US Dollar appreciation continues against Japanese Yen

The US Dollar (USD) has maintained its strength against the Japanese Yen (JPY), driven by persistent high US inflation data. Federal Reserve Chairman, Jerome Powell, reiterated this point on May 14th at the Foreign Bankers’ Association event in Amsterdam.

He stated, “We did not expect this to be a smooth road. We’ll need to be patient and let the restrictive policy do its work. We think that it’s probably a matter of just staying at this stance for longer.” There is growing concern that sustained tighter monetary policy could eventually weaken job growth and risk a recession.

As of May 15th, this “patient policy approach” seems to be unfolding. The April CPI report, which measures the cost of goods and services in the U.S., rose 3.4% from one year ago. Core CPI, excluding food and energy items, increased 3.6% annually, marking the smallest increase since April 2021.

These numbers might alleviate recent fears about the necessity for future rate hikes, allowing the Federal Reserve (FED) to maintain its current restrictive policy. A couple more months of similar downward-trending CPI reports could shift the focus to when the FED might begin reducing rates. Recently, we have seen a downturn in USD against JPY, especially following today’s CPI report, which announced the smallest increase in Core CPI in three years.

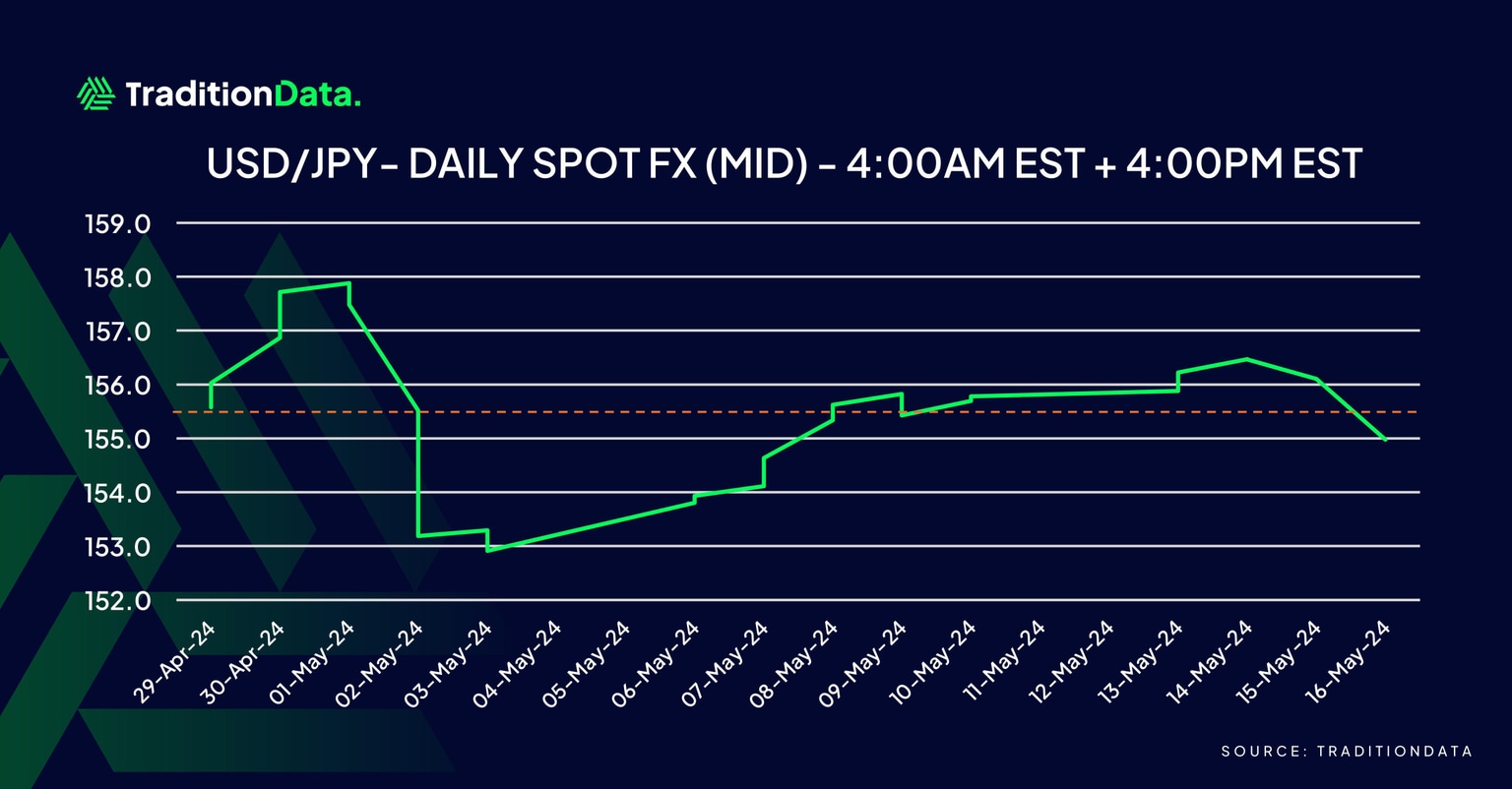

That being said, the USDJPY chart (April 29th – May 15th) below, which compares USD against JPY, shows prominent USD appreciation, despite recent Bank of Japan (BOJ) currency interventions on April 29th and May 1st. The primary reason for continued JPY depreciation against USD is directly rated to the interest rate gap between the U.S. and Japan.

The USDJPY chart below includes two daily market data points (4:00 AM EST and 4:00 PM EST), highlighting the BOJ intervention times and the resilience of USD. Just before the first BOJ intervention on April 29th, USDJPY was trading just above 160.00. By May 3rd, after the second intervention, USDJPY reached a low of approximately 151.90. Following the graph through to May 15th, we see USDJPY settling at a rate similar to where it was prior to the BOJ interventions, demonstrating the resilience of the US Dollar, underpinned by higher U.S. interest rates.

Author

Sal Provenzano

TraditionData

Sal Provenzano Is the FX Product Manager for the TraditionData business and has been tasked with shaping the future of the FX product range.