Week Ahead on Wall Street: Apple and Amazon can't save us, is it time to abandon ship?

- Tech earnings disappointing with Apple the standout and Facebook a relief.

- Amazon was poor and Apple spoke worryingly on the conference call.

- US GDP shocked to the downside and yields and oil are back on the ascent.

Equities are back at precarious levels as we approach the end of the week and the end of the month. Tech earnings season is now more or less done and dusted and the report card looks like its detention. Facebook (FB) rallied 15% but really those numbers were not great, it was just a relief rally that they were not as bad as last time. Amazon (AMZN) had a shocker which really we should have all seen coming as it became a pandemic stock. Now we all go back out, malls are packed and warehouses are quiet. Google (GOOGL) was also a bit of a disappointment.

So we come to the good news if there is any on a day when the Nasdaq is staring at -4% at the time of writing. Microsoft (MSFT) and Apple (AAPL) beat the street and produced solid earnings. But even Apple managed to slap bulls in the face on the conference call when it spoke about significant headwinds from supply chain issues. Apple turned around 4%. That set up Friday's fright. With the Fed in a blackout at least they cannot add to it with more of their recent hawkishness. But investors are running scared. We will naturally get some relief or bear market rallies but we are in a bear market make no mistake about it. Deutsche Bank moved to pencil in a nailed-on US recession in 2023 and their Chief Economist seemed incredulous that the Fed is even contemplating a soft landing. As he pointed out it has never been achieved before so why is it different this time. It never is different this time, history repeats itself.

Elon Musk remained in the news as his deal to take Twitter (TWTR) drags on. Some interesting news hit the tape as he has had to sell a decent chunk of Tesla (TSLA) to stump up the cash for the deal and put down quite a bit more as collateral. This could get very ugly if things turn lower for Tesla. There is a decent chance the deal doesn't make it across the finish line or else he will have to sell more Tesla stock if the deal does go through and this bear market really takes hold. Twitter also got a put down from Donald Trump who said he would not return to it and instead popped up on Truth Social on Thursday evening. DWAC stock naturally soared.

So is there any good news out there? Well curiously yes. It is always important at times like these when bearish thoughts are rampant to try and take a contrarian view and see if it holds. That is where the best trades come from. So let's get to it, this is getting me down already and it's the weekend! Refinitiv Lipper Alpha shows us that as of April 29, 275 companies from the S&P 500 have reported earnings and 80.4% of them have beaten estimates. Doesn't feel like it but there you have it. The long-term average is 66%. Q1 2022 revenue growth is running at 12.5% and even excluding energy that is 9.3%.

So why the long face?

Source: American Association of Individual Investors, AAII.com

Source: CNN.com

Both sentiment metrics are showing extremely bearish readings with the AAII, in particular, a noted low. The CNN Fear and Greed has moved from 38 to 29 in the space of one week.

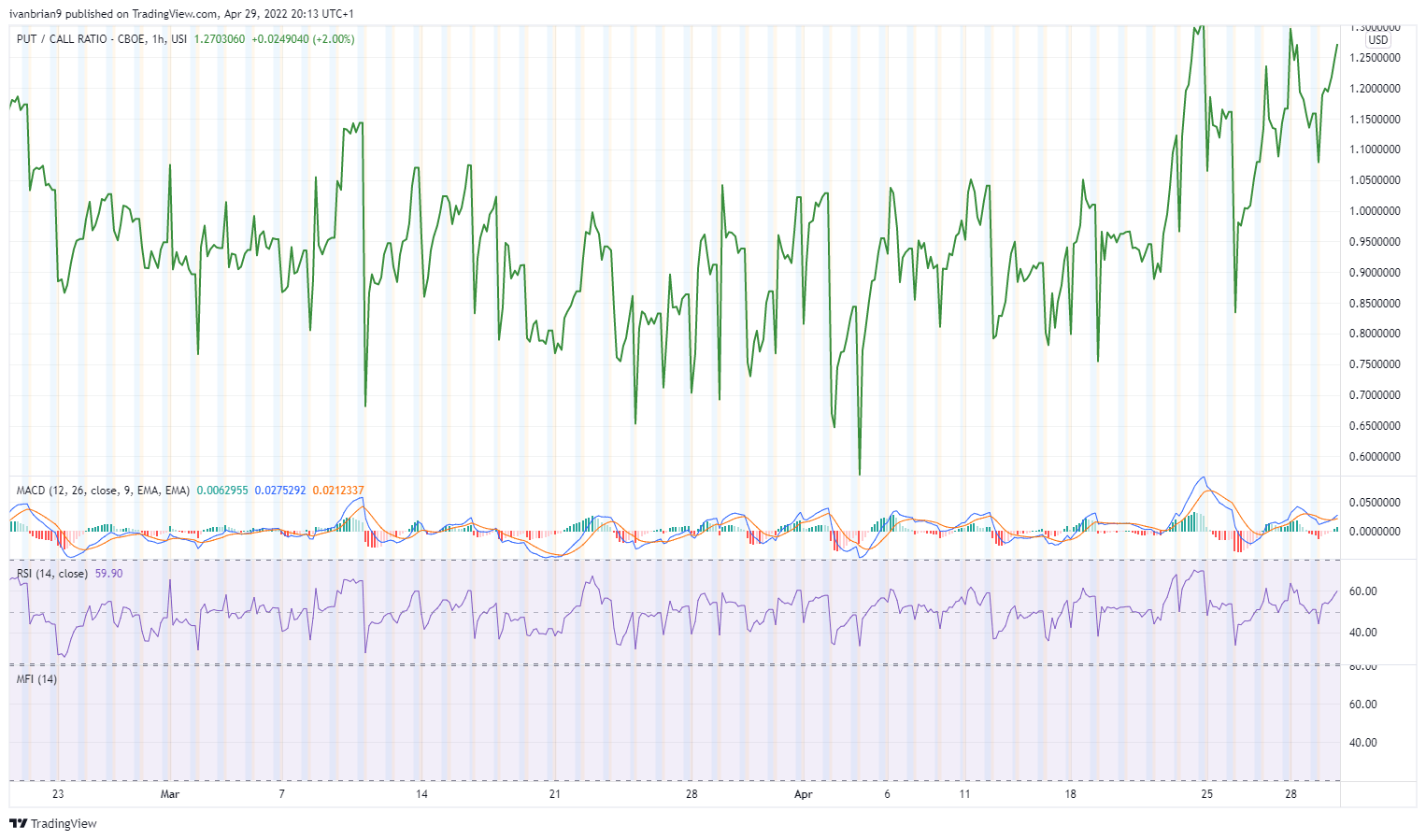

The put/call ratio has also spiked, so we're all buying puts now, hmm, looks like the perfect setup for a counter-rally fairly soon then!

Put/call ratio CBOE

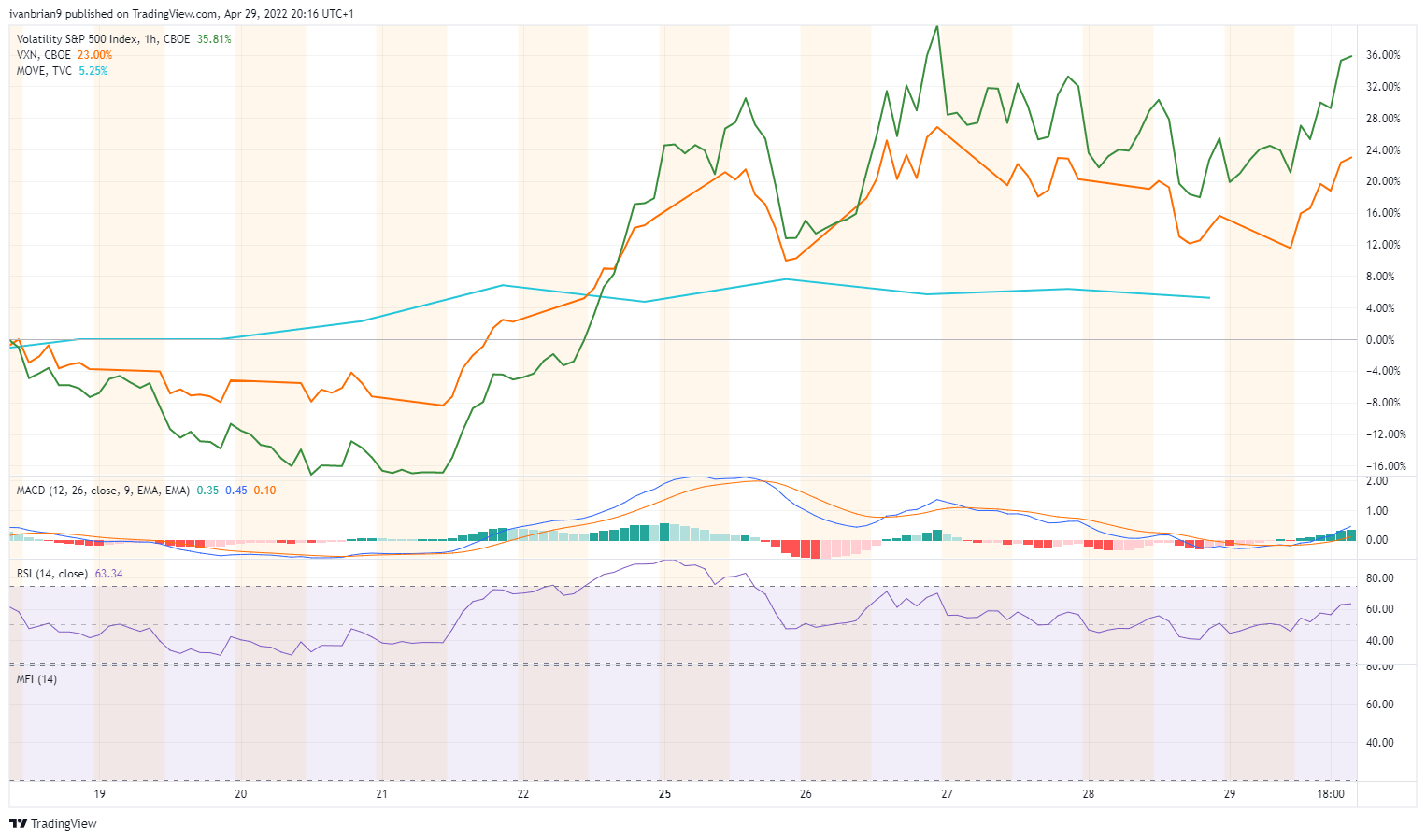

Volatility has naturally spiked as fear has, so this makes all of you rushing into buying puts, paying the top of the recent market. Below shows VIX and VXN (Nasdaq volatility) versus MOVE which is bond market volatility. That has notably quietened so could see some stability for yields going forward.

VIX, VXN and MOVE

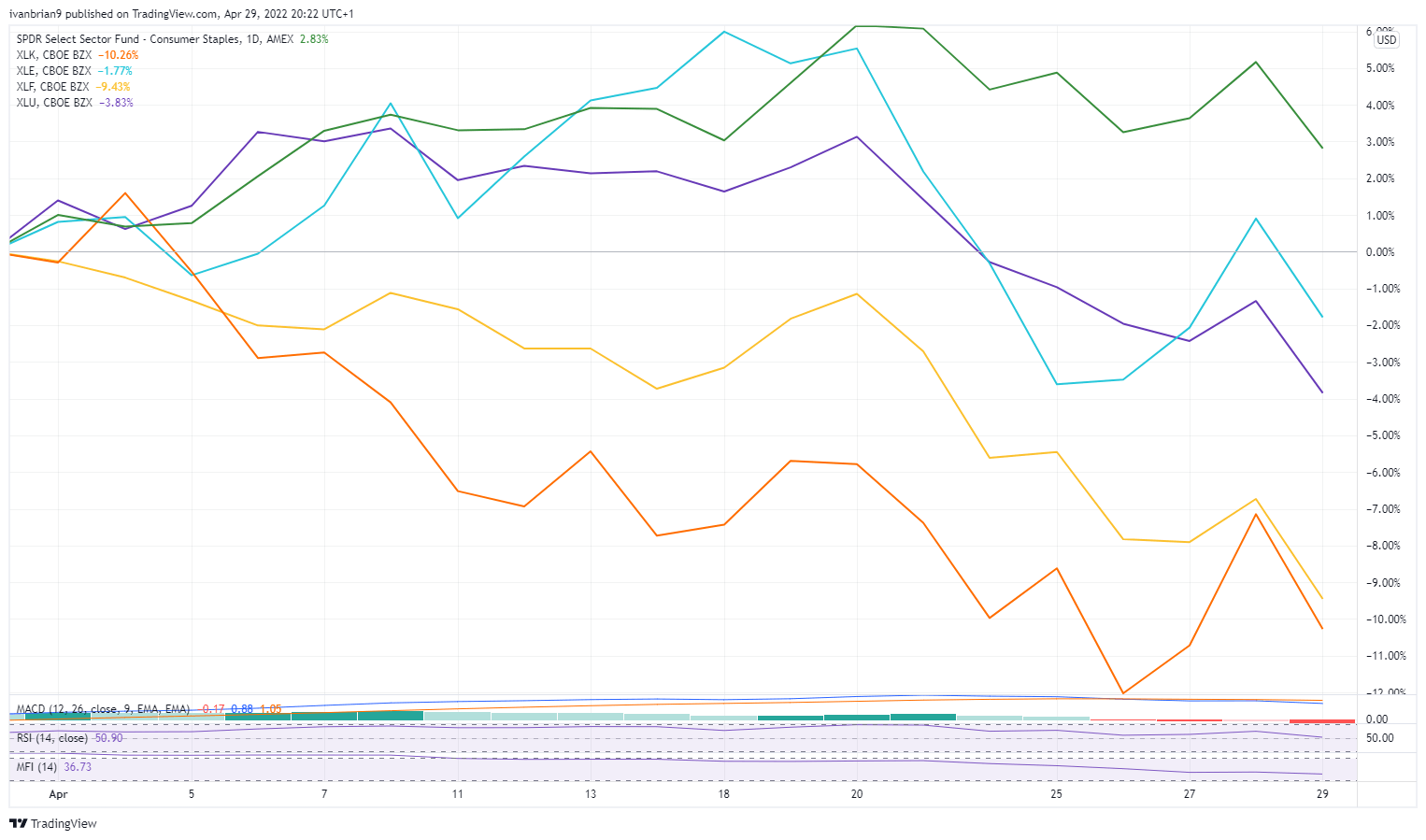

For April, the Energy (XLE) sector has not been the top-performing sector despite what many of you may think. That crown goes to, drum roll, XLP Consumer Staples, the green line in our chart above. XLE (Energy-blue line) is second while unsurprisingly XLK (tech orange line) is the worst-performing sector for the month.

SPY forecast

Still have massive support at $415 a potential triple bottom and then $410 the Ukraine invasion low. There is a volume gap from $405 to $395 so that could get a trigger if we move below $410. $400 is likely to see stops placed just below the level as well, we all love round numbers don't we! That move would likely flush out all the longs, result in peak bearishness and so set up a bear rally.

Nasdaq (QQQ) forecast

Also big support here at $316. Another triple bottom?

Earnings week ahead

This week was really it in terms of earnings with mega tech names stepping up. Next week is more broad-based with industry and consumer names filling the slate. We should get a lot of commentary on the strength of the US consumer though which will help shape our view of the US economy.

Source: Benzinga Pro

Economic releases

On the docket for next week is obviously the Fed interest rate decision. 50 bps a nailed-on certainty but let us see how hawkish they remain after this week's equity sell-off and more geopolitical woes. The initial US GDP read this week was surprisingly weak but within the reading employment remained red hot as did the consumer so the Fed has to keep raising in spite of the deteriorating economic picture globally. Friday's employment report will then draw our focus. Last month was red hot and caused another leg higher in yields. The unemployment rate is forecast at 3.6% and employers are still struggling to fill vacancies. Unemployment typically hits a low about 6 to 9 months ahead of a recession.

The authoer is short Tesla.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.