- Sterling likely to remain vulnerable for further weakness

- ECB will do whatever it takes

The release of the minutes from the last European Central Bank meeting wasn't as eagerly anticipated as some previous publications. No one was expecting anything new from the ECB and Europe's Central Bank didn't disappoint. That is perhaps a tad unfair; ECB President Mario Draghi did commit the ECB to acting like an "anchor of confidence" amidst the global storm. So that's OK then. Vítor Constâncio, the ECB's vice president, commented that the bank would do "whatever is needed” to get inflation back up to their target level of 2.0%.

Those comments weakened the Euro as traders mulled the potential for further ECB measures but there is clearly disquiet amongst the ECB board as some of the members expressed concerns over how reliant retail banks were becoming on cheap central bank money and support. It's a fair concern after nearly a decade of extraordinary measures.

The other central banker in the news on Thursday was Janet Yellen, the Chair of the US Federal Reserve. She was at pains to assure us all that the US economy was not a bubble reaching its bursting point. This followed comments from Donald Trump but Mrs Yellen said she didn't see any sign of over-valued assets and her comments about the weak global economy served to highlight the foreign pressure on the domestic economy. The US Dollar was a little weaker after her comments.

Today's news will start with UK industrial and manufacturing output. That is expected to reflect improvement in the industrial; but worse performance in the manufacturing data. If that is proven to be the case, Sterling is already very weak and will probably just remain so. Anything to the positive side would create a bit of GBP buying interest though.

This afternoon brings Canadian employment data and that is expected to be a tad worse than the previous month. The Canadian Dollar has been recovering somewhat as commodity and energy prices stabilise but poor employment data would knock any ebullience still in the system. If you are a CAD buyer, you may wish to place your orders later in the day. Contact your Halo Financial Consultant for more information.

And The Gloucestershire Echo is carrying a story that is a clear scoop. The story was all about a full KFC meal that was abandoned on the pavement in St George’s Place, Cheltenham. The fact that they even reported this is hilarious in itself (quiet news day me thinks) but it's the tweet from The Media Blog that made me really laugh. It reads "Entire KFC dropped on the floor in Cheltenham. Should Corbyn resign over this?" Love it.

Have a great weekend everyone.

Clever jokes

C, E-flat, and G walk into a bar. The bartender shows them the door and says, “Sorry, we don’t serve minors.”

The bartender says, “We don’t serve time travellers in here.” A time traveller walks into a bar.

I met a mathematician who had a phobia about negative numbers. He's stop at nothing to avoid them.

If you jumped off the bridge in Paris, you’d be in Seine.

René Descartes is at a party when someone says, "Aren't you Isaac Newton". Descartes replies, “I think not,” and promptly disappears.

I hate Russian dolls; they're so full of themselves

Rick Astley will let you borrow any movie from his Pixar collection, except one. He's never gonna give you Up.

I used to be addicted to mud. I've been clean for 4 months now.

What do you get if you cross a one-liner with a rhetorical question.

AUD

The decision by the Reserve Bank of Australia to leave their base rate on hold this week added strength to the Australian Dollar. The improvement in the value of oil and energy products added to that strength and the pressure that Sterling is feeling ahead of the EU exit vote pulled the Pound lower. The combined effect is that the Sterling – Australian Dollar rate has fallen from around A$2.05 at the start of the year to around A$1.85 as I write. As the 23rd June (the referendum date in the UK) appears to be a long long way away, Sterling is likely to remain vulnerable for further weakness. That is no surprise but there are support levels for the Pound that may offer some respite for those who need to sell sterling and buy the Australian Dollar. The half way point between the low of 2013 and the high of 2015 is A$1.8350 or thereabouts. That will be a target for many traders. Sterling could well bounce a little when that level is encountered, so don't be surprised and do be ready. If that level breaks though, there is scope for a tumble towards A$1.75. That's the 61.8% Fibonacci retracement level which traders will target as and when the Pound continues its decline. Anyone seeking to buy Aussie Dollars will shudder at the prospect but we shouldn't be too surprised if it happens.

CAD

A small scale rebound in the wholesale price of oil and other energy products has given the Canadian Dollar a bit of a fillip. That, plus the pressure the Pound is under regarding the EU exit vote, is pushing the Sterling – Canadian Dollar rate downwards. It seems almost inevitable we will see this slide to C$1.81. That is the 50% retracement level between the 2013 low and the 2015 high. Those who need to buy Sterling against the CAD would do well to target that level or as near to it as you can get because we may well see a bounce from there. If we do, then C$1.87580 is probably the first target. However, if the Pound manages to slink below C$1.81, then we can expect further losses and C$1.73 beckons. This kind of headless-chicken trading will haunt the Pound until the 'Brexit' vote is out of the way and, if the UK votes to leave the EU, further Sterling weakness will follow – at least in the early weeks. Sorry to be the harbinger of doom but traders hate uncertainty and this is about as uncertain as it comes.

EUR

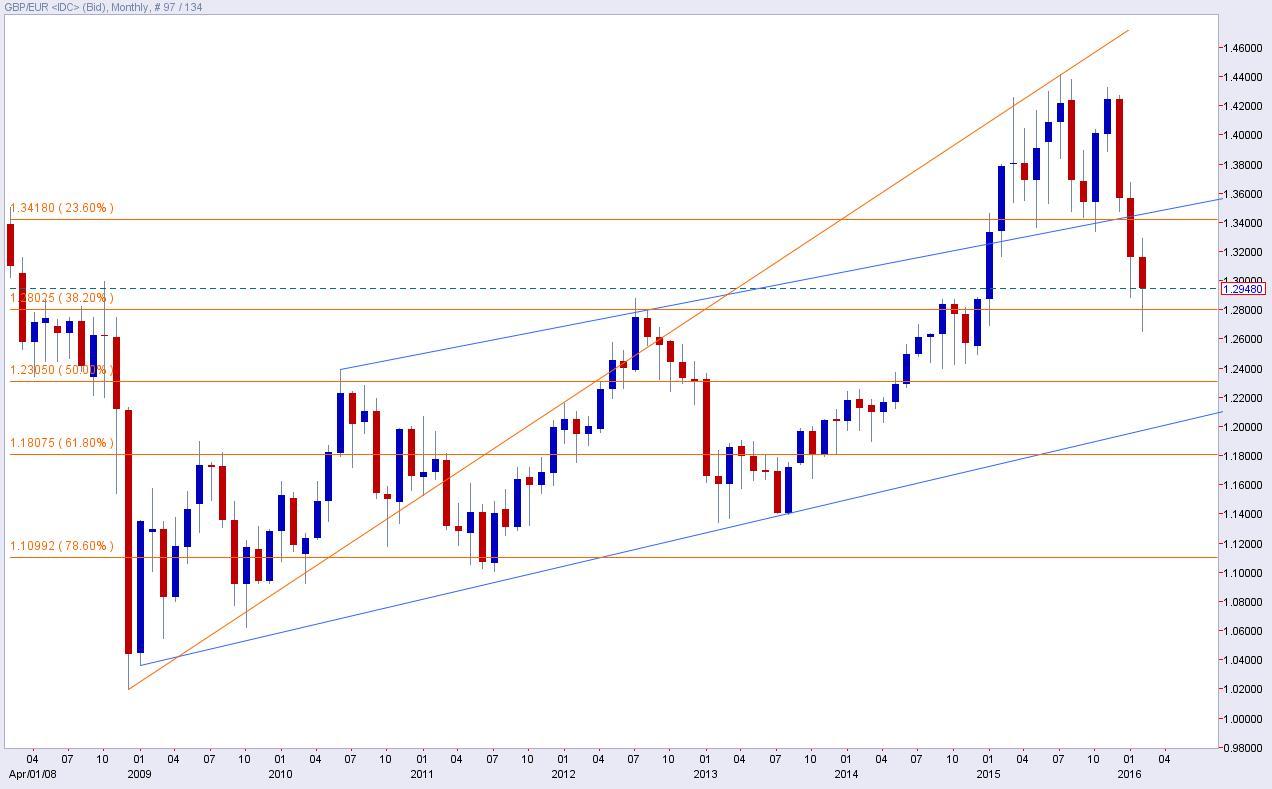

To the east of the Channel, the European Central Bank is committing itself to doing whatever it takes to reinvigorate the EU economy and the Euro is weaker today than it was yesterday as a result. To the west, the impending EU exit vote is taking centre stage and the BOE is almost a side issue. The result is that the Pound is being ...well, pounded and the Euro is being flattered by the weakness that sterling is suffering. The €1.23 level is very important. It marks a 50% retracement of the 2008 low to the 2015 high. If Sterling can hold in here, and technically speaking this ought to provide a significant amount of support for the Pound, then we may well see a bounce but, if €1.23 gives way, the GBPEUR exchange rate is likely to drive down to €1.20. That is the trendline support that started back in 2009. This trendline has been tested on numerous occasions and has stopped the Pound from falling lower. With the Brexit vote a couple of months away, I wouldn't be surprised if that level broke; at least in the short term.

NZD

As far as the Sterling – NZ Dollar exchange rate goes, the NZ$2.05 level appears to be providing sufficient support for the Pound at the moment. That has certainly been the case for the last six weeks and this at a time when Sterling has been diving against most other currencies. If this level holds, then the bounce in this pair could see us back up to NZ$2.10 pretty quickly and maybe even NZ$2.16 in the medium term. The Reserve Bank of New Zealand is very concerned over the strong NZ Dollar and the impact it has on exports and they have been actively cutting their base rate; ostensibly to boost domestic growth but knowing that is also weakens the currency. However; with Sterling being so damaged by the impending EU referendum, it is hard to see Sterling making any headway against the NZD or to see the NZD fall too much when the base rate is still 2.25% and that is very attractive to investors who are getting virtually no yield anywhere else.

USD

Fed Chair, Janet Yellen sees no bubble in the US economy but the US Dollar stubbornly refuses to weaken. The Sterling – US Dollar rate bounced in February but the UK EU exit vote is looming and the Pound has given up most of the gains as traders run scared. You can see the small upward trend that started in Feb but the more important level seems to be the psychological barrier of $1.4000. If Sterling can maintain itself above that level, we will see a bounce in this pair but if the fear of the Brexit vote overwhelms the Pound, we will be back at $1.38 before we know it and perhaps $1.35 within the next couple of months.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.