Fundamental Forecast for Dollar: Bullish

- US Dollar bounces off of key technical support, eyes potentially critical week ahead

- Late developments in Greek debt negotiations virtually guarantee a volatile Sunday market open

- Follow news as it happens via the DailyFX Real Time News feed

The US Dollar heads into the third quarter with momentum in its favor as it finished the week notably higher versus all G10 counterparts. Whether or not the USD can continue its recent streak will almost certainly depend on the outcome of ongoing Greek negotiations and highly-anticipated US labor market data.

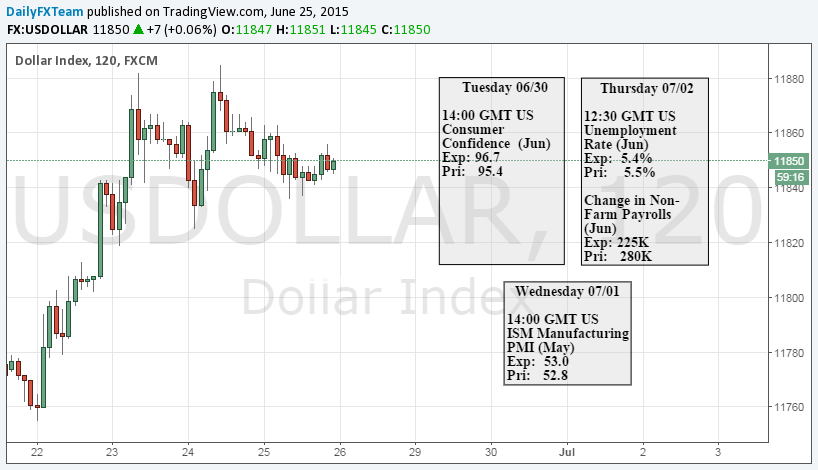

It was shaping up to be a relatively quiet week for the US currency and global financial markets given limited economic event risk, but a sharp Dollar rally against key technical support levels pushed it higher versus the Euro for the first week in four. A good week for US economic data helped further fuel the early-week rally, but the most decisive moves may come in the days ahead given the key Greek deadline and the US Nonfarm Payrolls report. FX volatility prices have picked up after hitting multi-month lows; what might we expect?

All eyes turn to Greece and ongoing negotiations with the Euro Working Group as both sides negotiate ahead of the key June 30 deadline, and the most recent announcement from Greek Prime Minister Tsipras effectively guarantees Greece will miss a key payment due to the International Monetary Fund.

Tsipras said he would ask for a short extension of Greece’s bailout program with its creditors—due to expire on June 30—in order to hold the referendum on creditors’ most recent proposal on July 5. This virtual bombshell promises important Euro volatility at Sunday’s weekly open, and the safe-haven US Dollar is in a position to do well amidst heightened uncertainty.

The planned referendum on July 5 also essentially guarantees that Greece will miss a payment due to the International Monetary Fund due on June 30. This in itself doesn’t mean that the government is in technical default; the IMF allows its borrowers a 30-day grace period before it formally notifies its executive board of the late payment. Yet it’s easy to see why the missed payment severely raises the risks of an eventual default and could quite easily bring a substantial run on Greek banks.

The European Central Bank has thus far stepped up its Emergency Lending Assistance to Greek banks as investors move their funds at a steady pace, but ECB President Mario Draghi said that ELA funds were contingent on Greece remaining within its existing bailout agreement with creditors. If the ECB pulls ELA funding the Greek government will have no choice but to impose capital controls on its banks—patently incompatible with the rules of the European Monetary Union and the Euro. Expect financial market volatility.

Once markets get past the initial shock of the new Greek news, attention will turn to a frequently market-moving US Nonfarm Payrolls Report due Thursday. Any major suprises could easily force a repricing of US Federal Reserve interest rate expectations and force the Dollar to react in kind. It is shaping up to be a volatile week for the Euro, Dollar, and broader financial markets.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.