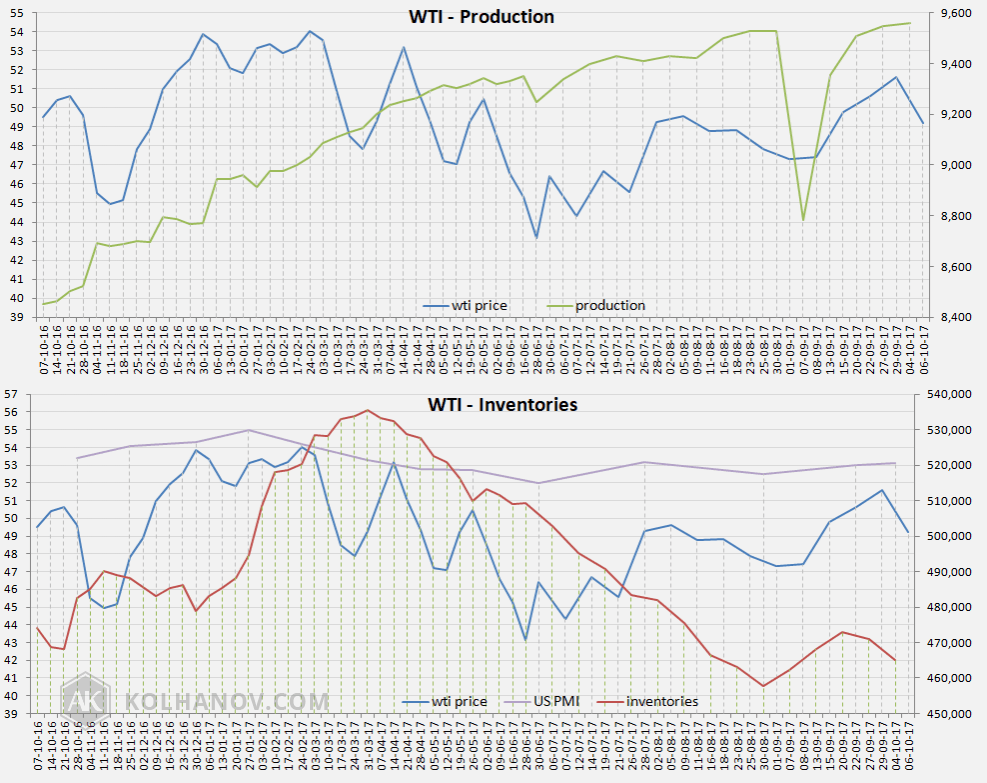

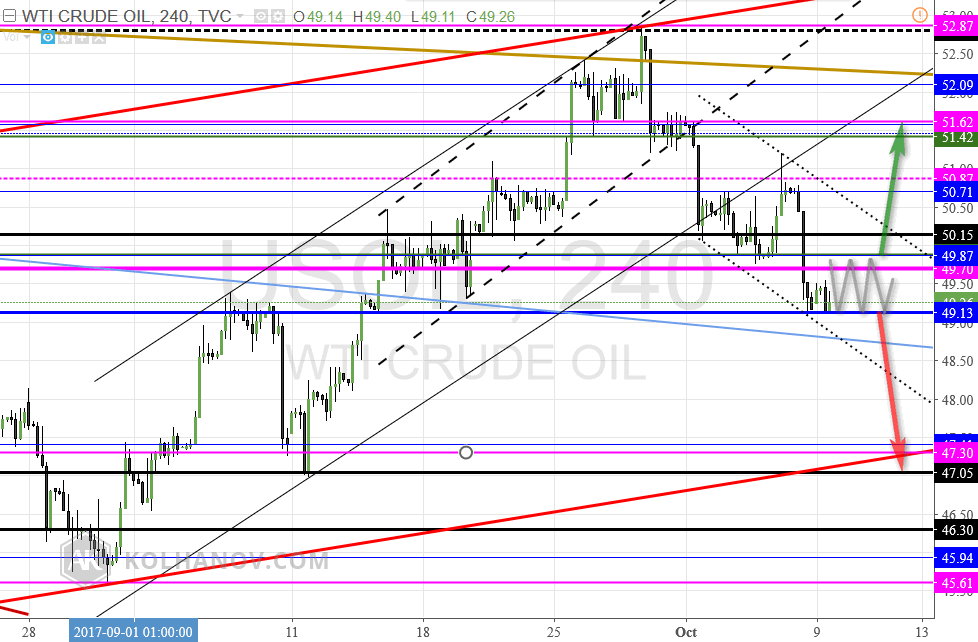

CRUDE OIL

LEADING INDICATORS

Weekly forecast, October 9 - 13

Oil production is started to increase by much less pace, same time we have one more week reduction of inventories, that can provoce market on correction from support 49.13 to resistance 51.62. On previous week that level was strong resistance, so market had downtrend as technical factor, but looking on inventories reduction, support 49.13 is able to stop this trend scenario. From another way, this downtrend impulse is strong, where support 49.13 is the last one and by her break down market will continue downtrend to 47.05.

The market is trading along a sideways trend between support 49.13 and resistance 49.87.

The downtrend may be expected to continue in case the market drops below support level 49.13, which will be followed by reaching support level 47.30.

An uptrend will start as soon as the market rises above resistance level 49.87, which will be followed by a move up to resistance level 51.62.

chart from previous week forecast, october 2 - 6

Weekly chart from October 2

All information provided by Anton Kolhanov is for informational purposes only. Information provided is not meant as investment advice nor is it a recommendation to buy or sell any trading instrument. Anton Kolhanov is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained. You should do your own thorough research before making any investment decisions and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.