- Equity markets plummet on a new covid variant from South Africa.

- Likely to be named Omicron, this variant appears to be vaccine-resistant.

- Equity markets collapse as travel leisure and airlines hit hard while vaccine makers surge.

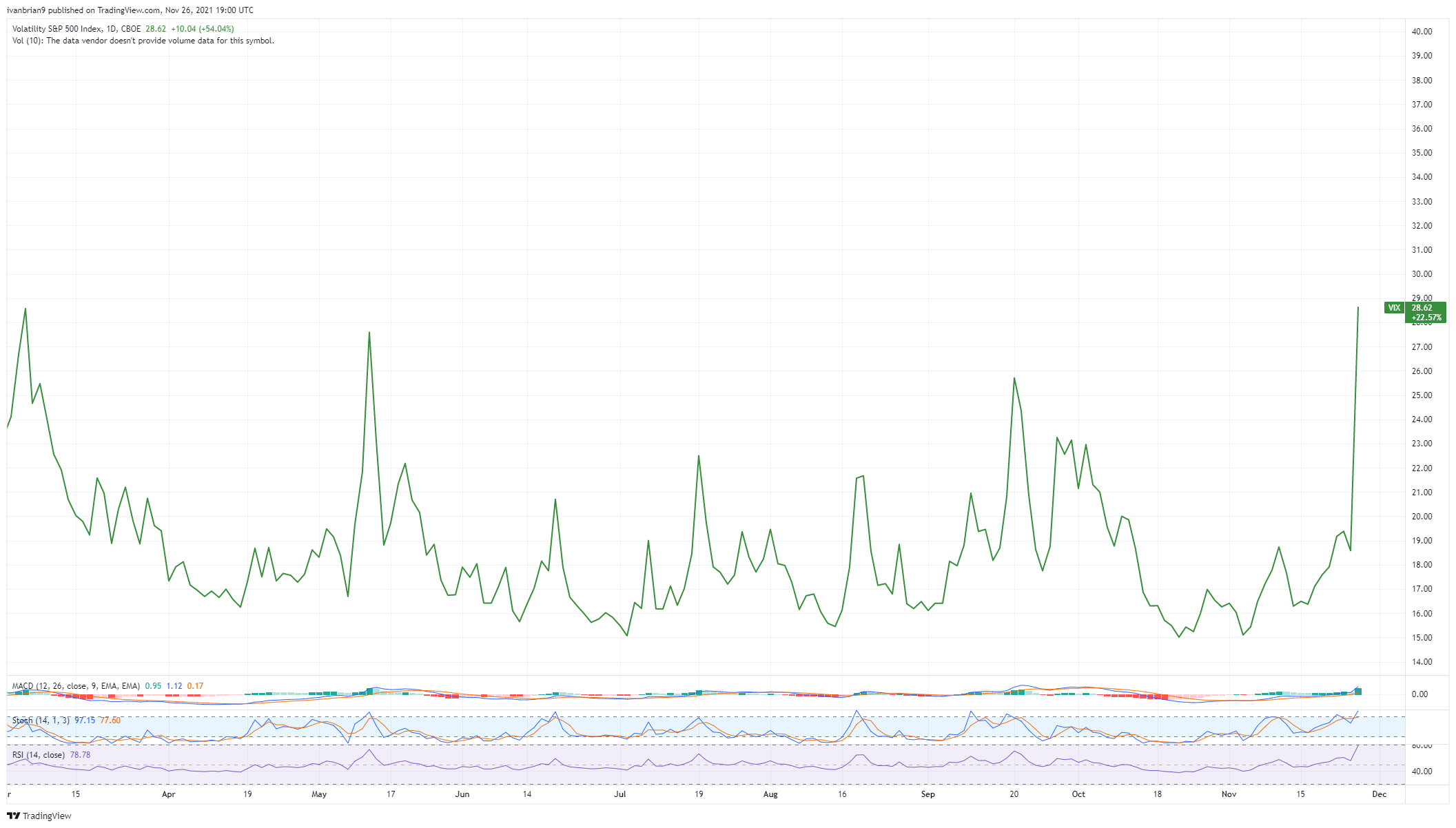

The equity markets took a serious turn for the worse on Friday in a thanksgiving hangover show. This probably has been brewing for some time and we did note the spike in VIX earlier in the week which is often a portent of doom. While the sell-off has been put down to the new strain of covid found in South Africa, some selling was long overdue in a Fed juiced market that showed no sign of slowing. Now this new strain of covid looks to be worrying according to initial research. More transmissible, more vaccine-resistant and more variants mean it could become the dominant strain globally, just as delta took over from earlier versions. However, even if it is resistant to vaccines, we have to have confidence in the ability of vaccine manufacturers to quickly bring out variants of the vaccine to combat any new strain and added to this we now have two antiviral pills from Merck (MRK) and Pfizer to help in the fight. So for now we will wait for further information before heading into wide-scale doom and gloom mode.

Europe is however in the grip of a fourth wave regardless of any new variants as the delta variant’s spread sees Germany, Austria and many Eastern European countries impose some form of lockdowns. This was causing some concern for investors already before this new strain arrived on our worry screens. With equity valuations already highly stretched and a lack of liquidity around Thanksgiving, the moves are being exacerbated on Friday. We had in our earlier weekly notes this November already restated our view for a 5-10% correction before the Santa Claus rally kicked in, so this is playing out nicely if a bit more volatile than anticipated.

S&P 500 (SPX) (SPY) 15-minute chart

Market Breadth

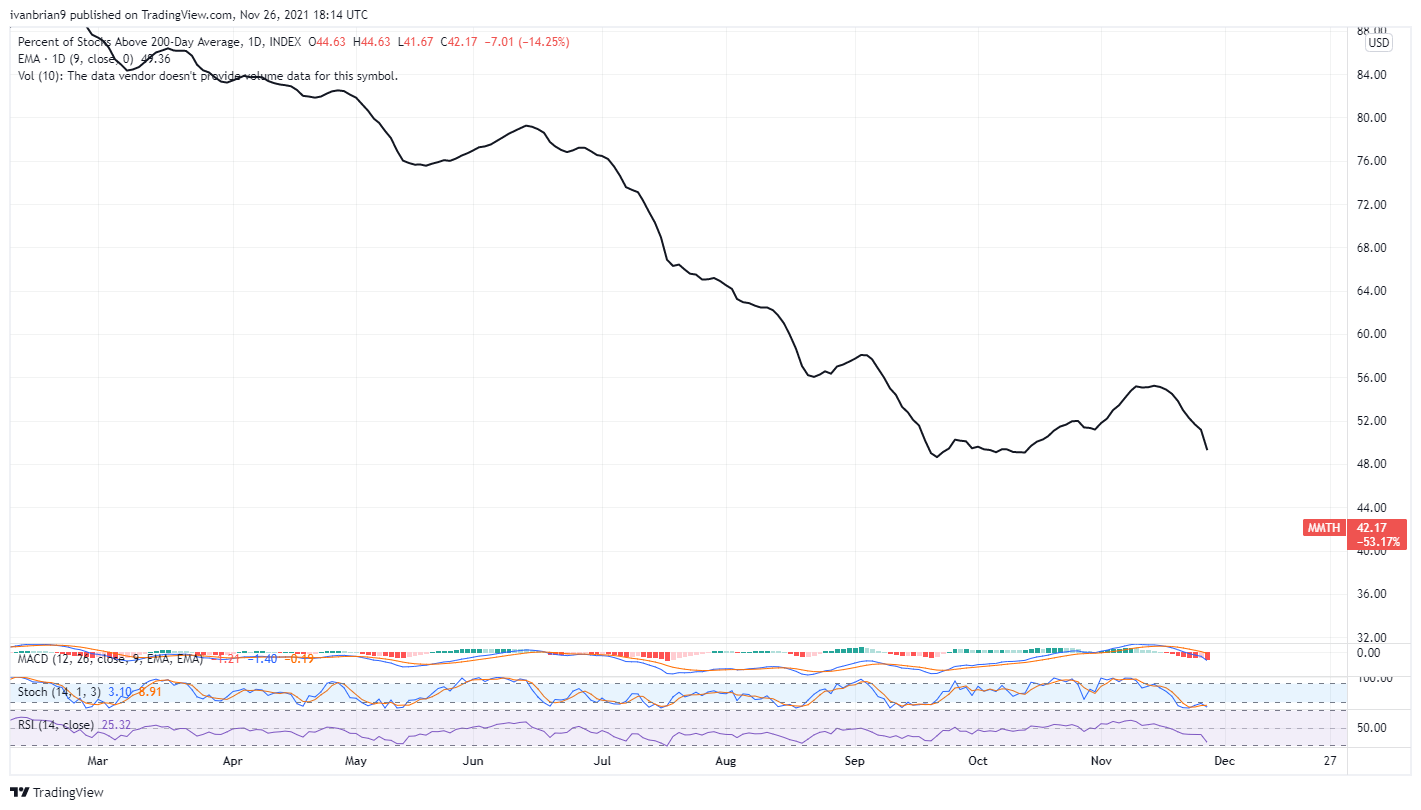

We mentioned VIX spiking in our daily report on Wednesday and last week we focused on the markets diminishing market breadth under the byline “you breath stinks”. For those not familiar, market breadth refers to the wide scale health of the stock market. If the SP500 rallies but only 10 stocks are making new highs or up on the day that means it is not a broad-based rally or it can be said to have poor market breadth. Traditional indicators are stocks trading above their 200-day moving average, stocks making new yearly highs or lows, and the number of advancers or decliners on a given day.

The number of stocks making new 52 week highs, above, is still falling. A bit concerning but other indicators are far more worrying.

Last week we highlighted the number of stocks making new lows was actually increasing despite the main indices rallying. Counterintuitive as it sounds. This trend has worsened and is now exceptionally high, the trend is actually accelerating. This rally was way too narrow and is now likely to pay the price.

Number of stock making new 52 week lows

The number of stocks above their long-term 200-day moving average (below) was also beginning to decline. Well as we can see the trend has persisted.

When you add this in with rising bond market volatility (MOVE) and rising VIX you have quite the recipe for fear, fear is the path to the Darkside as someone once said and is the path to suffering. Well, longs are suffering right now and we see this continuing into next week. We already have the macro background in place, rising inflation, rising yields, and rates and a rising dollar and now real fear.

MOVE Index, Bond market volatility above, and VIX chart below. Fear is now in charge of this market going forward.

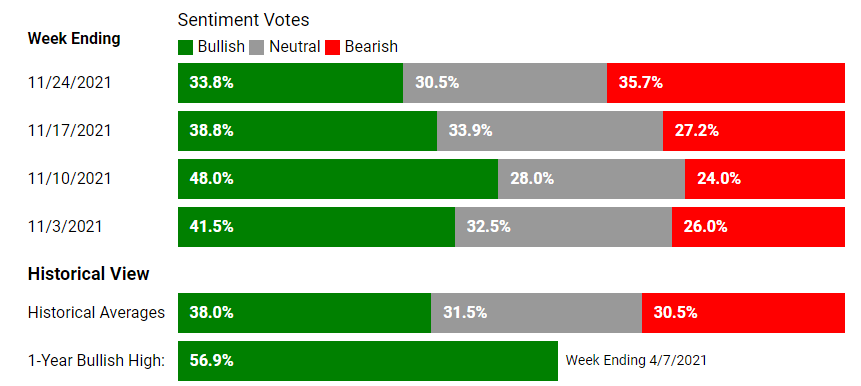

Investor sentiment surveys

The latest sentiment surveys we have do not take Fridays move into account and will likely worsen. But already the American Association of Individual Investors (AAII) has turned bearish with the lowest bullish reading we have seen for some time.

Source: AAII.com

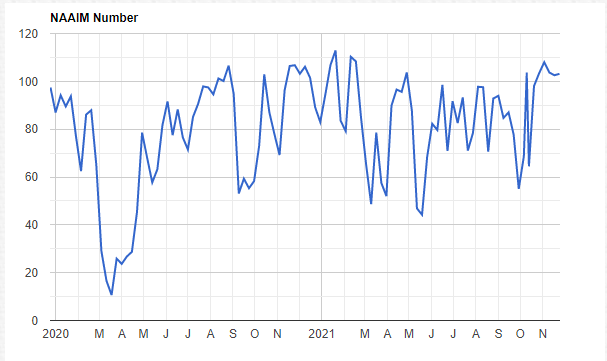

The professionals have ignored the fear for now. The National Association of American Investment Managers (NAAIM) data shows investment managers are over 100% long the market still, but again as noted this data is also until last Wednesday. Expect a panic reduced number for next week.

Source: NAAIM.com

S&P500 (SPY) forecast

Our weekly note from last Friday "We are going to go out on a limb here and call for the S&P (SPY) to top out and retrace next week to $453. The factors above re market breadth are weighing on our mind as is the mess that Europe is in economically and covid related". Currently at the time of writing the SPY is at $456 so only 3 points to go with one hour left!

The market breadth indicators still favour more downside as does the now elevated VIX and other fear indicators. $453 won't hold and is not the buy the dip point in our view. That is more likely around $440 to $444. The bearish divergence in the RSI identified last week has now played out so watch for divergence on the downside.

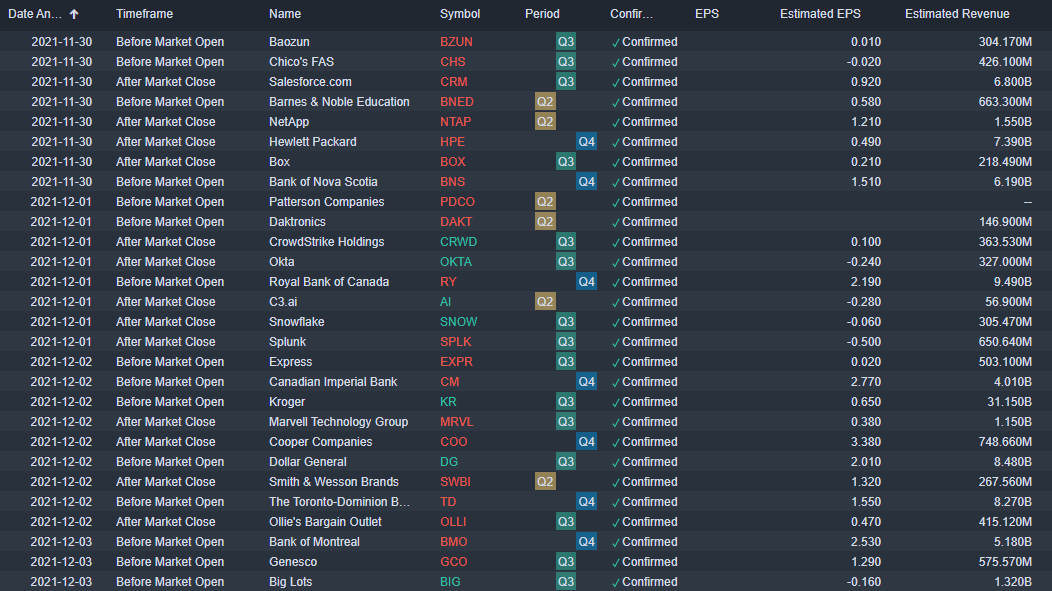

Earnings week ahead

We still have a few retailers left to report and if recent evidence is anything to go by these will be mixed at best. Some meme stock favourites are still around such as Crowdstrike (CRWD) and Snowflake (SNOW).

Source: Benzinga Pro

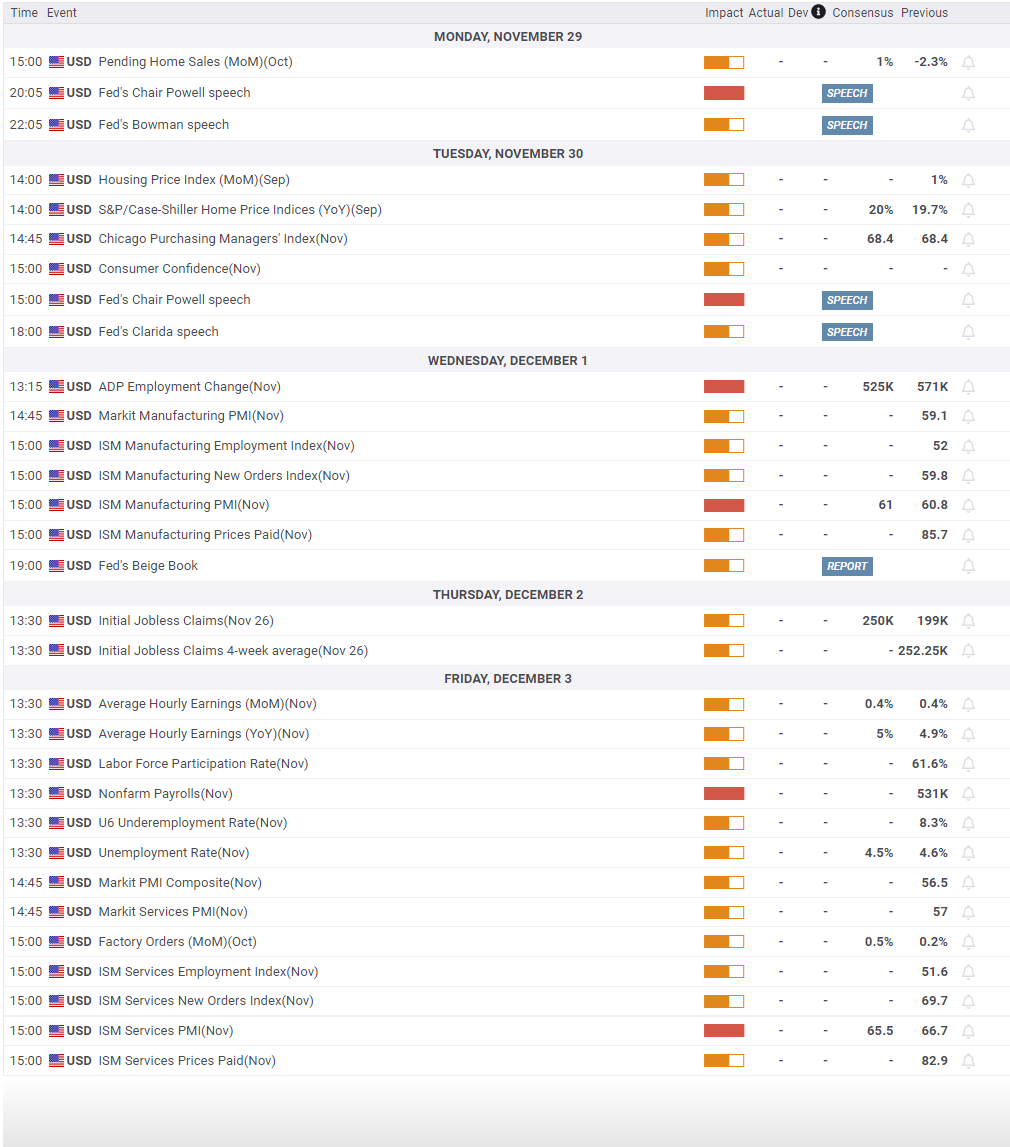

Economic releases

The week revolves, as ever for the first week of the month, around the employment report. Jobless claims have been hitting multi year lows so it should flow thorough to a positive report. Powell takes to the wires this week and his comments have more significance than usual now with the markets in full fear mode. Can he soothe them again?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.

-637735467891217461.png)