Visualising victory for Ukraine and oil prices

Back in February, when Russia launched its invasion of Ukraine, a victory for Kyiv would have been almost impossible to imagine. It's the classic David and Goliath. Recent developments on the battlefront, however, are starting to paint a different picture, showing the possibility of Ukraine ending the conflict with a win.

On paper, the war is just between Ukraine and Russia. Its implications, on the other hand, knew no bounds and it demanded to be felt across the globe bringing about economic uncertainties and causing supply chain disruptions. While it did not start the energy crisis, the invasion surely made the situation worse.

Nearly seven months into the war, people are hoping it will be over soon. Along with these hopes is the dream that the underdog (and innocent party) will claim the victory.

Win for Ukraine

Earlier in September, Ukrainian forces managed to recapture swaths of lands in the country's northeast that a few months earlier have been taken over by Russia. Considering this and the possibility that China's tacit support for Russia could be waning, it seems like momentum is on the side of Ukraine.

If that indeed happens, it could mean good things not just for Ukraine but probably for the rest of Europe. Orysia Lutsevych, in an opinion piece for The Guardian, wrote that a victory for Ukraine is vital for Europe to be able to live in peace and work collectively to meet global challenges. Considering the support that a majority of the remainder of Europe and countries in other parts of the world have thrown behind Ukraine, defeat would further entice Russia to flout international law and the sovereignty of other nations.

"The restoration of Ukrainian territorial integrity and, ultimately, peace will mean the collapse of Putinism as a doctrine and an end to Russian claims to territorial dominance elsewhere in eastern Europe and Central Asia," Lutsevych added.

On the other hand, a victory for Russia would validate the country's aggressiveness and fuel its desire to further expand its territory. Russia uses newly conquered territories to stage further conflicts and a Ukraine victory would prevent that from happening. Aside from preventing future wars, a victory for Ukraine is also expected to reduce the risk of a mass famine and even restore the stability of economies that have been affected by the sanctions imposed on Russia for instigating the conflict.

What happens to oil when Ukraine wins the war?

When the war started, the price of oil surged past the $130 per barrel mark for the first time since 2008. The Brent benchmark neared the record high of $147 in March exacerbated by the conflict.

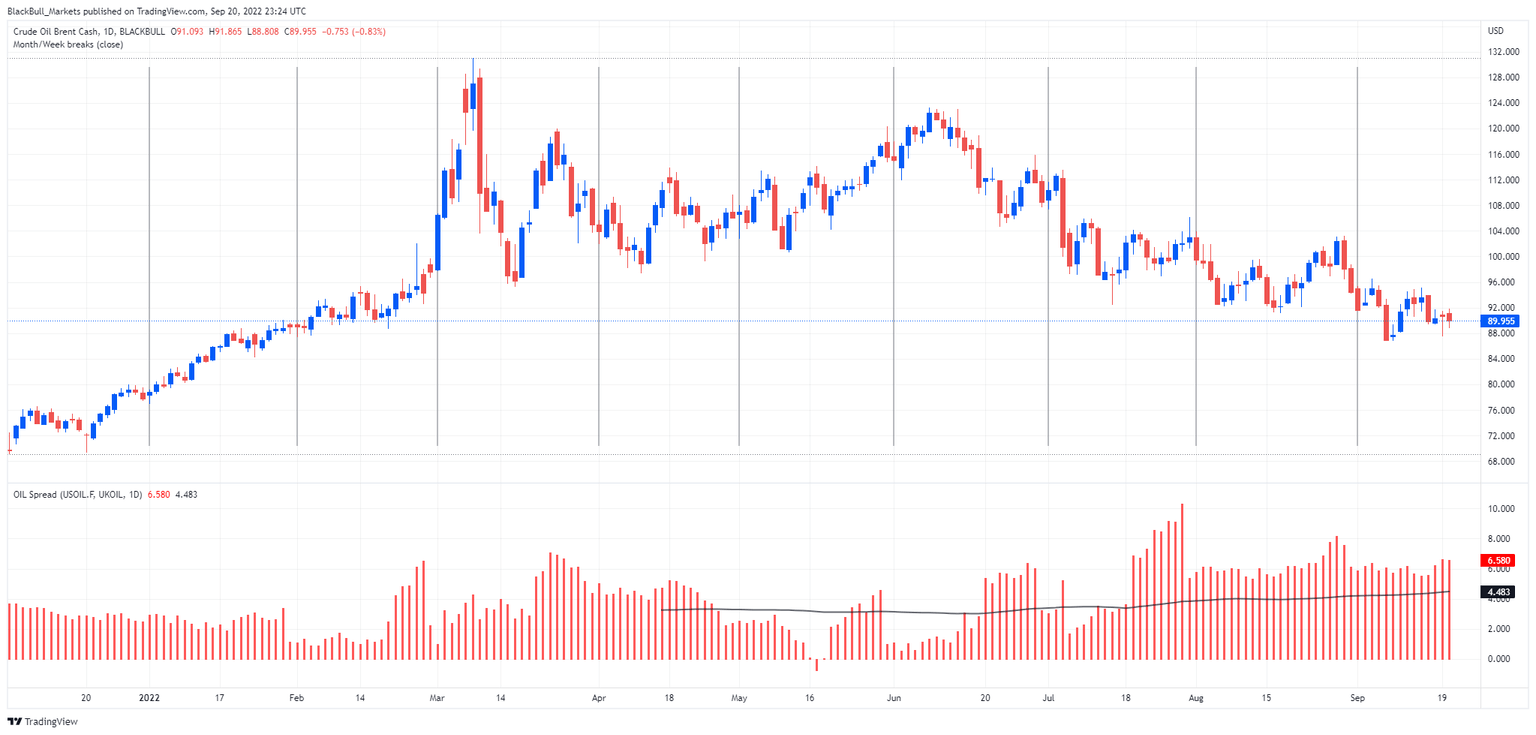

Brent Crude 1D, with WTI/Brent spread Indicator

Almost seven months into the war, the prices of oil somehow stabilised and is now at ~$90 per barrel for Brent crude as concerns about weaker economic growth and demand drag prices down.

European countries have also been forced to impose price caps on electricity and oil and come up with new taxes for energy companies in order to support their people amid the ongoing energy crisis in the region. Many countries have also started finding alternative energy sources to compensate for the supply cut off from Russia.

Russia has been using the energy crisis as another ploy in its grand battle scheme. Earlier in September, Vladimir Putin said: "We will not supply anything at all if it is contrary to our interests. No gas, no oil, no coal, no fuel oil, nothing."

The potential impacts to the energy market of a Ukraine victory would depend on how Russia will take its defeat. Will it be a gracious loser and choose to capitalise on rebuilding bridges with countries that have been beneficiaries of its supply or a petty loser that will continue to lock in supply for it to use and to sell to select buyers who are probably allies and supporters?

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.