Fundamental Forecast for Euro: Neutral

- The Euro has seen moderately higher prices in recent days, but the longer-term outlook remains bearish.

- EURUSD traded into a key resistance level, and now the US Dollar may be searching for a bottom post-FOMC.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

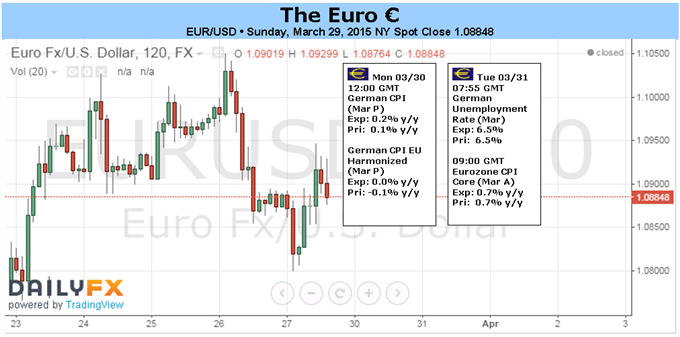

Continued general improvement in Euro-Zone data and a further build of commercial long positioning (now an all-time high of 271.9K net-long contracts) helped buoy Euro exchange rates for a second straight week, although the turn of the calendar from March into April may prove to be more difficult than days past. EURUSD rallied by +0.62% to close last week at $1.0885 and EURGBP jumped by +1.09% to £0.7321, yet both major EUR-crosses settled considerably lower than their high watermarks for the week ($1.1052 and £0.7385 respectively).

In the days ahead, the market has a chance to refocus its attention on two of the major drivers of Euro weakness in 2015: persistently low inflation in the Euro-Zone; and the sustained improvement in the US labor market that is driving a wedge between ECB and Fed policy expectations. On Tuesday, the March Euro-Zone CPI report will be released, where the CPI Estimate is due at -0.1% y/y from -0.3% y/y, and the CPI Core is expected at +0.7% y/y unch. On Friday, the March US Nonfarm Payrolls report is forecast to see job gains of +250K, the thirteenth consecutive month of at least +200K jobs growth in the world’s largest economy.

In a holiday shortened week, these data reports represent the two most obvious landmines to EURUSD traders. The propensity for these reports to impact the market is high despite the potential for diminished liquidity, as speculators have embraced the most bearish view of the Euro on record, having 221.K net-short contracts on the books for the week ended March 24, eclipsing the previous all-time high of 214.4K net-shorts set during the week ended June 5, 2012. Whereas Euro speculative shorts have grown in tandem with commercial longs digging in, speculative traders in the futures market have relinquished the aggressive bullish US Dollar view: Dollar Index (DXY) net-longs contracted by -10.7% to 71.2K contracts.

If EURUSD is to fall back, then, it will need to be due to a combination of soft Euro-Zone CPI data and strong US labor market data – not either/or, but both. Market measures of inflation expectations have steadied, but not by much: the 5-year, 5-year inflation swaps (FWISEU55) ended the week at 1.649%, just below the four-week/20-day average of 1.709%. The recent dip in inflation expectations (1.760% on March 20) can be attributed to the recent relief rally in the Euro, as data otherwise remains relatively strong.

The Citi Economic Surprise Index for the Euro-Zone hit +52.1 at the end of the past week, up from +40.2 from a week earlier. Euro-Zone data has been outpacing US data at its best clip in nearly four and a half years. Markets haven’t priced in the improved Euro-Zone data as a batch that would materially change the pace of ECB easing, however: Morgan Stanley’s ‘months to first rate hike’ index (MSM1KEEU) resides at 45.5 suggesting a December 2018 rate hike.

Overall, the big picture for the Euro remains unchanged, even as it continues to take shape: rising inflation expectations coupled with falling nominal bond yields means prospective real yields are being reduced, fueling the need for investors to search for yield outside of the region; this should accelerate capital outflows as Euros are exchanged for other currencies to as to invest in foreign assets. The time for this view to come back into focus may be nearing, as investors get a first-hand look at the policy differential between the ECB and the Fed with the data due in the days ahead.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.