- S&P (SPY) closes up over 4% on the week.

- Nasdaq (QQQ) closed with a gain of 4.5% versus a week ago.

- Dollar loses its grip on power as Yen and Euro rally.

A huge week in data terms. The Fed pushed rates higher by 75 basis points and everyone cheered. Equity markets rallied sharply, a curious statement but there you go. We did note that the previous 75 basis point hike in June was met with a sharp sell-off so why the difference this time? Well as we often say the market decides what it wants to do and then shapes the narrative around that outcome. We were told the Fed had turned all dovish because the market wanted and needed to rally. That was the path of least resistance and maximum pain to investors. The Fed merely abandoned guidance it didn't really get all lovey-dovey.

US GDP then came and added to the dovishness. Again more bad news, the US is in recession, but the equity market immediately begins to rally on this so-called bad news. Why? Because it wanted to. Bond yields falling helped high-risk sectors move higher and from there the only hurdle left was earnings. But Apple and Amazon both held up their end of the bargain and so here we are at the end of the week some 5% higher. Right or wrong, you decide. Currently, the market is pricing in a very optimistic setup in our view. Inflation falling from nearly 9% to 3% in 18 months is unprecedented and quite frankly highly unlikely in our view. We are not alone in our view and have some good company!

“Jay Powell said things that, to be blunt, were analytically indefensible. There is no conceivable way that a 2.5% interest rate, in an economy inflating like this, is anywhere near neutral:” Larry Summers https://t.co/s13UJpGvCh

— Lisa Abramowicz (@lisaabramowicz1) July 29, 2022

But don't fight the Fed and the flow is the mantra to live by so rally on dudes!

Earnings season is now over the hump with big tech, banks, and oil majors out of the way. That leaves the smaller fish to come which should not upset the bullish apple cart too much. We expect volatility to remain high though as the bond market looks to work out exactly where it should be pricing year-end rates. Bond volatility means equity vols will remain elevated so expect more large PnL swings. But we all got a bit too pessimistic about this earnings season, your author included. We did not get the washout low that many were expecting. Maybe it comes in Q3 or maybe it does not come at all. But already Wall Street has pared 2023 consensus S&P 500 EPS from $250 to $243 during earnings season. Sticking a current forward P/E of 17 here means a move from 4,250 to 4,131 for forward S&P forecasts. Small but steady and likely more to come.

Stock price reactions to earnings misses in SPX are now the lightest in our records. Clearly sentiment got too bearish in front of this earnings season. pic.twitter.com/gvZSQ3LTtx

— Gina Martin Adams (@GinaMartinAdams) July 29, 2022

S&P 500 2023 EPS expectations falling off a cliff. pic.twitter.com/5rgLtWGo0V

— Gina Martin Adams (@GinaMartinAdams) July 29, 2022

We have noted how underweight the latest fund manager surveys are along with the low sentiment from the AAII and Bull and bear surveys. All this has meant the rally was set up. Fund managers and especially hedge funds need a strong quarter and H2 to stem redemptions in the second half of the year. They will bet big on beaten-down tech names and no surprise to note this is already happening.

Price reactions show us money is going into the years biggest stock market losers after the initial downdraft following EPS misses. pic.twitter.com/VRMgAQon4j

— Gina Martin Adams (@GinaMartinAdams) July 27, 2022

Is the #PainTrade higher? With #sentiment very negative, positioning extremely light, and the #fear of underperforming (#career #risk), have fund managers been pushed to buy stocks due to #FOMO? The market is fighting the #Fed's dot plot.

— Lance Roberts (@LanceRoberts) July 28, 2022

h/t @thedailyshot pic.twitter.com/4zqTZ4gegY

Adding to the rally has been the flip from trend following CTA programs that have closed short bets.

Here's a technical reason for the recent stock rally: quants are closing out of short positions at a dramatic clip. https://t.co/VGqvwos7FY

— Lisa Abramowicz (@lisaabramowicz1) July 29, 2022

The only chart that matters going forward though is this one, fed funds futures for Dec 2022 (bar chart) and Dec 2023 (line). Currently pricing in aggressive rate cuts in 2023. Optimistic. If this changes equities will quickly reprice. If the spread narrows and or either goes up then it is time to exit risk.

Earnings highlight

AMC earnings preview

We know you all like this one and certainly, we can expect some good soundbites from CEO Adam Aron to his AMC apes. Footfall remains good with the summer blockbuster season going well so that should lead to an upbeat report and strong revenues. The problems are further down the road but with financial conditions easing expect more risky assets to rally so that tees up AMC next week.

Monday has PINS and ATVI earnings. Tuesday AMD and PYPL, Wednesday Lucid and Moderna, and Thursday AMC.

SPY forecast

The gap to $401 has finally been filled and $415 now beckons. Volume begins to increase up there so this move may begin to slow but we remain bullish.

SPY daily

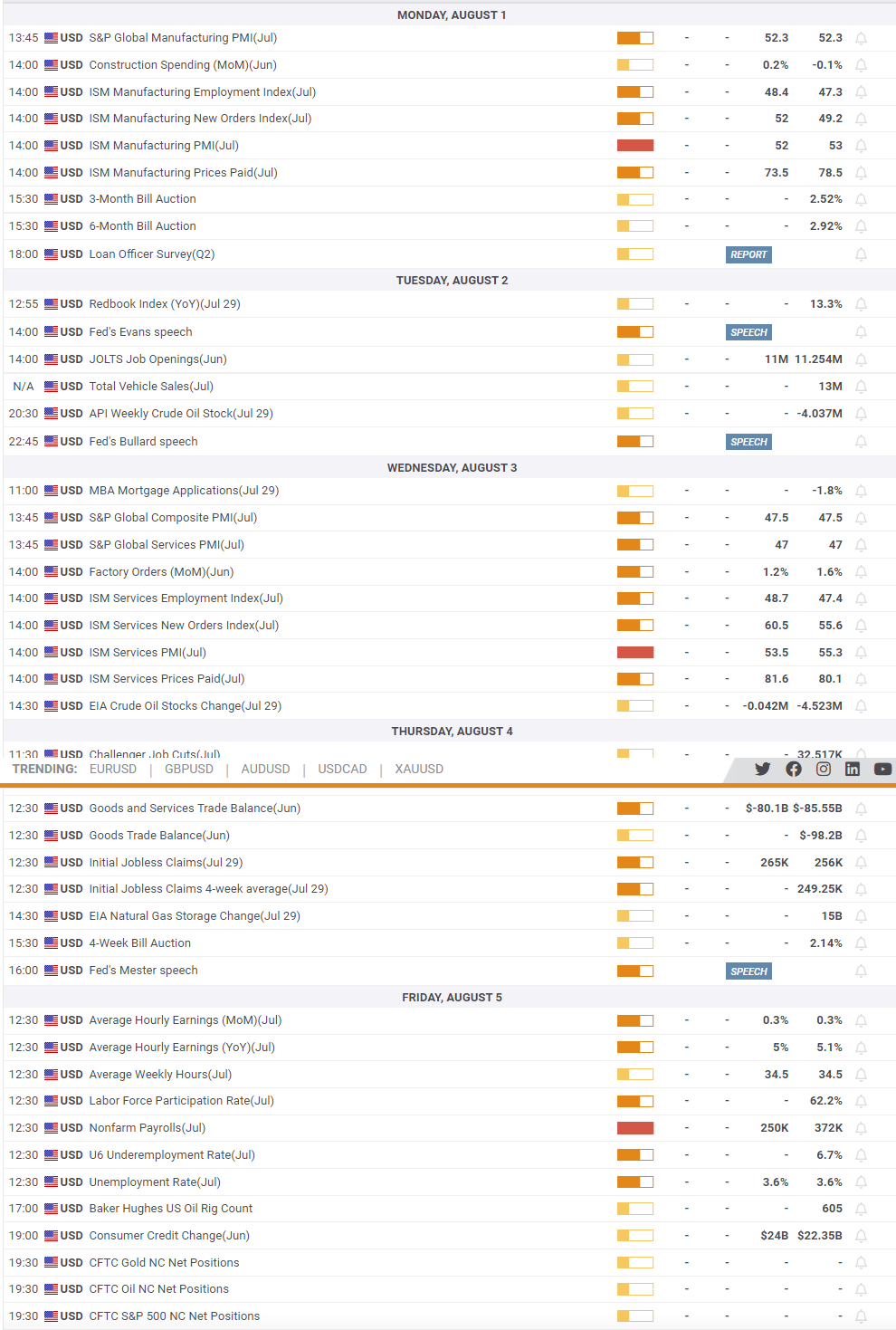

Economic releases

There is not too much data to disturb this rally until perhaps Friday's employment report. The most recent weekly jobless claims data is beginning to show signs of the jobs market slowing but last month's employment report was strong. This is no surprise as companies finally catch up with filling vacancies and pent up demand cools so slowing employment growth. Expect the employment market to slow into year end.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0850, further support at nine-day EMA

EUR/USD continues to lose ground, trading around 1.0860 during the Asian hours on Friday. From a technical perspective on a daily chart analysis indicates a sideways trend for the pair as it continues to lie within the symmetrical triangle.

GBP/USD posts modest gains above 1.2650, focus on the Fedspeak

The GBP/USD pair posts modest gains near 1.2670 during the Asian session on Friday. Meanwhile, the USD Index recovers some lost ground after retracing to multi-week lows near 104.00 in the previous session.

Gold price loses momentum, with Fed speakers in focus

Gold price trades with a bearish bias on Friday after retreating from the nearly $2,400 barrier. The bullish move of precious metals in the previous sessions was bolstered by the softer-than-expected US inflation data in April, which triggered hope for rate cuts from the US Federal Reserve.

LINK price jumps 10% as Chainlink races toward tokenization of funds

Chainlink price has remained range-bound for a while, stuck between the $16.00 roadblock to the upside and $13.08 to the downside. However, in light of recent revelations, the token may have further upside potential.

Fed speak tempers rate cut expectations

The biggest takeaway into Friday is the latest round of Fed speak. These Fed officials reiterated their stance rates should be kept restrictive for a longer period of time until there is more clear evidence inflation is heading back towards the 2% target.